“Discipline turns volatility into value”

LNG portfolios are expanding rapidly as global supply capacity is set to grow by more than 200 mtpa into the early 2030s. Each new LNG contract requires integrated valuation and risk frameworks that link market pricing, limit setting, deal assessment, credit practices and operational controls in order to ensure this new supply can be effectively managed.

This article summarises 5 key components of such a framework, drawing on our work with LNG portfolio teams, risk functions and investment committees.

1. Valuation: Building curves in illiquid markets

All LNG contracts (& hedges executed against them) must be fully valued over an agreed trading horizon, with the exposure to market prices measured in full.

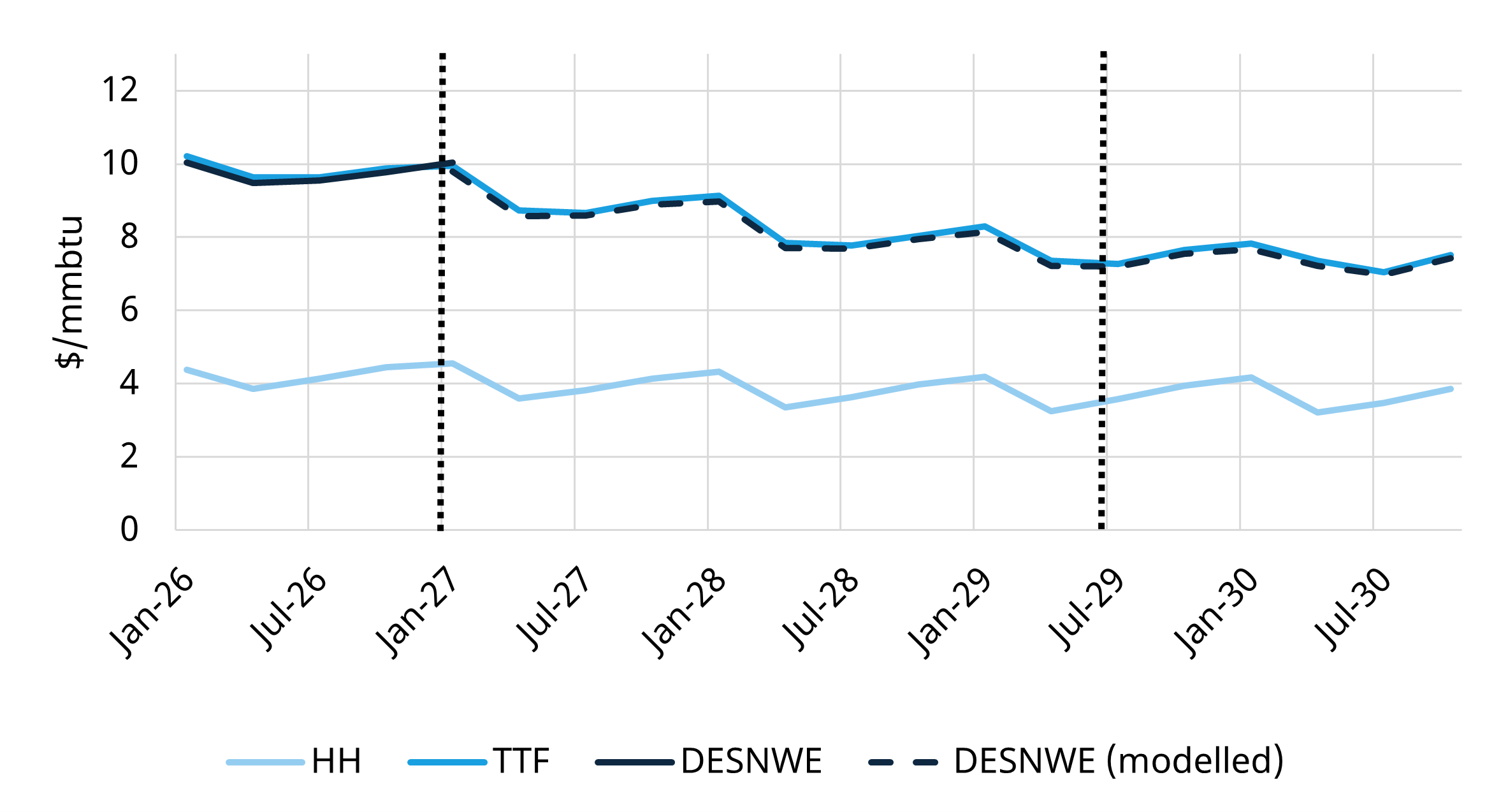

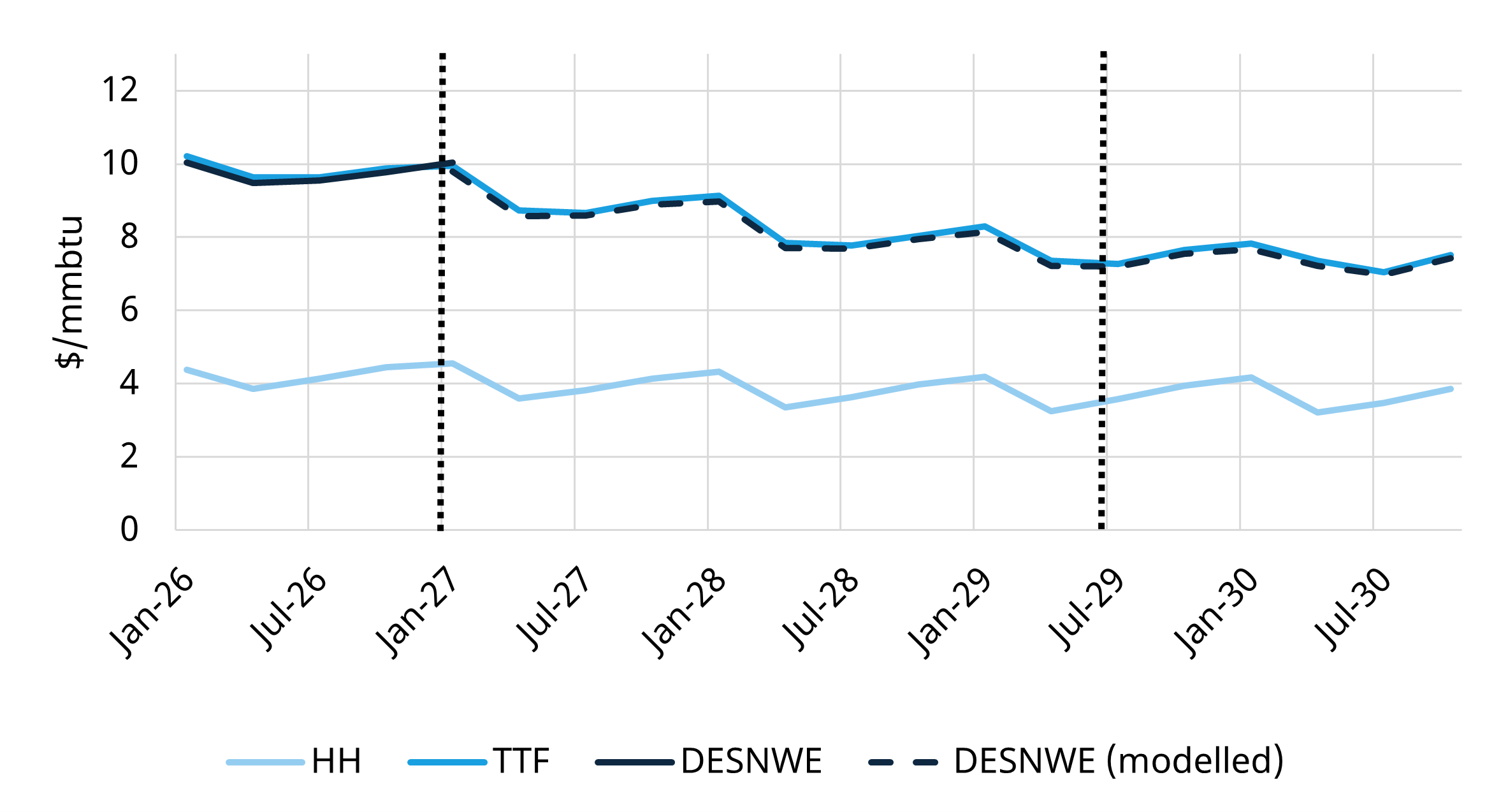

More established markets (e.g. JKM, TTF, Henry Hub) have reasonable liquidity out to 3 years ahead of delivery. However many LNG delivery points and tenors have more limited liquidity, with some price assessments only available for the front ~12 months of trading as illustrated in Chart 1.

Chart 1: Limited forward liquidity at DES NW Europe vs TTF and Henry Hub

Source: Spark Commodities, ICE, Timera Energy

There are various approaches to building price curves for these further dated horizons, from simple extrapolation of the available market assessment to trader-driven marking which allows for a more granular outlook. The resultant curves can be calibrated to observable LNG price assessments.

This enables valuation of physical and financial positions on a consistent basis while spanning illiquid horizons.

For FOB contracts, valuation also requires a shipping dimension. Forward curves need to incorporate:

- Charter rate and utilisation assumptions

- Boil-off and propulsion efficiency

- Bunkering costs

- Canal and port-related fees

These inputs materially shape netback pricing and hence contract value. As portfolios expand, the accuracy and transparency of curve construction becomes increasingly important for both and risk reporting.

2. Limit setting: linking VaR and EaR

Valuation underpins limit frameworks. In LNG portfolios, effective governance requires measures that capture both short-term market variability and longer-term economic risk.

Most LNG players rely on:

- Delta (Open Position Limits): A threshold of outright financial exposure associated with the net hedged positions. Applies to an agreed trade window.

- Value at Risk (VaR): A statistical measure that estimates the potential short-term P&L loss on the portfolio under normal market conditions, typically over a 1–10 day ‘holding period’ horizon. Used to manage near-term P&L volatility exposure.

- Earnings at Risk (EaR): A forward-looking measure that captures the potential change in portfolio earnings over a longer horizon, reflecting how both physical and financial exposures evolve through time. Used to manage and quantify structural earnings or margin exposure.

A combined framework of position limits, VaR triggers and EaR constraints provides a clear structure for managing risk while preserving commercial flexibility. For a more indepth analysis of these different risk metrics, see our previous post here.

3. Pre-deal assessment: understanding value and risk before signing

Large LNG deals can reshape portfolio value and risk. Before approval, they should undergo structured pre-deal assessment that covers:

- Intrinsic valuation – assesses the value of the contract based on a single set of current market price curves

- Extrinsic value – quantifies the value of embedded flexibility (e.g. destination, volume, indexation or shipping optimisation) that can be exercised as markets evolve

- Incremental VaR and EaR – evaluates how the deal alters short-term market risk (VaR) and longer-term earnings exposure (EaR) relative to the existing portfolio.

- Initial margin requirements – estimates additional margin or collateral needs arising from hedging strategies or positions linked to the deal.

- Stress testing – tests the deal under adverse scenarios (price shocks, shipping delays, basis movements) to understand downside value and risk resilience.

The objective is not to expand analysis for its own sake but to support clear decision-making: How does the deal add value? How does it alter risk? How will it interact with existing portfolio exposures?

4. Credit risk: managing volatile exposure profiles

LNG credit exposures can shift quickly given price volatility, cargo scheduling changes and counterparty diversity.

Standard offtake terms typically allow for around 10 days of unsecured credit exposure. Higher-risk counterparties are often required to post Stand By Letters of Credit (SBLCs) to mitigate potential loss. (See chart 2)

A useful enhancement is a ‘walk-forward’ approach, which projects exposure changes over the coming days rather than taking a point-in-time snapshot. This aligns credit monitoring with the operational realities of LNG delivery schedules.

Integrating valuation and shipping schedules into credit processes helps portfolio teams anticipate exposure changes early and negotiate appropriate collateral structures.

Note that this addresses only operational credit risk, which is just one aspect of the wider credit exposures tied to total contract value.

5. LNG midstream considerations: where valuation meets operations

FOB terms transfer shipping responsibility to the buyer at the loading port. This introduces a set of exposures that must be captured coherently across valuation, risk and operations:

- Shipping valuation covering chartering, routing and bunkering

- Operational risk control around congestion, laytime, canal delays and vessel performance

- Bunker management, a key cost driver

- Accurate cargo booking on a mark-to-intent basis to ensure risk metrics reflect commercial reality

FOB exposures can behave like embedded shipping options. Capturing their value and risk requires coordination between trading, operations and risk teams rather than treating shipping decisions as an operational afterthought.

Timera support for LNG Portfolio value and risk management

Effective LNG portfolio management requires integrated valuation, risk and operational frameworks to support clear, commercially grounded decisions.

Timera supports clients in this area by:

- Embedding robust risk management frameworks aligned to portfolio structure, deal pipelines and governance requirements

- Delivering value and risk analysis for portfolio origination using tools such as LNG Bridge (intrinsic/extrinsic value, VaR/EaR, margin impact, stress tests).

- Designing LNG portfolio operating models including curve methodologies, limit structures, credit practices and FOB/shipping risk processes.

For further information, feel free to contact our LNG & Gas Director David Duncan david.duncan@timera-energy.com.