In today’s article we set out why concerns as to impact of Middle East conflict may be exaggerated. We also look at how a policy inflection point in China could have a much bigger impact.

Middle East geopolitical risks

Conflict in the Middle East is a tragic mess. That does not necessarily translate into market risk.

From an oil market perspective the potential impact of Middle Eastern supply disruptions (key risk Iran) is dampened by the current backdrop of substantial OPEC spare production capacity (of at least 2 mbpd vs global demand of ~103 mbpd). This buffer exceeds even the more extreme case of a complete loss of Iranian production (~1.7 mbpd).

Without a kinetic war in the Middle East which is very unlikely in the near term given dominance of US and its allies, the risk of substantial disruption to Middle Eastern LNG exports (focused on Qatar) is also low.

Temporary risks around LNG & oil shipping route disruptions are limited given alternative options e.g. there is already substantial cargo diversion via the Cape of Good Hope.

China cannot compete with the Middle East when it comes to headlines, but it may turn out to be a much bigger market mover.

Why the Chinese currency is important for commodity prices

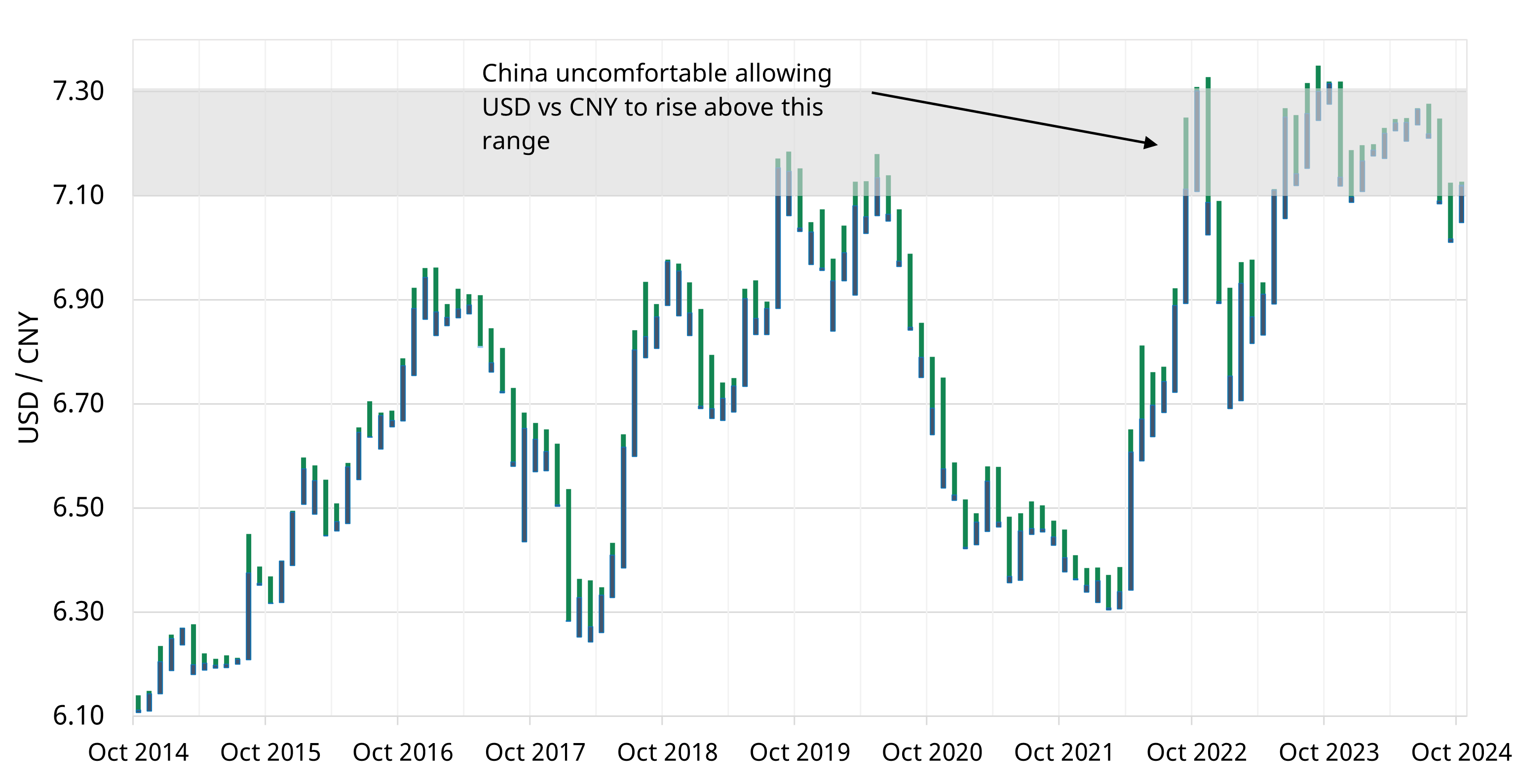

Chart 1 shows evolution of the USD to Chinese Renminbi exchange rate over the last 10 years. What has this got to do with energy markets? Bear with us.

China is the world’s largest marginal buyer of most commodities. For those of you familiar with Sesame Street or The Muppets, China represents the commodity market equivalent of the Cookie Monster.

As a result, incremental changes in Chinese economic growth can have big impacts on commodity prices. In the energy space this includes LNG (as a key marginal fuel source in China), and oil (China is the world’s largest importer).

There is a direct knock on impact of Chinese LNG demand on European gas prices, given LNG is the key marginal source of gas supply in Europe. This feeds through into European power prices, given the importance of gas-fired plants setting marginal power prices.

With this context on the importance of Chinese growth for commodity demand, here is the progression of logic that makes the USD – CNY exchange rate important:

- One of China’s key policy objectives is currency stability to support increased adoption of the renminbi (CNY) amongst its trading partners.

- As a result the Chinese central bank (PBoC) manages the level of the renminbi in a range vs the USD.

- China has suffered a major property bust across the last two years which has acted to weaken the CNY as capital exits China, threatening the bottom of China’s managed currency range (USD rising against CNY in Chart 1).

- CNY weakness has significantly constrained the ability of Chinese policy makers to stimulate an ailing economy, because stimulus measures act to further weaken the currency.

- In the absence of stimulus, a weakening economy has translated into softer commodity demand; but that could be about to change.

The US signalled a major change in direction of its monetary policy in Sep 2024, with a 50 basis point interest rate cut and the flagging of more to come. The USD has weakened sharply against most currencies as a result, including the CNY as can be seen in Chart 1.

The implications of this shift for China are profound. Stimulus is suddenly back on the table, given China’s hands are no longer tied by a weakening currency.

Stimulus expectations buffeting markets

China announced a major monetary stimulus package in late September 2024, aimed at trying to revive the economy amidst ongoing real estate and consumer demand challenges. Key measures included central bank liquidity injections, interest rate cuts and easing in lending conditions.

This stimulus announcement triggered a sharp rally in crude, LNG & almost all other commodity prices. The Chinese stock market rose over 40% in two weeks. A lot of this immediate market reaction & enthusiasm was driven by the expectation of imminent fiscal support measures to follow the monetary stimulus package.

Commodity & equity markets were disappointed & quickly retraced some of this rally in early October when the National Development and Reform Commission (NDRC) failed to provide much detail on new fiscal stimulus measures. However markets are keenly awaiting further announcements on scale & nature of fiscal stimulus expected from National People’s Congress (NPC) across next few weeks.

Who cares?

China seems along way away and its politics & economic challenges are fiendishly complex – so why bother with details so far removed from our day jobs in power & gas markets?

The simple answer is that China moves energy markets. The state of the Chinese economy materially impacts global commodity demand & therefore prices. And these impacts are structural not just short term.

We have no forecast as to what happens. We are just spectators, not experts on China or the Chinese economy. But we are closely watching the outcome of stimulus announcements to understand their impact on energy demand & prices. This may be something worth considering for your radar screen.

Join our upcoming Italian BESS webinar

Topic: “MACSE strategy” – key Italian BESS investment case drivers & commercial strategy for MACSE & Capacity Market

Time & access: Tuesday 12th November at 10AM CET (9AM GMT).

Registration: Pre-registration required (access is free); webinar registration link – register here

Scope:

- 4 BESS business models that allow investors to profile risk/return

- MACSE vs Capacity Market investment routes for BESS

- MACSE bidding strategy drivers

- Impact of latest TSO capacity target announcements (Oct 2024)

- Key Italian BESS investment case risks & challenges.

Join our upcoming LNG webinar “Absorbing the supply wave”

Topic: “Absorbing the supply wave” – how demand and supply side flex mechanisms will balance the global LNG market

Time & access: Weds 27th Nov 09:00 GMT (10:00 CET, 17:00 SGT)

Registration: Pre-registration required (access is free); webinar registration link – register here

Scope:

- What’s been setting global gas prices?

- Importance of market flex in the coming regime

- Overview of LNG supply response & Asian demand flexibility

- Demonstrating market flex impact on marginal price formation through (i) HH price impact (ii) Asian demand growth trajectory