‘Stochastic modelling of the electrolyser supply chain drives competitive advantage’

It has been a case of ‘two steps forward, one step back’ when it comes to electrolyser investment across Europe.

In almost all cases, some form of policy support is a pre-requisite for a bankable project. Yet governments have been dragging their feet in defining a workable set of ‘rules of play’.

This policy backdrop means investors in electrolyser projects are navigating a dynamic and uncertain environment. Several key factors contribute to this:

- Dependence on government support: Electrolyser investments require substantial capex, making them highly dependent on government subsidies and incentives.

- Challenges in sourcing green power: Electrolysers need to meet green power sourcing requirements to qualify for support. Securing reliable, clean energy sources & integrating into a H2 production supply chain is an evolving challenge.

- Uncertainty in future hydrogen demand: Hydrogen offtake demand is still at an early stage of evolution and long-term demand for hydrogen remains uncertain.

These factors mean that electrolyser revenue analysis needs to incorporate the flexibility to adapt to changing market conditions and evolving policy landscapes. Revenue forecasting should also clearly capture risk via a distribution of potential outcomes.

Quantifying electrolyser supply chain value

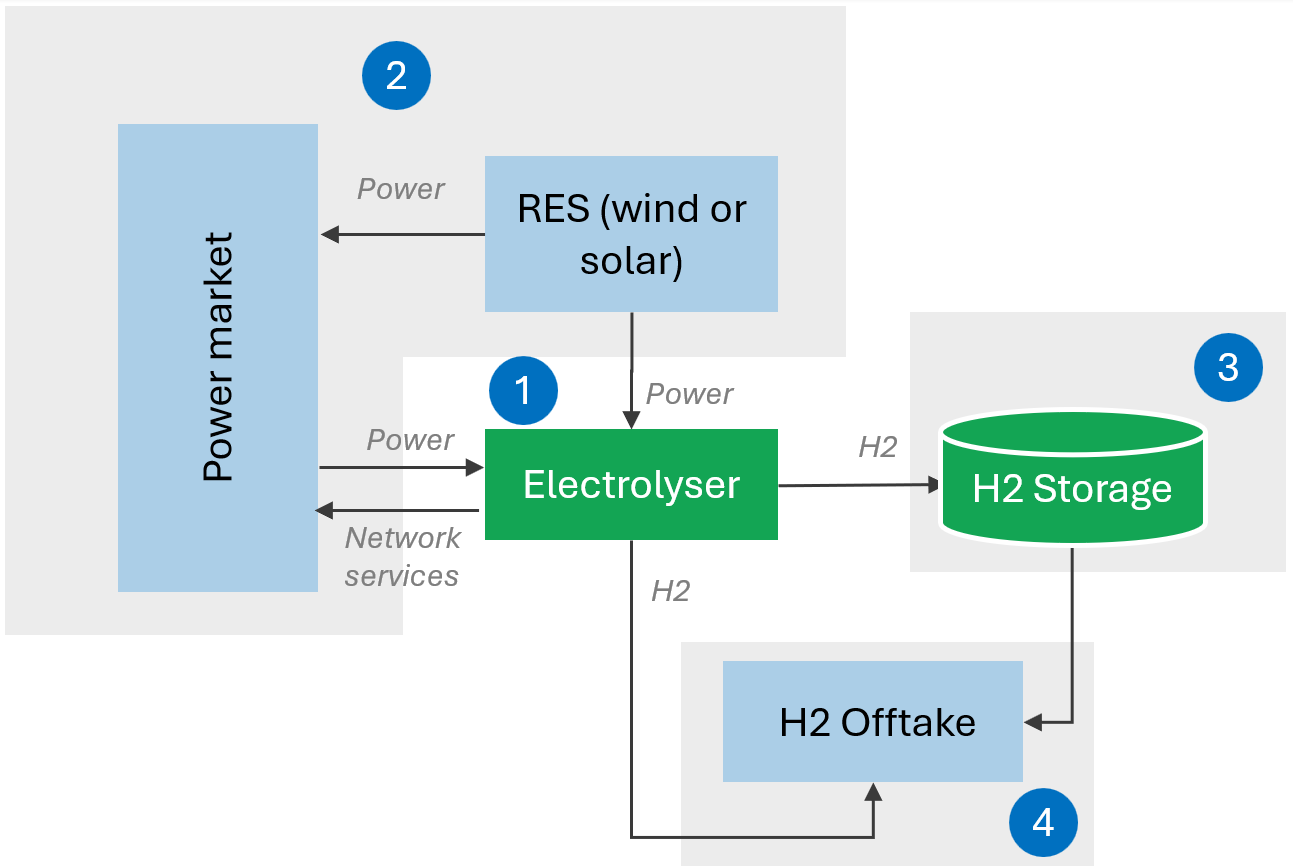

Diagram 1 sets out 4 key components of the green H2 supply chain: 1. Electrolyser, 2. Power sourcing strategy, 3. Storage flexibility & 4. Offtake structure.

It is important to properly model & optimise each of these components as well as capturing supply chain interdependencies, in order to deliver a realistic revenue forecast and maximise overall value.

Stochastic modelling is essential for capturing the full value of each component & quantifying risk distributions.

Let’s now have a closer look at each of the 4 supply chain components one by one.

1. Electrolyser:

The electrolyser is the core driver of H2 production volumes. Electrolyser configuration can have a substantial impact on supply chain value capture, with key variables including sizing, efficiency, operational flexibility (e.g. minimum run, ramp-up times) and outage management.

Optimising electrolyser size is an important consideration in building a viable investment case. Stochastic modeling of electrolyser value capture underpins sizing analysis as we illustrate via a simple case study.

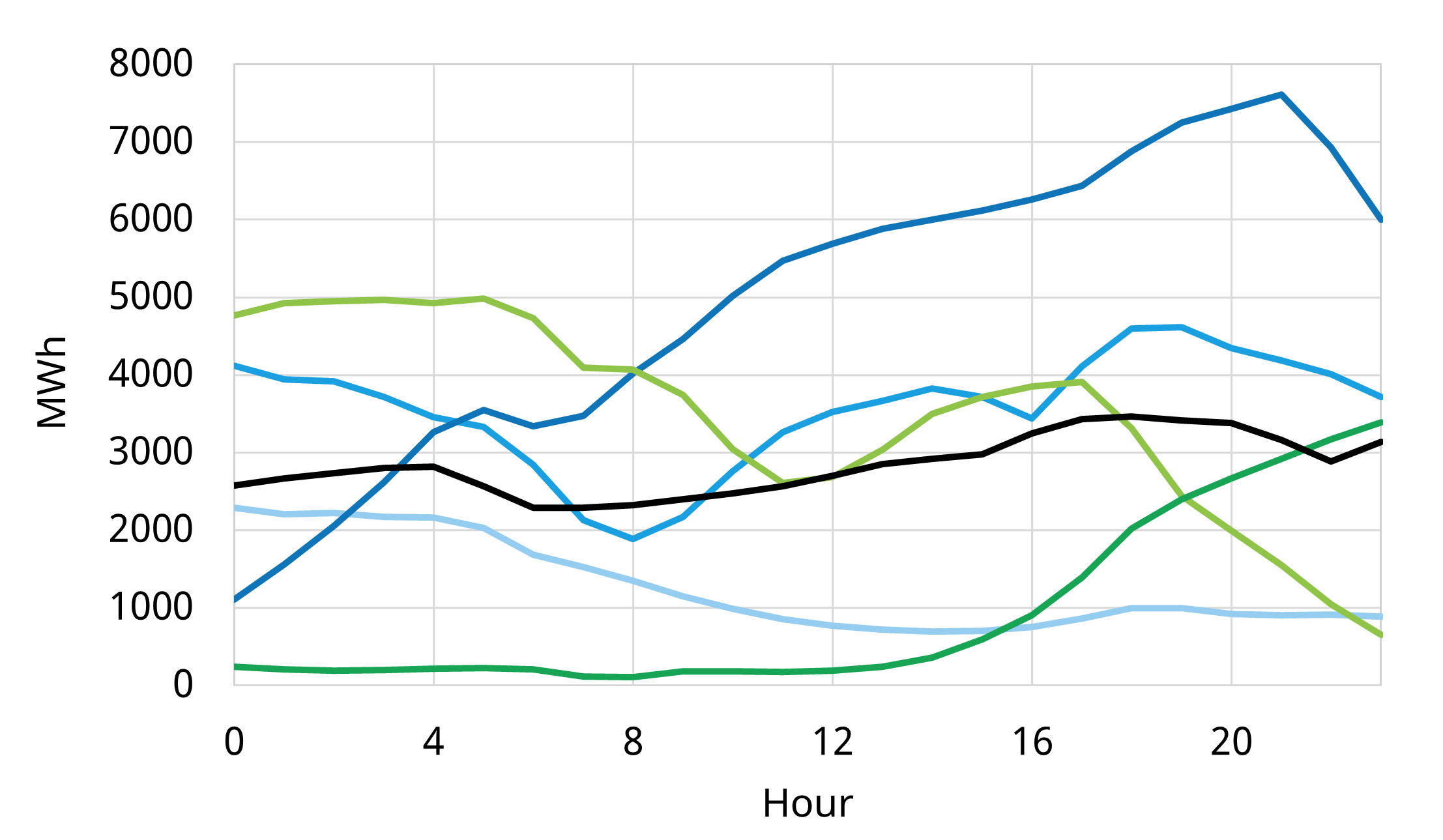

Chart 1 provides an illustration of 5 different stochastic simulations of wind generation output profile feeding into an electrolyser across a 24 hour period. It also shows a deterministic profile (the black line which is the mean of all 5 simulations).

Chart 1: 5 wind output simulations + mean output path

Source: Timera stochastic electrolyser valuation model

Sizing the electrolyser based on the deterministic wind generation profile (black line), would result in a decision based on the flawed assumption of a relatively stable utilisation rate.

The reality of the large variance of wind output across individual days is captured by the stochastic simulated output profiles (green & blue lines). These imply a very different electrolyser output profile and optimal sizing relative to analysis based on the deterministic profile.

2. Sourcing strategy

Electrolyser projects aim to source power from a combination of renewable energy sources (e.g. PPAs or colocated assets) and the wholesale market. The key consideration here is how ‘green power’ regulatory requirements are met.

Sourcing rules are quite complex and can have a substantial impact on project design & value capture. We will come back to these in an article to follow, where we set out a summary of the sourcing rules and considerations for electrolyser investors.

Key value drivers relating to sourcing strategy include market price exposure (e.g. level, shape), grid connection & PPA sizing. From a modelling perspective it is important to capture:

- the potential to feed in green power from multiple sources

- remaining policy uncertainty (which can be dealt with via scenarios / sensitivities)

Stochastic modeling of the electrolyser supply chain is again important e.g. to support decisions on the sizing, flexibility & pricing structure of renewable PPAs.

3. Storage flexibility:

In the work we do supporting green H2 investors, we consistently see the value uplift from onsite storage being underestimated.

Storage drives value by allowing the decoupling of H2 production from offtake enabling:

- Flexibility to source power in lower priced periods (therefore increasing margins)

- Provision of higher reliability to offtakers (who often have very high costs of interruption)

- Reduced impact of electrolyser operational constraints (which can lead to lower costs or higher value capture).

Value drivers here include storage sizing but also the knock on impact on electrolyser configuration, efficiency & CAPEX/OPEX.

Stochastic modelling unlocks additional value by optimising storage to respond to e.g. capture of price and RES volatility, while preserving the correlation between price and RES profiles. Deterministic models, on the other hand, often underestimate the full potential of storage.

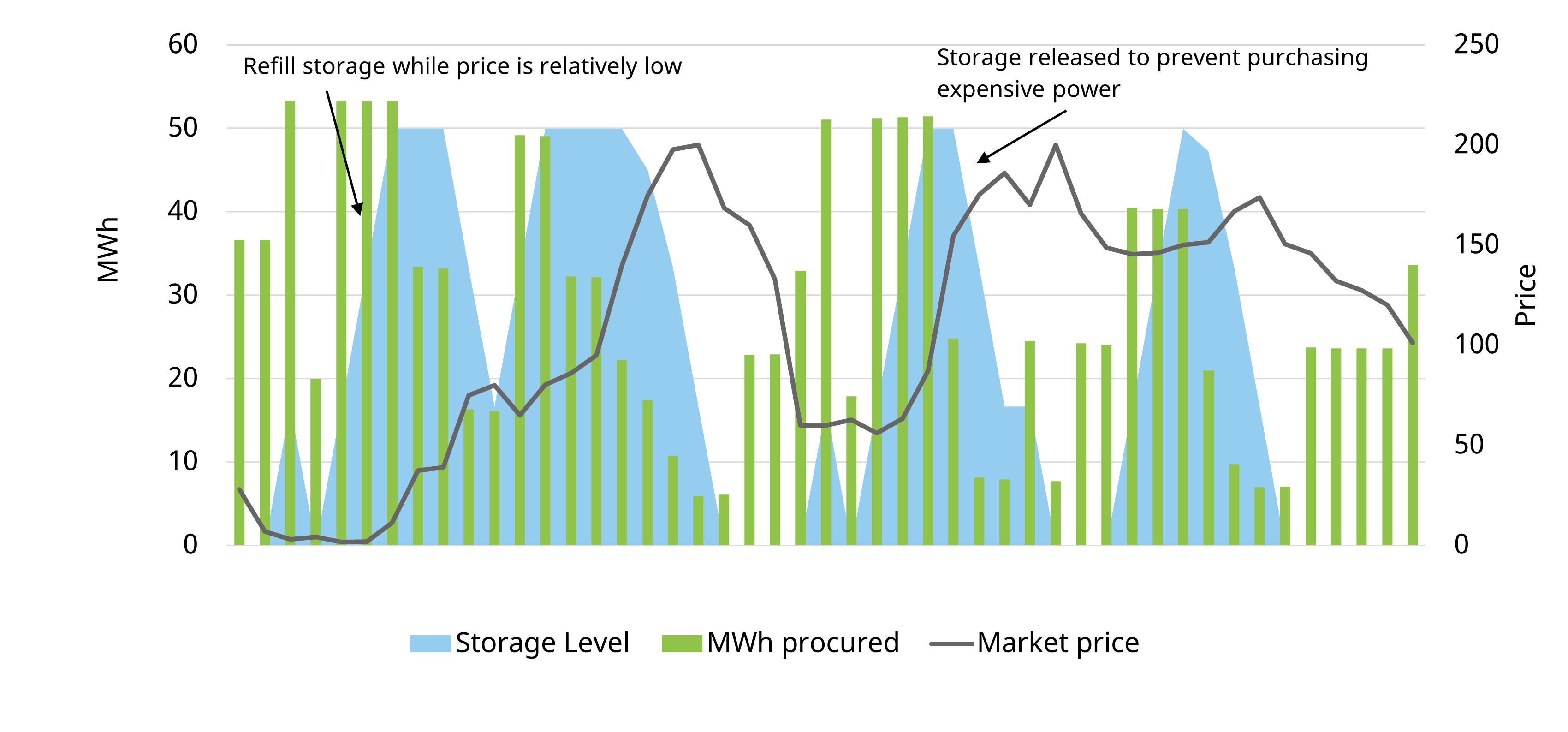

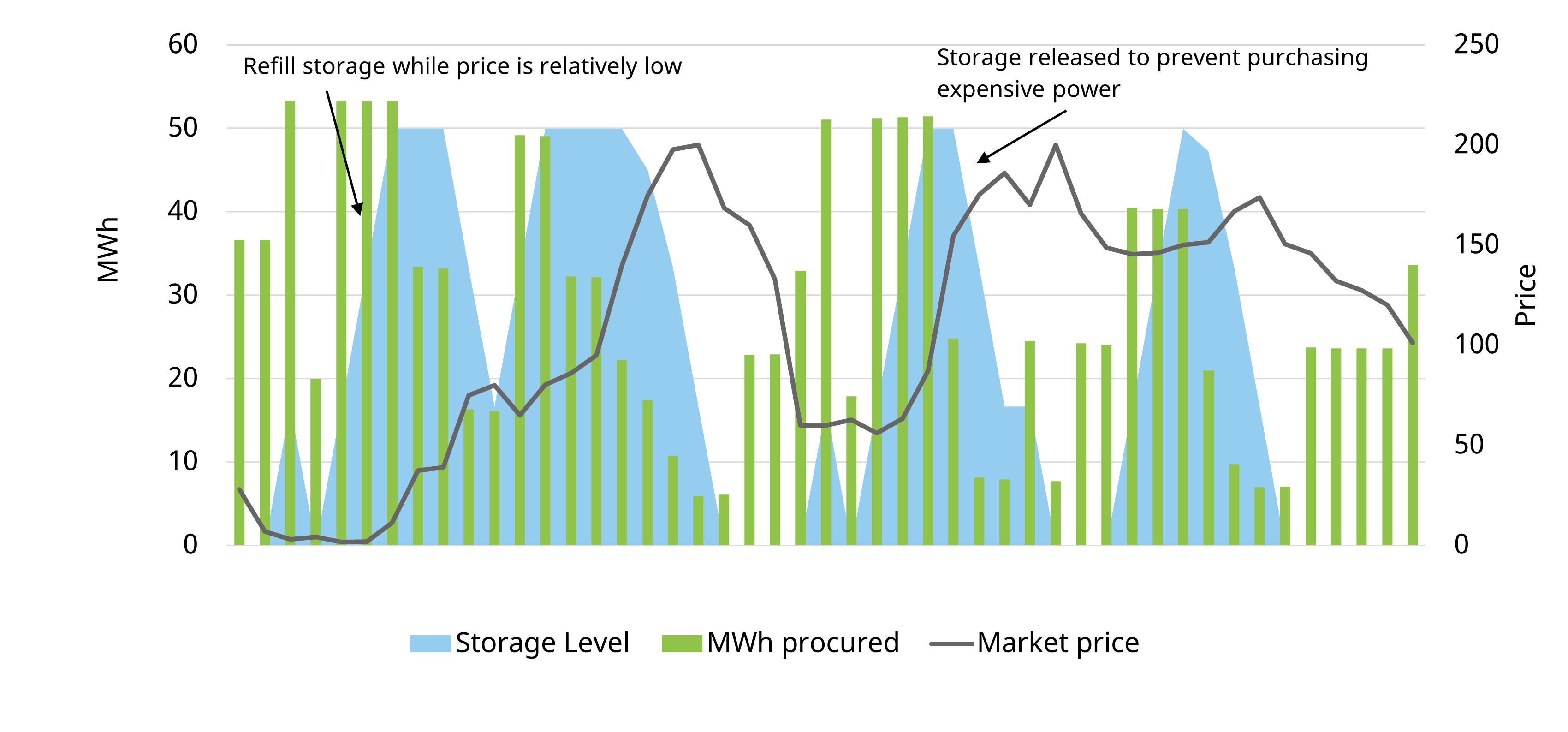

An example of a two-day storage optimisation strategy with one stochastic price profile is shown in Chart 2.

Chart 2: Case study H2 storage & electrolyser optimisation profile vs power market price

Source: Timera stochastic electrolyser model

This chart shows one of many outputs from our stochastic electrolyser model, which captures the impact of uncertainties such as imperfect price foresight and forecast errors when implementing the storage optimisation strategy.

4. Offtake structure:

The final component of the supply chain is the offtake structure, often linked to complex physical end-use of H2. This means that offtake contract constraints can have a significant cost & value impact on electrolyser supply chain configuration.

The value impact of offtake is driven largely by end-user demand dynamics. Key value drivers include H2 price indexation, volume profile, predictability, and required reliability.

The benefit of stochastic modelling of offtake is that it provides more accurate insights into green H2 production and better addresses the challenges of maintaining a stable offtake profile amid RES output volatility.

Supply chain as a whole

While we have broken out the electrolyser supply chain into 4 components above, these have strong interdependencies which impact configuration, cost & value capture.

The investors & developers we have seen with a clear competitive advantage are those that are able to structure their project configuration based on stochastic analysis of the supply chain as a whole.

For more information on Hydrogen and the services we offer, please visit our Hydrogen page, or contact us.