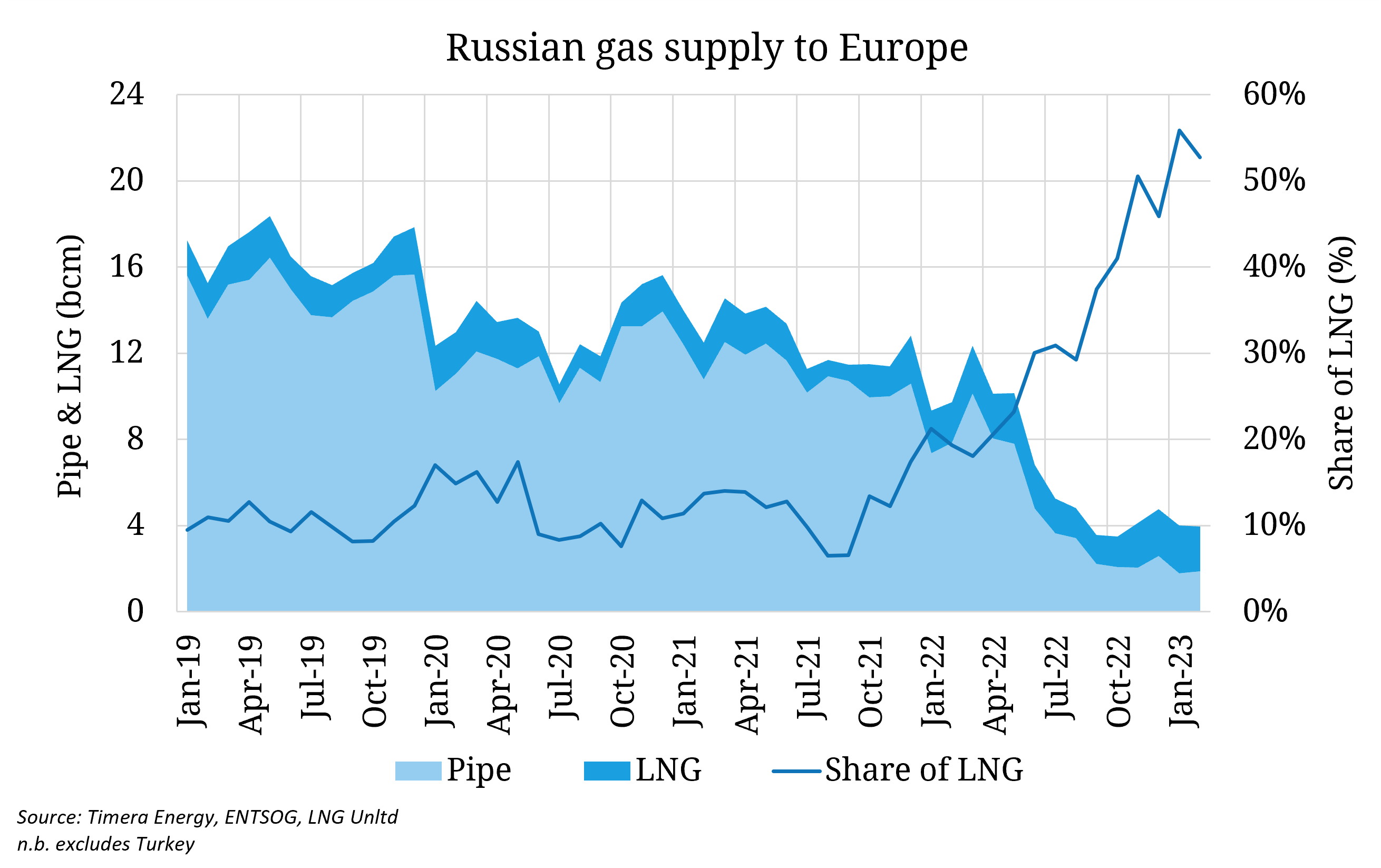

Russian piped deliveries to Europe have fallen materially since late 2021, heralding an unprecedented period of high prices and volatility in global gas markets. Since September however, piped Russian flows have somewhat stabilised around the ~ 2 bcm/month mark, with limited deliveries continuing through Ukraine and Turkstream. While risks continue to tilt to further cuts, especially to flows through Ukraine, the volume at risk is significantly smaller than this time last year – a factor contributing to the softening of prices and volatility seen in the year to date, as the risk premium embedded in the TTF curve has unwound (see our March 6th article for some background to the easing of the gas crisis).

The topic of Russian LNG deliveries to Europe has however come into the crosshairs of late, with EU ministers approving proposals to allow countries to temporarily block Russian firms from booking gas infrastructure capacity this week (n.b. proposals still need to pass the European Parliament). This comes as Russian LNG deliveries to Europe have made up over 50% of all Russian gas deliveries to the continent in the year to date, having increased by 4.2 Bcm y-o-y in 2022. Following Russia’s invasion of Ukraine, EU sanctions were imposed banning the exports of key components due to be used in under construction Russian LNG plants, significantly challenging the scope and timelines at projects such as Arctic LNG 2. However, deliveries from operational Russian LNG terminals have continued normally (with the exception of some country level import bans), contributing to the significant growth in European LNG imports that has been critical in offsetting Russian piped losses.