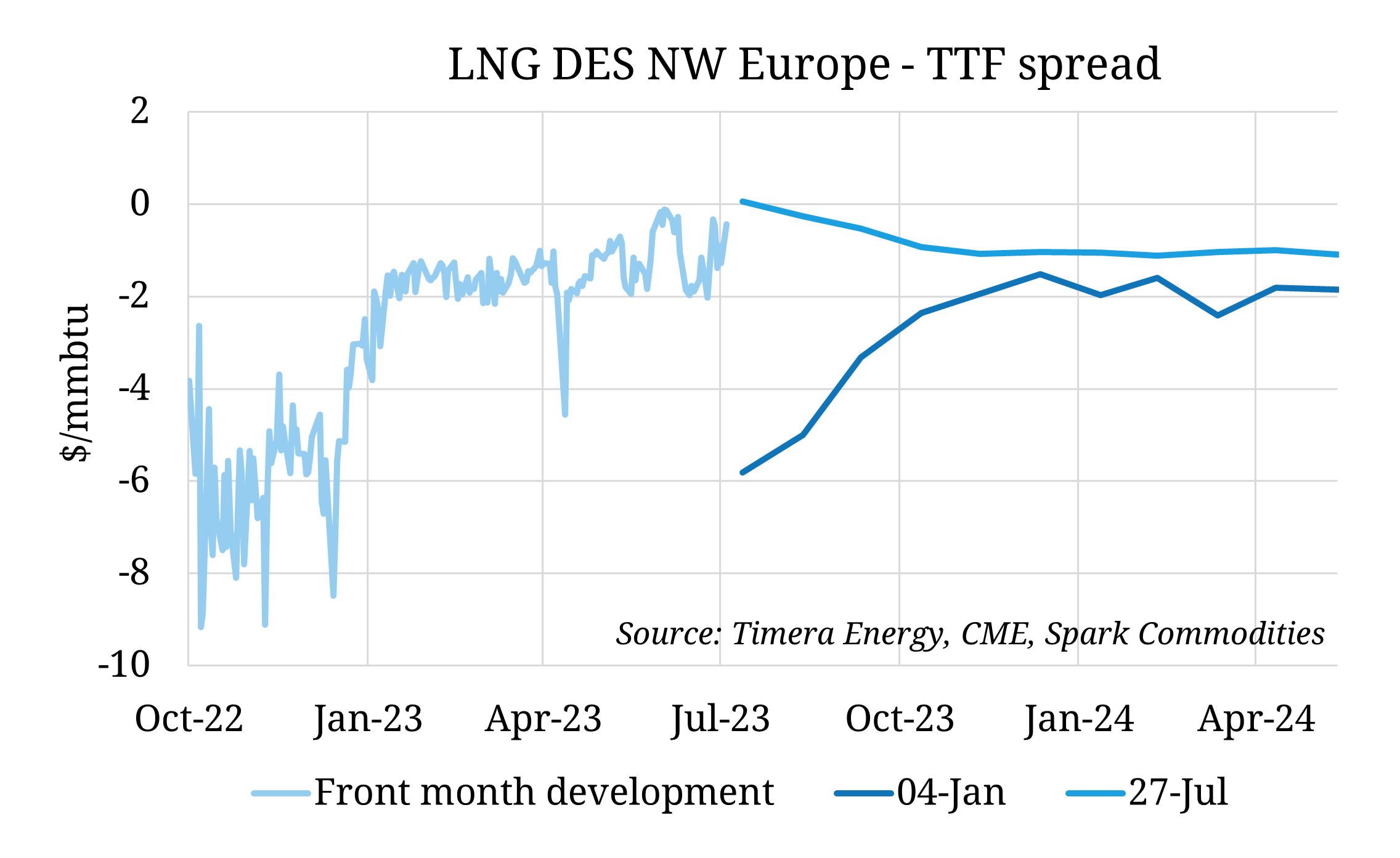

Europe’s shift from Russian gas to LNG in 2022 drove regasification capacity constraints, resulting in a significant basis risk between (i) the price paid for LNG offshore Europe (DES NWE) and (ii) the price of gas onshore (e.g. TTF).

This spread has narrowed over the year to date however, and recently inverted, with DES NWE now at a slight premium to TTF for August 2023 delivery. Several factors are contributing to this trend:

- Expansion of European regasification capacity: seven new FSRU’s have come online across the region in the past month, adding over 30 bcma of incremental capacity (see earlier blog post)

- Subdued European gas demand and increased Asian LNG imports: flexible Atlantic Basin LNG cargoes have shifted towards Asia, borne out by US Gulf Coast netback forward curves showing Asia at a premium to Europe through October (see recent snapshot)

- Steep seasonal contango in the TTF curve: Suppliers are incentivised to ‘float’ tankers and sell into the premium priced November contract, delaying demand for slots (reflected in the backwardation in the DES NWE – TTF spread)

Any market players with fixed contractual commitments into Europe are therefore being forced to buy LNG at a premium to TTF to encourage suppliers to deliver into Europe on the prompt, sacrificing both higher prices in Asia and the chance to float into a later dated premium contract.

While both the steep contango and subdued prompt demand in Europe are temporary, the expansion of European regasification capacity is a more structural driver of a narrower DES NWE – TTF spread. This limits the merchant value of any European regas position and increases the importance of understanding portfolio value when considering the investment economics into any European regasification position.

Supporting our clients in analysing European LNG market access strategy is a key theme currently. We are supporting clients on both the buy & sell side of regas deals, by modelling regas capacity value within portfolios (e.g. supported by LNG Bridge) and advising on strategic contracting decisions.