It is often said that when the tide goes out on commodity prices we find out who’s been swimming without shorts on. The market smells trouble brewing amongst some large commodity trading companies. The most prominent of these, Glencore, has attracted plenty of attention over the last week. Since the latest commodity rout began in August, Glencore’s share price has slumped and the cost of insuring default risk has soared.

The focus on Glencore is partly because of its size, but also because it is one of the few publicly listed commodity traders. This means that there are much clearer market price signals for balance sheet stress. But Glencore’s exposure to falling commodity prices is far from unique. In fact the majority of global commodity traders have a similar business model. That means that trouble for one is likely to signal trouble across the sector. These companies are big energy market players and that brings credit risk sharply into focus.

For the energy industry, the echoes of Enron’s collapse in 2001 are sufficiently loud that they are worth revisiting. In this article we look at the credit risk issues that are rapidly evolving in the current market. But we do so in the context of looking back at the Enron driven credit event as a case study for what may happen next. We will then return next week and consider what’s to be done about it from a credit risk management perspective.

What’s all the worry?

Glencore and its commodity trading peers, companies such as Vitol, Trafigura, Noble & Mercuria, have evolved their business models substantially over the last 10-15 years. Growth has been fuelled by a big bull market in commodities. As an example, Vitol (the world’s largest oil trader) had zero profit in the late 90s but ballooned to a $2.28bn profit by 2009.

Commodity traders have expanded their core trading business by backing it with large asset portfolios in an attempt to claim margin across the supply chain. This has meant business model evolution has been accompanied by an expansion in structural long portfolio exposures to commodity markets. The theory of this business model is that the trading business manages portfolio risk via hedging core exposures, i.e. the companies are essentially a margin business that should benefit from market volatility.

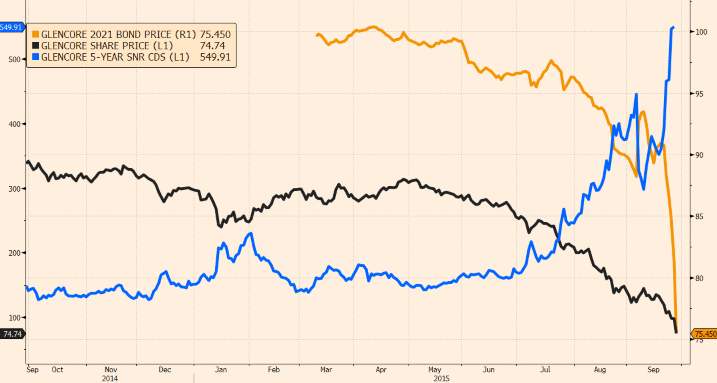

But current market price signals suggest that this theory may be harder to implement in practice. Chart 1 shows the prices of Glencore’s shares and bonds plunging in September. At the same time Credit Default Swaps (CDS) have risen sharply. Last week’s CDS prices meant that traders required about 14 percent upfront to protect against a Glencore default over the next 5 years. That is the highest level since April 2009 during the midst of the financial crisis.

Glencore is not alone. The shares of another large publicly listed commodity trader, Noble Group, have also fallen sharply over the last two months. Stress is also evident in non-listed companies via traded debt prices. The yield on Trafigura’s 2018 bonds soared to over 10% last week (from yields under 5% in early August) reflecting a sharp increase in credit risk premium. The threat of credit contagion echoes the events around Enron’s demise last decade and this is a useful case study to revisit.

Enron: A credit event case study

Enron was a major force in commodities trading beyond its dominance of gas and power markets. However Enron was not actually a victim of falling commodity prices. In fact, Enron had gone significantly short (and profitably so) in key markets during the commodity price declines that preceded its collapse. It was not even finished off by the major scandals that later engulfed its senior management. The fundamental cause of Enron’s demise was one of the oldest problems in business: it was under-capitalised, with profits greatly outstripping cash-flow. That may turn out to be a problem that Enron’s successors confront during the current commodity downturn.

The knock on credit risk impact of Enron’s balance sheet issues are very relevant to current events. Enron was everybody’s counterparty. This was frequently through Enron Online, a universally used B2B platform (with Enron as principal in every trade) unmediated by exchange or clearing. But it was also via large structured contract positions, often relating to underlying physical energy assets. Despite this Enron was never rated above BBB+.

As Enron’s balance sheet stress grew, the dominos fell, but in slow motion, which was:

- initially confusing, disguising the very real sector-wide capital weakness, but

- helpful in allowing the banks to manage what might otherwise have been an avalanche

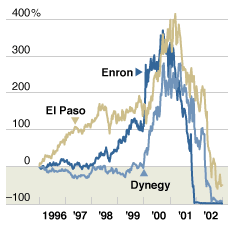

The other energy merchants remained in a state of denial and envisaged picking up Enron’s market share between them. But they were all, to a greater or lesser degree, also undercapitalised. One by one, at the rate of approximately one per month, other energy merchants went bust, the last big one being TXU Europe in 2002 a year after Enron filed for Chapter 11 bankruptcy. Chart 2 illustrates the speed of the energy merchant downfall.

Many of these collapses were accelerated by (i) the complex chain of credit exposures, and (ii) softening of energy prices from 2000 onwards, especially power prices. For example Enron’s disappearance had a significant negative impact on TXU Europe. AES Drax was primarily hedged by TXU. Then when TXU Europe went under, and as UK power prices fell sharply, AES Drax also went under (as did a significant portion of UK IPPs, and British Energy).

This is a key takeaway from the Enron experience relevant for current market events. The Enron episode exemplifies not only Credit Risk but Systemic Risk, when feedback loops cause an entire commercial infrastructure to come under enormous strain, causing a credit event that impacts a significant number of industry players.

A further systemic consequence was a huge hit to the then-booming Project Finance sector in banking. At the turn of the century there were well over 70 banks actively engaged in the energy sector. This fell to a dozen or so by 2003. The fall of a key player that is heavily engaged with an entire market can have devastating consequences, within and beyond that market.

Returning to 2015

Glencore and its peers are big enough, and in sufficiently similar positions, to suggest 2015 may evolve into a large-scale credit risk event. The interconnected nature of commodity trader exposures suggests that systemic risk is also a threat. The low interest rate environment over the last 5 years has added to this threat. Cheap borrowing costs have incentivised commodity traders to issue debt and utilise structured finance opportunities which bring capital into focus as margins decline.

How would the commodity sector, and more specifically the energy sector, cope with such a credit event? The fact that the industry has been tested by (i) the Enron collapse and (ii) the financial crisis credit shock of 2007-09, suggests that lessons have been learned. Credit risk management techniques have improved, although these are often far from adequate as we will explore in more detail next week.

What feels uncomfortable this time is that wide spread commodity price weakness is happening against a backdrop of weakening global growth and tightening corporate credit conditions. Banks were well placed to manage liquidation of large portfolios and take over bust IPPs after the Enron crisis, but are less so now. US oil producer debt is an accident waiting to happen as we have set out previously. These conditions increase the likelihood that one or two large failures trigger a systemic credit risk event. The UK is particularly vulnerable to a systemic event in the commodity sector given the importance of resources companies to the FTSE indices.

Even if systemic risk is avoided right now, at the very least we can expect commodity trading companies to come under intense capital pressure. This means drawing in their horns and taking out risk-capital and liquidity from the market. And that will have negative consequences for all market players, even those which are adequately capitalised and have well-managed portfolios.

Article written by Nick Perry & David Stokes.