The energy crisis of 2021-22 has forced a change in attitude to gas-fired power. The crisis highlights the dependence of European power markets on gas-fired generation flexibility, until a viable alternative can be scaled.

This presents an uncomfortable challenge for Europe on its path to decarbonisation. Continued deployment of wind & solar capacity is growing low carbon energy production. Batteries are proving to be an economically viable source of shorter duration flex to balance renewables swings (e.g. to 4 hours of duration).

However there is so far no clear scalable & economic solution for providing longer duration flexibility (e.g. from 4 hours to 4 weeks). That underpins the current role of gas in the capacity mix.

Why is gas generation still system critical?

Until a viable low carbon longer duration technology emerges, CCGTs and gas peakers remain the key providers of longer duration flexibility. And they are instrumental to ensuring system security of supply e.g. across periods of low wind & solar output that can last weeks.

In some of Europe’s power markets, the development of new gas-fired plants is also important for enabling the closure of high emission coal & lignite capacity. The most prominent of these is Germany that will likely need 15-20GW of new gas capacity to enable closure of its coal fleet. Gas is also important for displacing coal in Eastern Europe (e.g. in Poland & Czechia).

Building new gas-fired plants or re-powering existing assets feels uncomfortably at odds with decarbonisation of Europe’s power markets. This is leading to an increasing focus on ‘decarbonisation ready’ asset development e.g. via being hydrogen or CCUS ready, albeit with significant cost & technology risks associated with transition.

The economic viability of both new build & existing gas-fired plants depends on value capture. Let’s look at some analysis of how margins are evolving across European power markets.

Contrasting 2022 v 2023 gas plant margins

Several weeks ago we published an article showing a comparison of 2023 vs 23 day-ahead value capture for batteries across a broad range of European power markets. This was one of our most popular articles of recent years so this week we set out a similar analysis for gas plants in Charts 1 & 2.

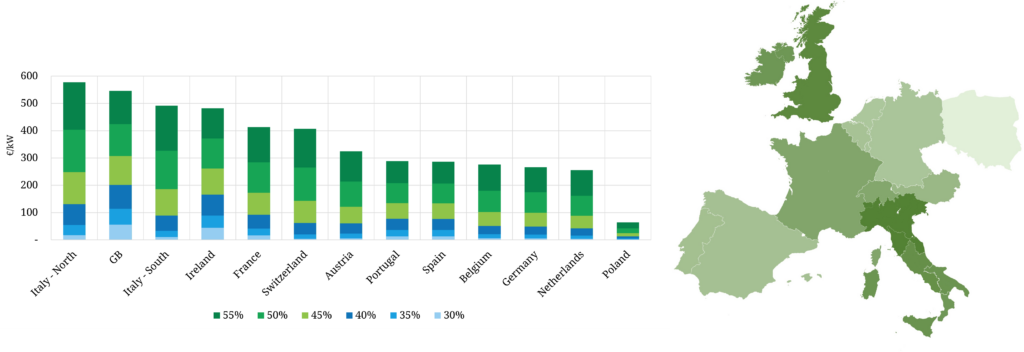

Chart 1: 2022 incremental gas plant margin capture by plant efficiency

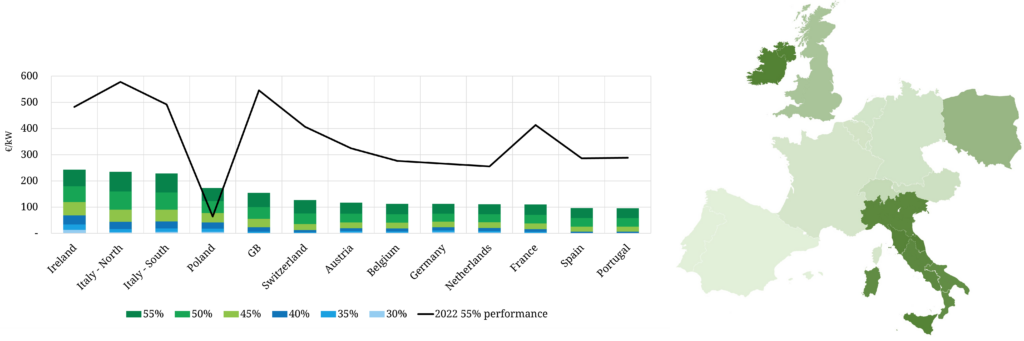

Analytical approach behind charts: Analysis show the gross margin capture of gas-fired plants based on hourly spot power prices & daily gas & carbonprices. Importantly in this relatively simple analysis we do not account for the ramping & start constraints of assets. But the analysis provides a reasonable benchmark for relative gas plant value capture across markets.

Some takeaways that can be observed from the charts:

Overall takeaways

- Extreme power market tightness of 2022 drove structurally higher margin capture vs 2023 (where e.g. French nuclear availability & hydro balances were higher and gas prices lower)

- Gas plant capture varies significantly by market & efficiency in both years… but with some patterns which we explore below.

- The impact of capacity prices on gas plant value capture is not shown in the charts and can have a substantial impact on asset economics e.g. with higher capacity price markets like GB, IT & IE vs zero capacity payments in DE & NL.

Specific market takeaways

- The impact of very high prices in 2022 is clear in GB & Ireland given the ‘island’ nature of these markets during the energy crisis with low net interconnector imports (e.g. due to low French nuke availability); price spikes in these markets drove the relatively high value capture of even low efficiency peakers (blue bars).

- Italian CCGTs also captured relatively strong margin across both years given a power price premium vs Northern Europe; this was reinforced by the Italian PSV gas hub trading at a slight discount to NW European gas hubs across 2021-22 (given less acute crisis constraints on hub access).

- Germany & Netherlands have relatively weak value capture across both years given the impact of rising renewable penetration in supressing prices (45% RES share of generation in 2023) and the influence of the large German coal & lignite fleet.

- In Spain and Portugal the price intervention mechanism (Mecanismo Iberico) had a strong impact in driving plant margins alongside the large penetration of solar and wind compressing CSS (41% wind + solar generation in Iberia in 2023 against e.g. only 21% in Italy).

- In Poland, coal (63% of generation) was responsible for the divergence of 2022 power prices from gas variable cost fundamentals, causing a substantial compression of margins. This impact was significantly reduced in 2023 as gas prices fell reducing the impact of divergence of gas vs coal plant variable costs.

Annual data disguise margin variation within-year

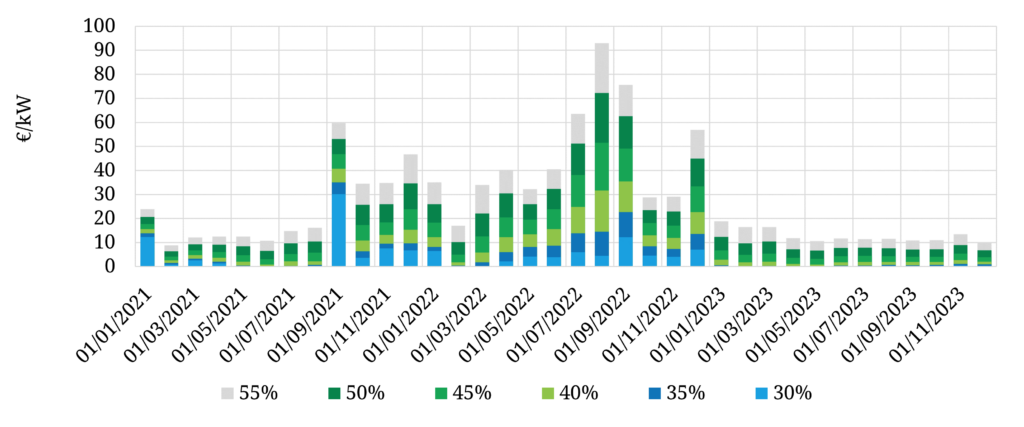

Chart 3 shows the same analysis at a monthly level for GB as a case study market. Across the 2021 – 2023 horizon.

Chart 3: Monthly gross margin capture by efficiency in the GB market (2021-23)

It is clear from the chart when the energy crisis took hold in late summer of 2021 as Russian supply cuts accelerated and French nuclear availability issues grew. This led to a period of extraordinary margins for gas plants, with clean spark spreads surging to record levels. The GB market was so tight in 2022 that many gas peakers were running high load factors.

The 2023 monthly margin levels illustrate just how quickly power markets stabilised in early 2023 as French nuclear availability improved and the gas crisis eased.

What does this analysis imply for new build gas plants?

We finish with four simple conclusions for markets that need new build gas fired plants to enable coal closures or replace ageing existing gas assets:

- Under normal market conditions, merchant gas plant margins are not enough to support new build of new CCGTs, OCGTs or gas engines

- As renewable penetration increases it is set to gradually erode the margins of both new & existing gas plants

- Points 1. & 2. mean that some form of capacity payments are key to ensure enough existing gas plants remain, as well as underpinning new investment (a particular issue for Germany that will need to implement capacity payments if it is to achieve its coal & lignite closure goals)

- Mandating credible decarbonisation gas plant solutions is important (given new gas assets have economic lives of 20+ years), but this increases investment costs that need to be recovered via a combination of market spark spreads & capacity payments.

Policy makers face a difficult balancing act across the next 5 years in providing enough support for gas plants to ensure security of supply, while at the same time increasing support for new low carbon flex technologies that can replace gas into the 2030-40s.

Timera speaking at the Key Energy conference in Rimini, Italy 29th Feb

Steven Coppack our Power Director is doing a presentation on the unique investment opportunities for batteries in Italy and how Italian BESS investment compares with the GB market (https://en.key-expo.com/).

He will be presenting alongside the head of the Energy Department of the Italian Energy and Environment Ministry (MASE), the head of Energy Division of the Italian regulator ARERA & the Executive Vice President for Grid Development Strategies and Dispatching at the Italian TSO Terna.

Feel free to reach out to Steven if you would like to meet up at the conference (steven.coppack@timera-energy.com).