“Not all capacity is created equal”

European LNG imports have risen this year, supported by weak Asian demand and lower European storage levels after winter 2024–25. Reduced Asian pull has kept more flexible US Gulf Coast supply in the Atlantic Basin, while tighter European storage balances have supported incremental LNG demand.

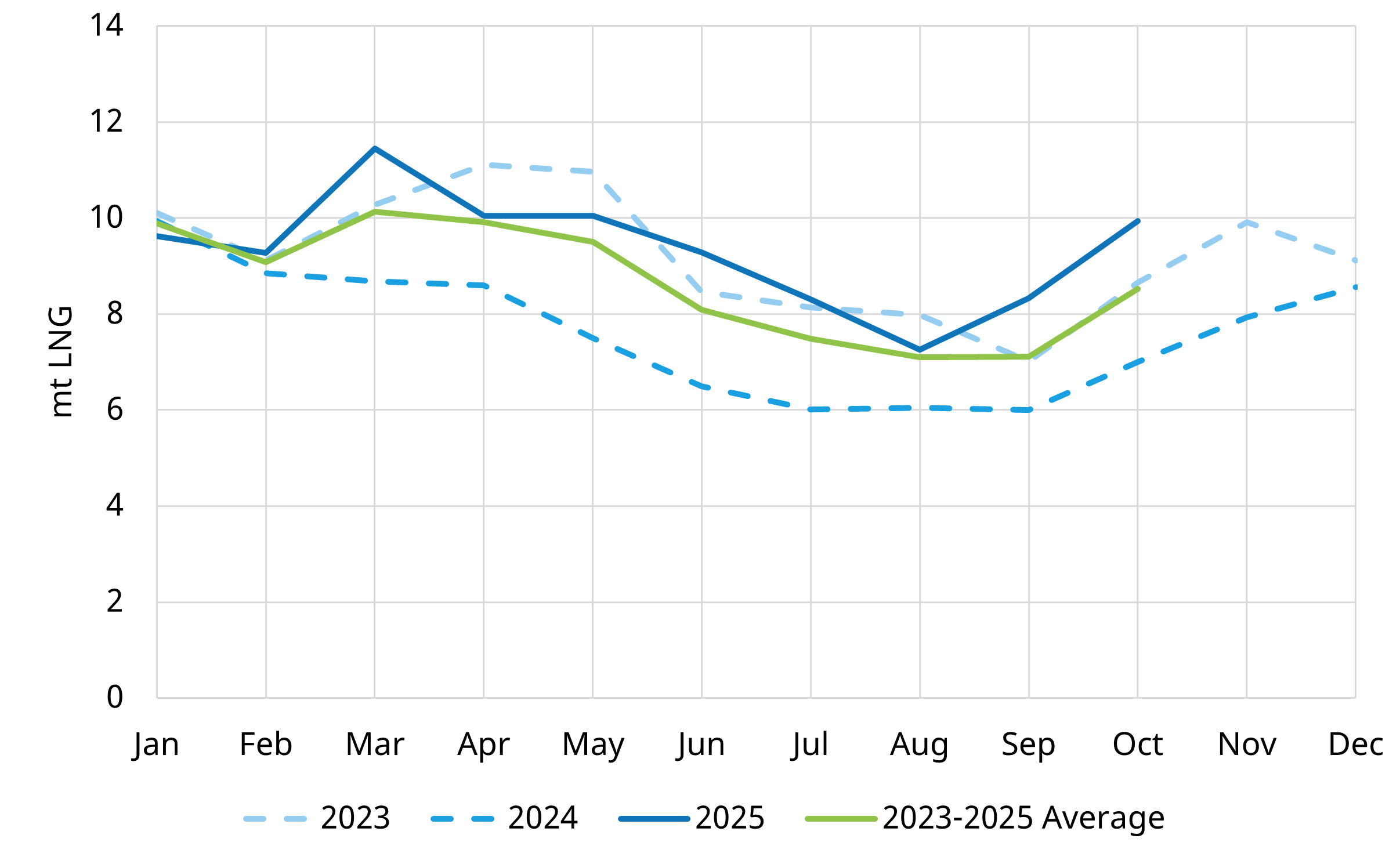

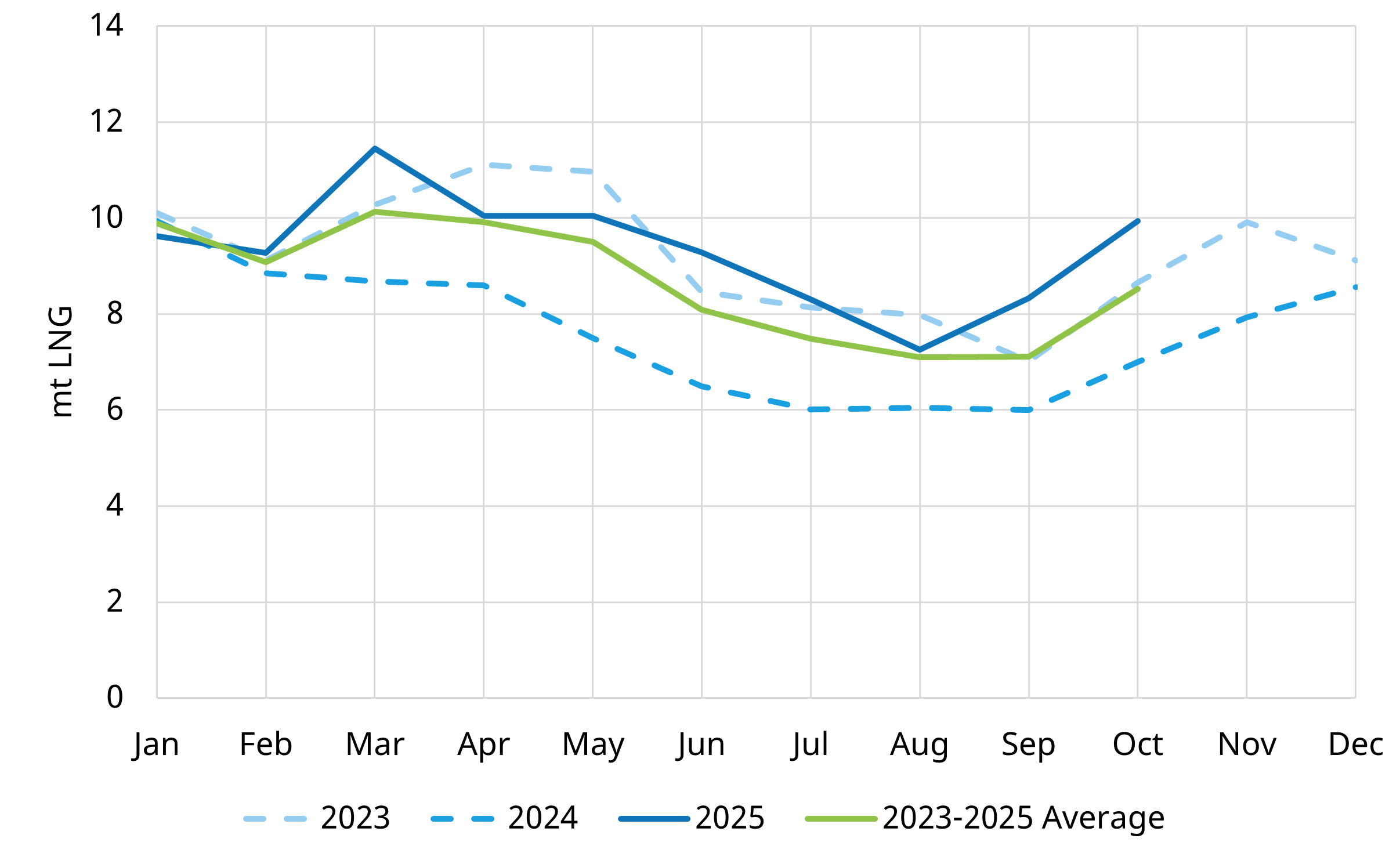

Chart 1: European LNG imports

Source: Timera Energy, LNG Unlimited

Chart 1 shows imports across 2023–25 trending toward the upper end of recent ranges.

Limited price responsive flexibility in Europe is helping to keep global LNG prices elevated. These higher prices are in turn impacting Asian LNG demand at the margin, at least until the new wave of LNG ramps up in earnest.

Against this backdrop, the need for a robust European market access strategy remains key.

Why portfolios need firm regas access

Spot regas slots can work for small players, but scale quickly exposes limitations. Up to 4 cargos a month is typically the threshold before operational issues emerge such as:

- Tight short-term slot availability

- Challenges in aligning slots with supply loading windows and vessel rotations, that can introduce margin leakage

For players holding larger Atlantic focused offtake positions, reliable contracted market access is important to monetise portfolio flexibility and to deliver gas consistently into Europe’s hubs. Firm capacity provides predictable physical entry that is not guaranteed with a spot access strategy.

DES–hub spreads drive value

The DES to hub spread is set by the variable cost of the marginal importing terminal. The relative value of a terminal to the spot market (or another terminal) is then dependent on which hub you gain access to, and the associated fixed & variable cost structure.

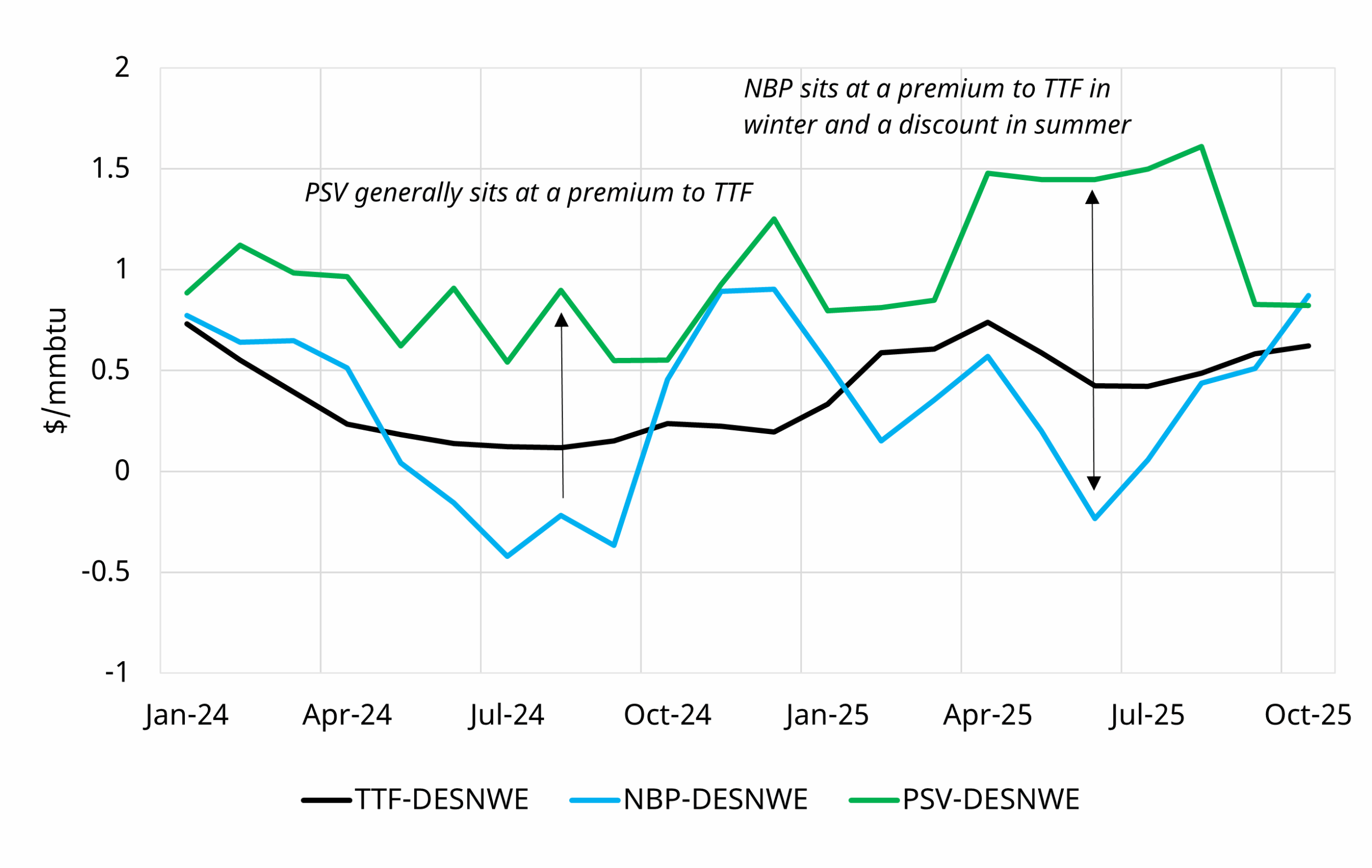

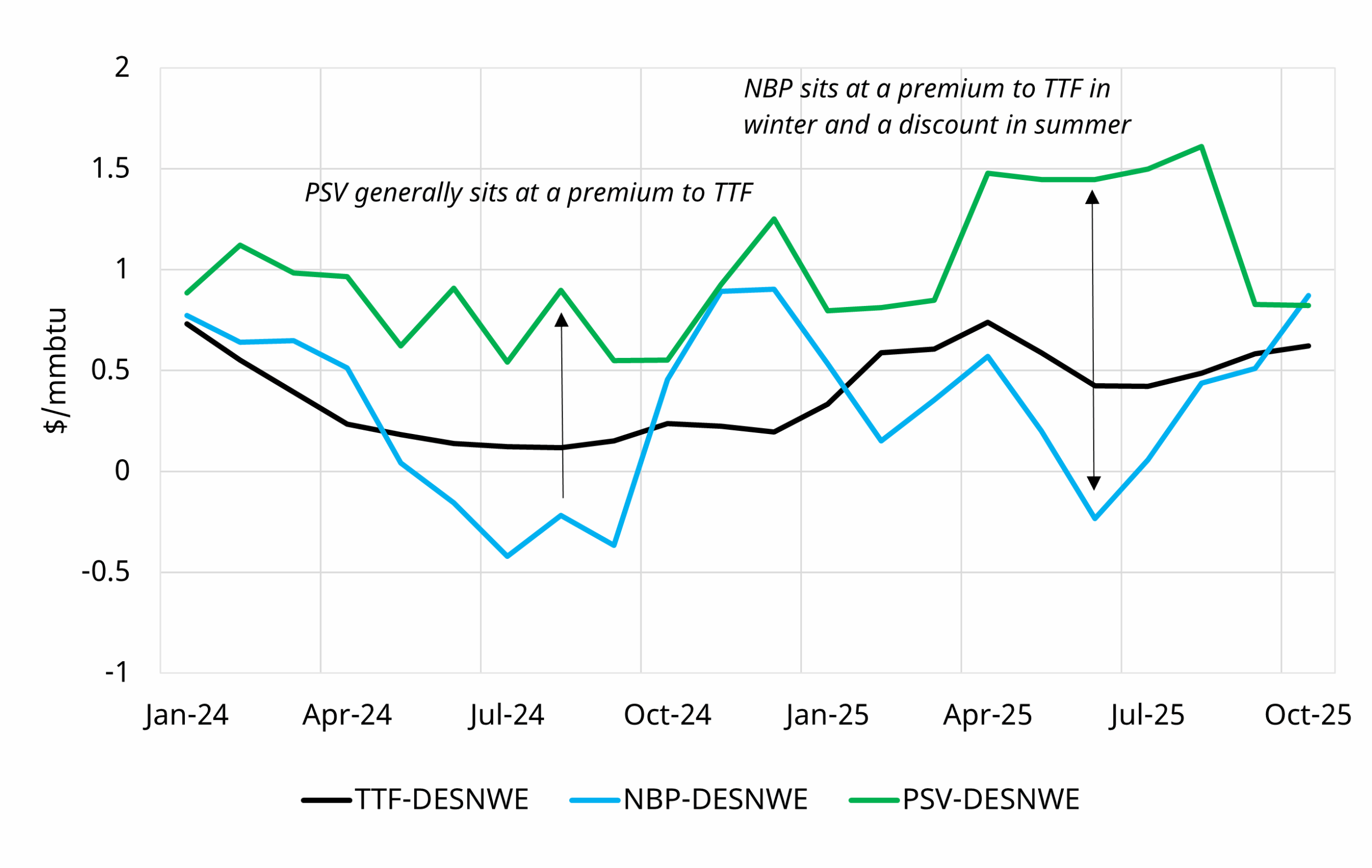

Chart 2 highlights the familiar pattern: NBP tends to trade at a premium in winter and a discount in summer, while PSV generally sits above TTF.

Chart 2: DESNWE vs Hub price spreads

Source: Timera Energy, Spark Commodities, ICE

Increased European import levels this year have come hand in hand with the price signal increase of DES-TTF spreads ($0.54/mmbtu in 2025 YtD, $0.27/mmbtu on average in 2024). This is supporting the merchant value of regas capacity, but where the terminal sits in the merit order is key.

Not all regas capacity is created equal

Evaluating European regas opportunities requires careful differentiation across three areas:

- Onshore hub access: Direct, efficient access to liquid hubs (TTF, NBP, PSV) impacts the value of regas capacity (i.e. liquidity premium).

- Tariff and service structure: Fixed & variable costs matter, but flexibility terms (e.g. cancellation optionality) typically dominate risk-return outcomes.

- Embedded optionality: Cancellation flexibility dominates standalone merchant value, with certain terminals have value uplift from greater flex on storage access & send out.

The right regas capacity can significantly enhance portfolio optimisation, particularly for Atlantic focused offtakers.

Regas capacity value on a standalone merchant basis can be relatively limited. However the portfolio value unlocked by secure access is often substantially larger. For LNG players, especially US offtakers, quantifying this portfolio value is driving regas access strategy.

How Timera supports clients

We support LNG players on European market access strategy & individual opportunity evaluation. This is underpinned by (i) fundamental modelling that drives future price formation and (ii) stochastic modelling of merchant & portfolio value, using LNG Bridge.

Our support includes:

- European market access strategy

- Primary capacity auction bidding strategy & valuation

- Bilateral deal negotiation & valuation support

- M&A transaction support (market context, valuation, commercial due diligence)

For further insight, please contact our LNG & Gas Director David Duncan david.duncan@timera-energy.com.