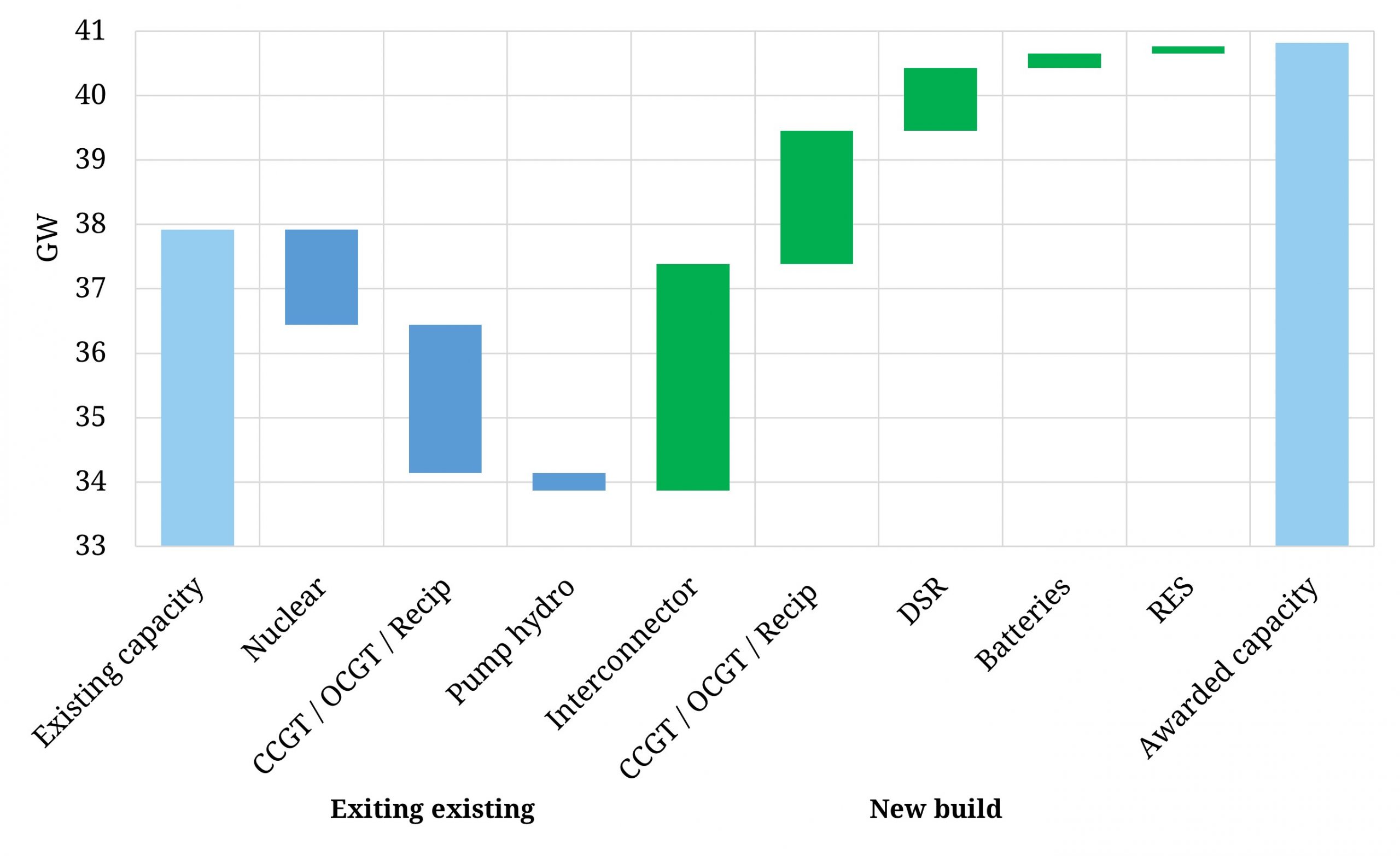

Just over 4 GW of existing derated capacity failed to secure an agreement in yesterday’s T-4 auction for 2024-25. This was dominated by ageing gas (2.26 GW) and nuclear (1.48 GW) units.

6.9 GW of new derated capacity was successful in the auction. 3.52 GW of this was interconnector capacity, although Viking link (0.73 GW) was the only genuinely new project (as Eleclink, IFA2 & NSL had cleared in previous auctions).

There was 0.97 GW of DSR (dominated by E.ON & Enel), 0.85 GW of OCGTs (3 x Drax projects), 0.68 GW of refurbished CCGT (Connah’s Quay) and just under half a GW of gas recip engines.

0.23 GW of batteries were successful on a derated capacity basis (0.57GW nameplate, split roughly 60% 2hr duration vs 40% 1 hr) as well as small volumes of merchant wind (27 MW) and solar (5 MW).

The clearing price of 18 £/kW follows the last T-4 auction which cleared just under 16 £/kW. Prices look to be stabilising in the 15-20 £/kW range with strong supply of new gas & peaking capacity above 20 £/kW and exit of older gas & nuclear below 15 £/kW. These capacity prices combined with rising UK wholesale & balancing price signals, is structurally supporting the investment case for flexible capacity.