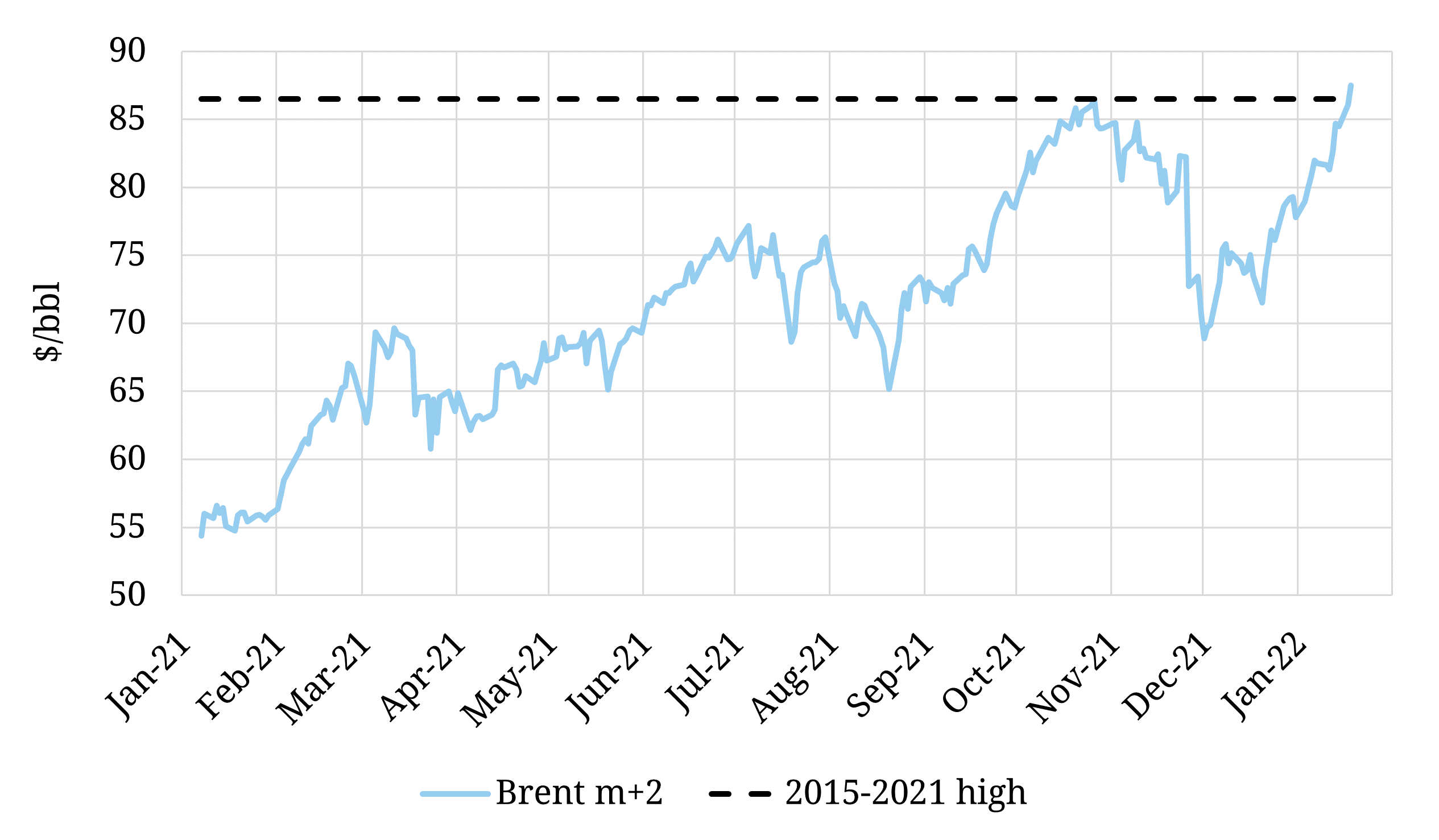

In our last feature article on the global oil market back in June 2021, we highlighted why crude oil prices “may be set to surge”. Fast forward 7 months and front month Brent prices have reached highs not seen since 2014. Demand has remained robust in the face of the Omicron variant, while Opec+ are struggling to meet their existing production quota increases, a tailwind to unwinding production cuts even more rapidly in the face of rising prices.

The longer term dynamics remain as we laid out in June. Cost of capital and decarbonisation risks have contributed to limited investment in the sector (e.g. the cancellation of the UK Cambo project). As a result the price anchor range of US shale producers may have increased, to be followed by the associated 1-2 year delay in response time. A lot rides in the shorter term on the ability of OPEC+ to increase production within the existing headroom.