As laid out in our briefing note earlier this year, the regime change in the LNG market has led to Asia and Europe competing for constrained global supplies, with demand response on the margin in both basins. More dynamic cargo flows are being required to clear the market, leading to increasingly volatile inter-regional price signals.

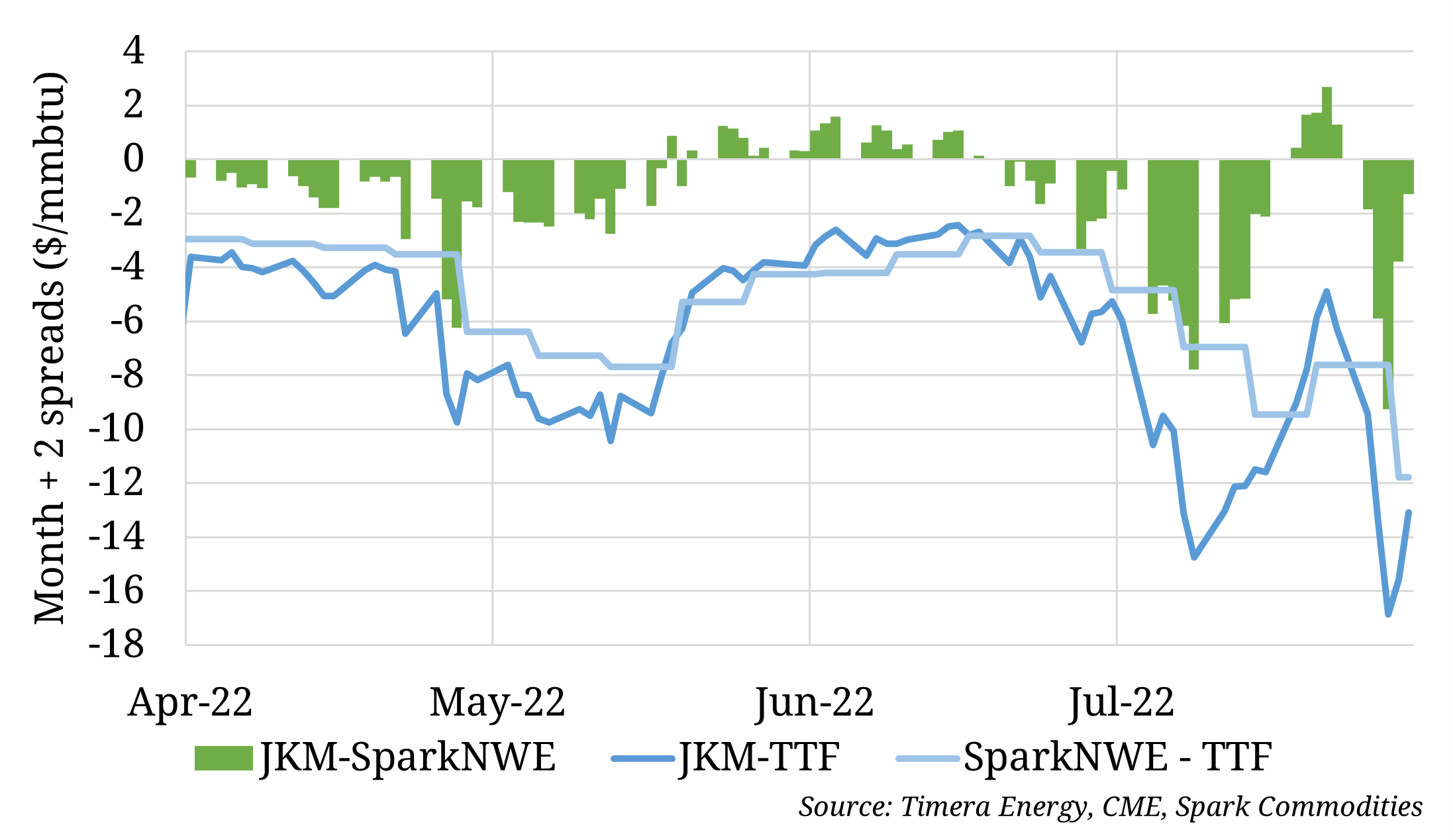

The key price spread from a marginal LNG cargo flow perspective is not the JKM vs TTF spread (in dark blue on the chart) but the JKM vs NW Europe DES spot price (e.g. TTF – spot regas access) spread (in green). A steep discount of NW European DES to TTF has opened up this year (light blue), given regas terminal capacity constraints. This discount has increased dramatically since the Nord Stream 1 flow reductions, as market participants expect higher European LNG imports (at the expense of Asia & other markets). There is significant momentum in response around FSRU projects as a solution to more rapidly alleviate the regas constraints (e.g. Eemshaven in the Netherlands, Le Havre in France, multiple German FSRUs).

Market participants with physical exposure to cargo flows between the two basins are currently largely constrained to managing risk against the relatively liquid JKM-TTF derivative spread. Monitoring both inter-basin cargo flow expectations and European regas constraints are to remain equally important in the near term, as is modelling the impact on risk.