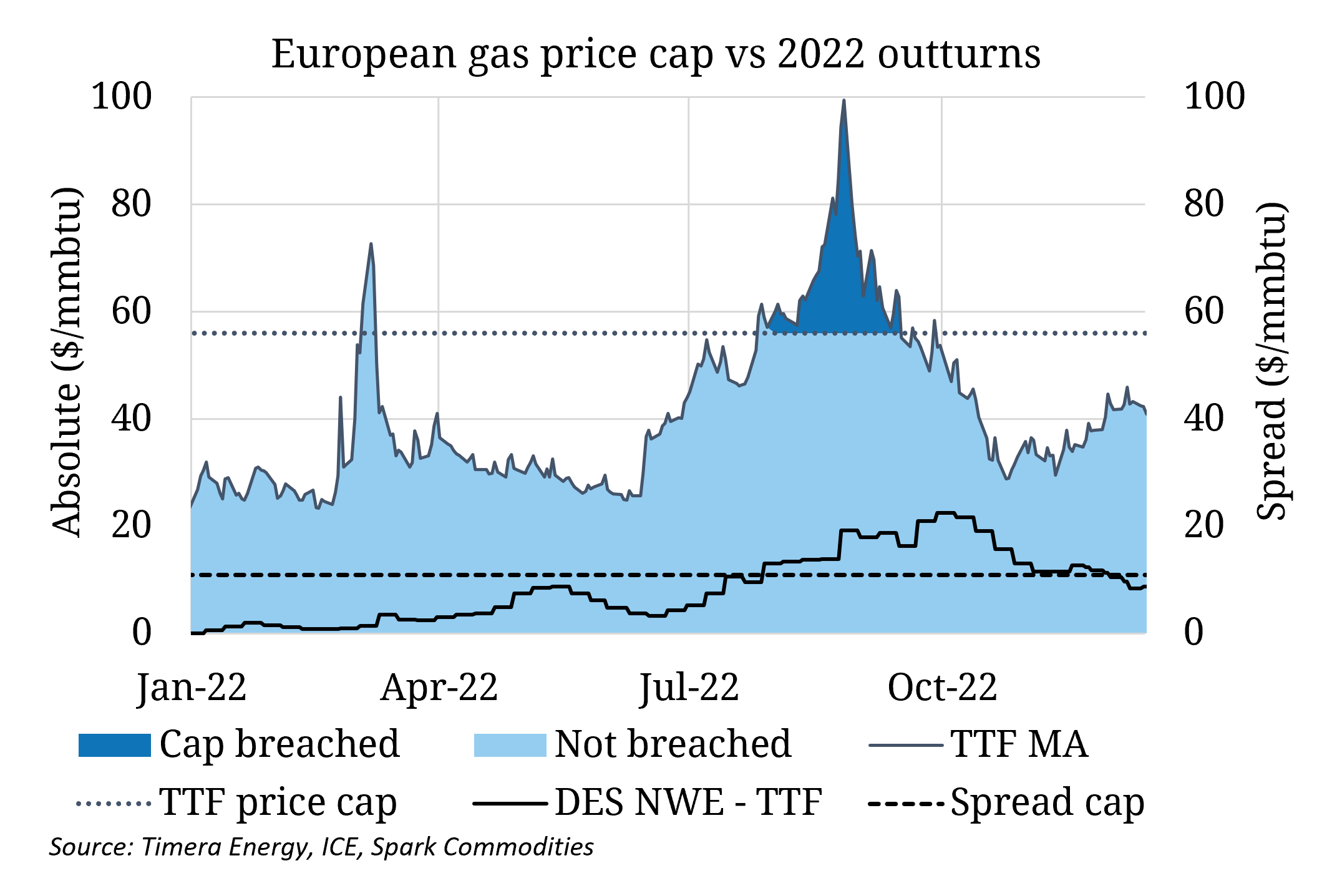

EU countries on Monday agreed to a gas price cap that will be triggered from 15th Feb 2023 if TTF month ahead price both exceeds 180 €/MWh and sits 35 €/MWh above a reference global LNG price for three consecutive working days.

In 2022, the cap would have been triggered from early August to mid-September. By bringing in the cap, the EU is trying to artificially bring the price of demand destruction in Europe lower, whilst retaining its ability to compete with Asia for LNG.

We commented of the dangers of price caps earlier this year, given the risk of market distortions. However, while absolute TTF prices could top 180 €/MWh in 2023, the dislocation between TTF and global LNG prices is expected to narrow, as regasification capacity constraints in Europe ease, making a breach of the 35 €/MWh spread threshold less likely.

The commissioning of new FSRUs in Europe provides the capacity for LNG imports to grow by up to 40 bcm year on year in 2023. However, with global LNG supply growth of just 20-30 bcm, and Asian demand showing signs of rebounding (i.e., Chinese unlocking), Europe is unlikely to fully utilise this incremental capacity.

Full utilisation could be possible if Asian demand disappoints, although this is likely to drive prices in Europe below the 180 €/MWh cap anyway. More notable is if European balances tighten substantially, TTF would need to rise to incentivise greater levels of demand destruction, both in Europe and Asia, to balance. In such a case, the cap could prove inhibiting if global gas prices dislocated due to full utilisation of European LNG capacity, with any correction back to 180 €/MWh potentially signalling both for LNG to flow back to Asia and for some demand to return.