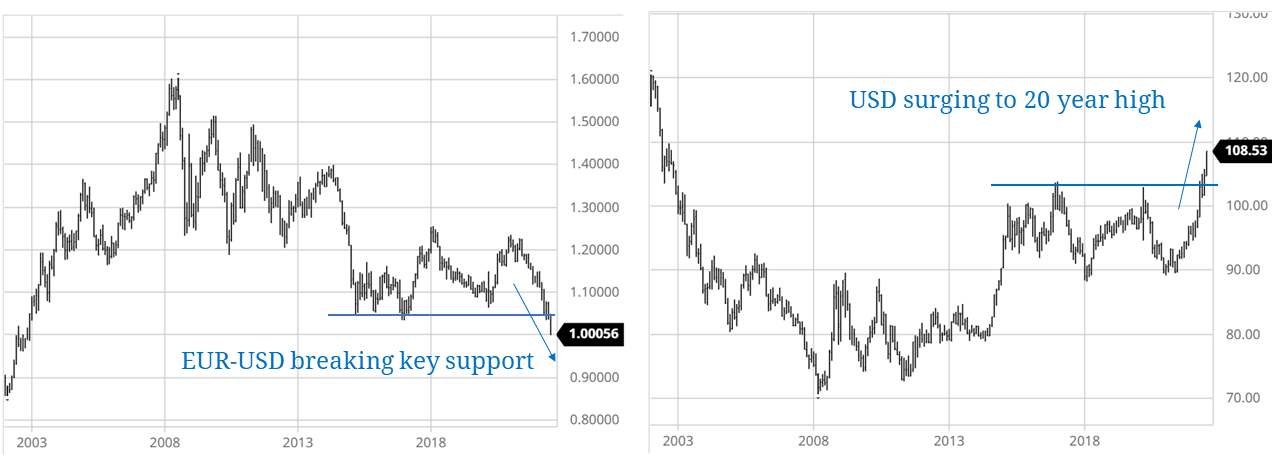

European power, gas & coal prices remain near record levels driven by acute supply constraints linked to the Russian conflict (as have arbitrage linked commodities e.g. JKM & Newcastle coal). But the price of almost every other global commodity has fallen sharply across the last 4 weeks (including oil). This has coincided with a surge in the US dollar to 20 year highs (right hand panel of chart), with the EUR testing parity with the USD (left hand panel).

The inverse correlation between commodity prices and the dollar is a long standing phenomena. Global markets are pricing in the risk of a sharp recession driven by European energy prices (as we set out in our feature article this week) & aggressive monetary tightening to fight inflation. As global growth expectations slow and liquidity conditions tighten, commodity prices are falling and there is a strong demand for USD as the global reserve currency.

European energy prices have so far bucked the trend. Russian supply constraints have outweighed the impacts of accelerating demand destruction to support prices. Whether that continues depends on political decisions determining the flow of hydrocarbons out of Russia. Meanwhile the USD is a key barometer to watch as a signal for broader commodity prices.