A renewed surge in European gas & power markets is starting to drive shock waves through global financial markets. This reflects the rising probability of Europe facing stagflation as the result of an energy price explosion comparable to the 1970s oil price shocks.

“Now is a time for razor sharp proactive risk management of energy portfolios”

Against a backdrop of aggressive central bank tightening and a weak Chinese economy, financial markets are pricing a rapidly increasing risk that Europe could lead the world into a sharp recession.

Across the last 2 weeks, European forward gas & power prices for 2022 delivery have hit new record levels. What is more concerning is that prices are now surging across the 2023-25 horizon. Between mid-June and early July the already elevated Calendar 2023 TTF benchmark gas price exploded another 80% higher.

The reason? Markets are pricing a big increase in the risk premium associated with major Russian supply cuts to Europe. And investment lead times mean that global supply cannot respond to replace this gas. This means gas & LNG prices are rising to levels required to induce demand destruction.

In today’s article, our last before the summer break, we look at 3 charts that summarise this new phase of Europe’s energy crisis and set out why the impact is infecting global financial markets. We also look at 5 emerging trends impacting the European energy industry across the first half of 2022.

European energy crisis in 3 charts

With all of the events that have happened since the Feb 2022 invasion of Ukraine, it is easy to forget that the European gas market was already confronting a record tight balance at the start of 2022.

Prices rose again post-invasion as the market priced in the rising risk of temporary Russian supply interruptions. The most recent run up in prices (since mid-June) has been driven by Russia cutting Nord Stream 1 (NS1) flows in what appears to be a clear intent to ‘weaponise’ gas supply.

European energy markets are pricing in a growing risk that NS1 (the key trunk pipeline route from Russia into Europe) will remain at zero flows after its summer maintenance outage (12-21 Jul). Price rises across the next few months have been reinforced by a fire causing an outage at the US Freeport LNG export terminal.

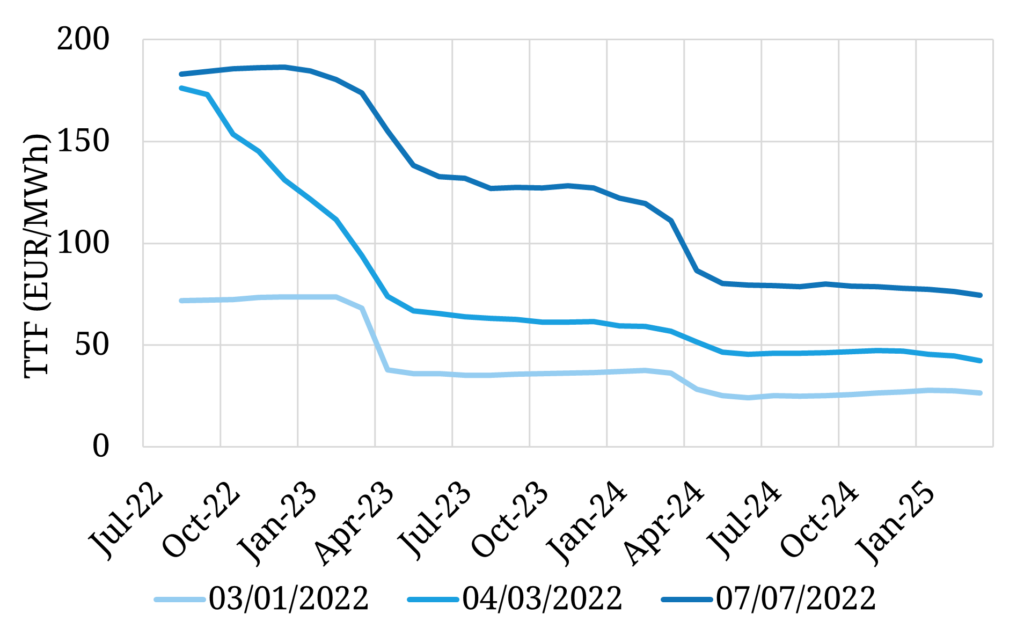

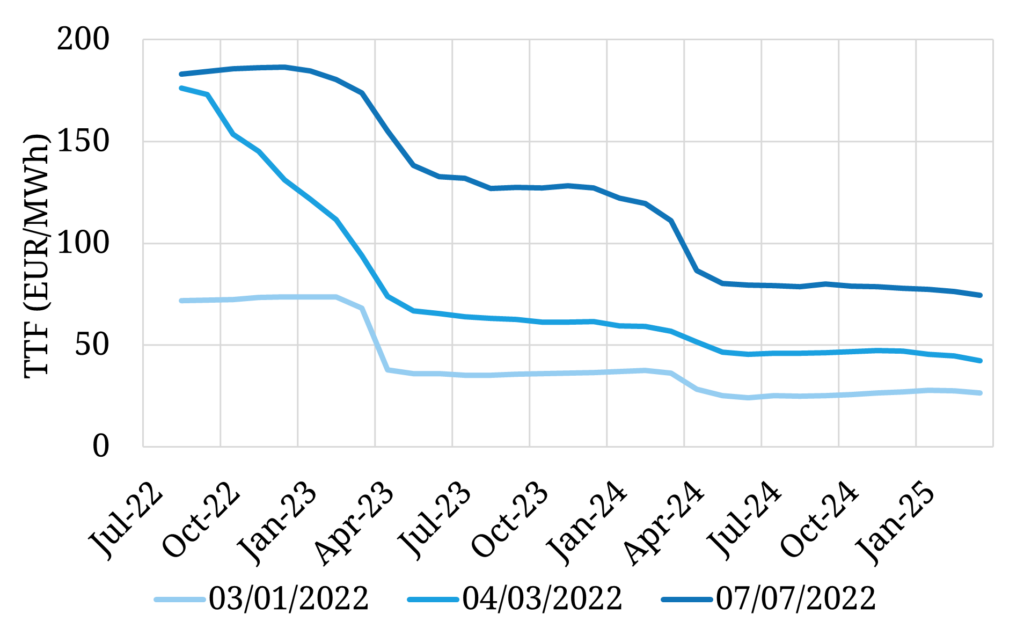

Chart 1 shows the evolution of the TTF forward curve from the start of the year (light blue), through the Russian invasion (mid blue) to its level late last week (dark blue). The gap between the top two lines illustrates the scale of the surge in prices across 2023-25 horizon, most of which has taken place since mid-June.

Chart 1: 3 step evolution of TTF forward curve since start of 2022

Source: Timera Energy, ICE

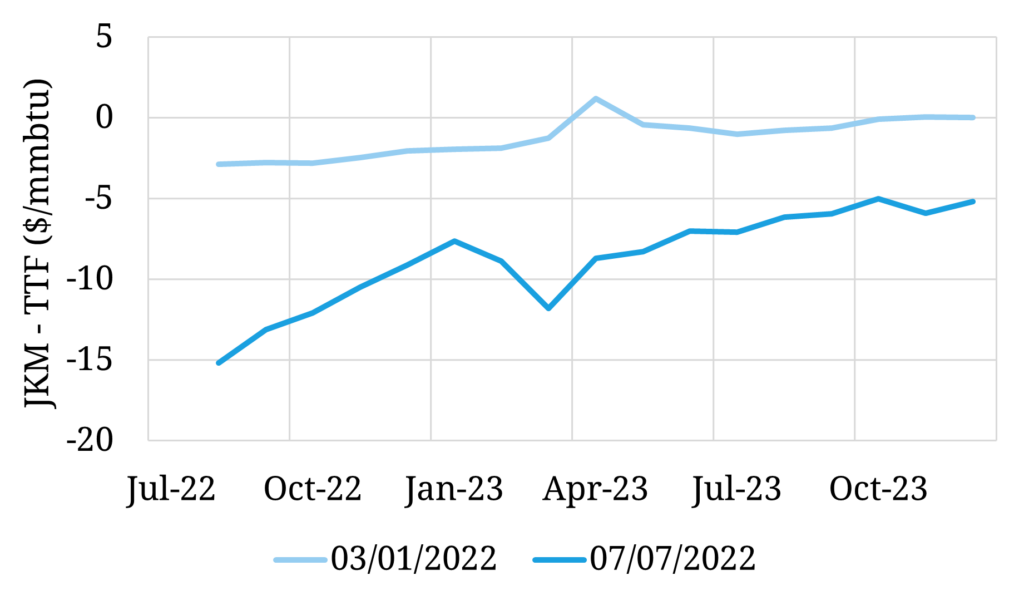

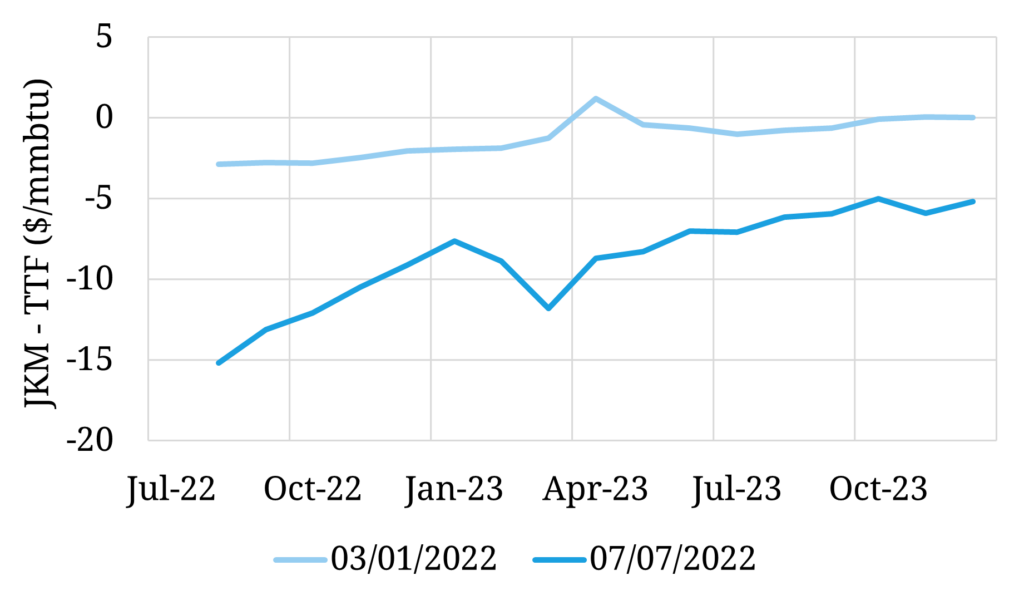

The NS1 supply cut risks leave Europe aggressively bidding for all available LNG cargoes. Up until the current gas crisis, European gas prices have always traded at a structural discount to Asia. Chart 2 shows how the 2022 supply crunch is now driving a huge premium of European hub prices over Asia. TTF prices are rising to signal cargo diversion and induce demand destruction.

Chart 2: TTF vs JKM price differential

Source: Timera Energy, CME

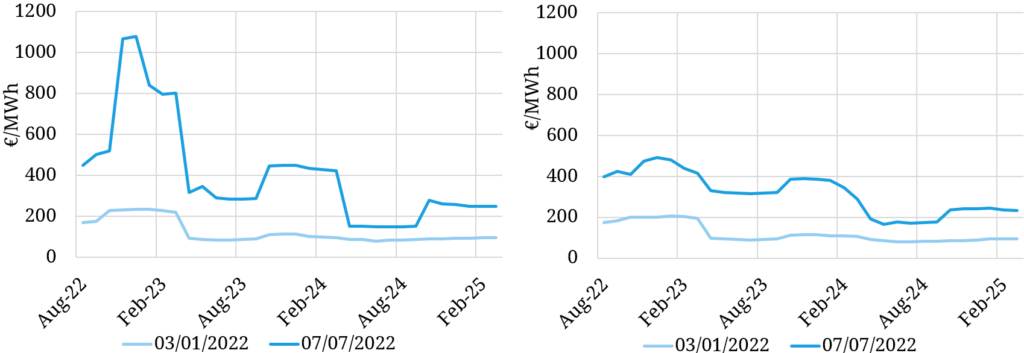

As well as Europe’s gas supply issues it is also experiencing a parallel power market crisis. This is the result of rising gas prices dragging up power prices across Europe (given gas is the marginal price setting fuel). But it is also being exacerbated by low French nuclear availability given reactor maintenance and safety issues. This contributed to the French government’s decision last week to fully nationalise EDF.

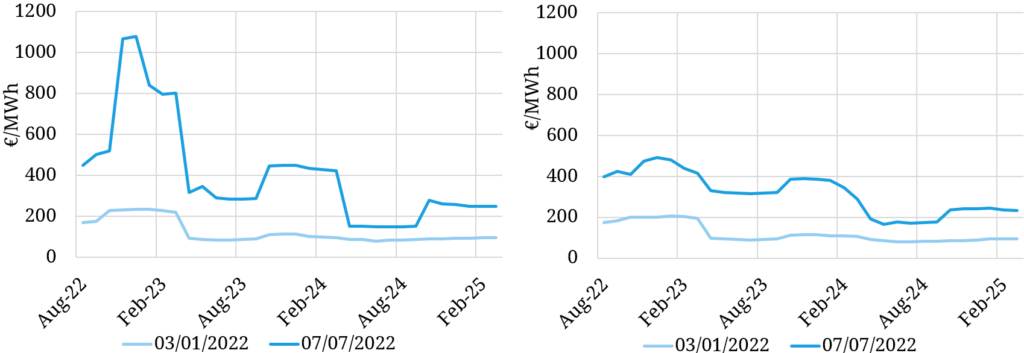

Chart 3 shows the scale of the surge in French and German forward power prices since the start of 2022. Prices are at record levels as is the price divergence between the two countries. Transmission constraints are causing sharp increases in basis risks across European power & gas markets.

Chart 3: French (left panel) & German (right panel) baseload forward power curves

Source: Timera Energy, ICE

The global impact of Europe’s energy crisis

Up until two weeks ago global financial markets were treating high gas & power prices as a European problem. That started to change in late June as the latest price surge hit not just the 2022 horizon, but extended out across the next 3 years.

Financial markets have transitioned from a one-tracked focus on inflation and started to aggressively price in the risk of a global recession. This was evidenced by a sharp decline in the prices of non-energy commodities, forward interest rates and inflation expectations (as measured by inflation breakevens).

Putin squeezing Europe has global implications via the risk of driving Europe into a stagflationary recession. Some of the factors fuelling this risk are:

- Industrial demand destruction (due to both high prices & energy rationing)

- Loss of European industrial competitiveness given extreme energy input costs

- Surging producer & consumer price inflation (e.g. Spanish PPI is currently 44% y-o-y; 34% in Germany!)

- Rapid declines in consumer confidence & disposable income.

This may all sound a bit alarmist against the backdrop of a political narrative that everything is under control. There is indeed a credible scenario that Russian gas flows increase post NS 1 maintenance and prices retrace sharply. But there is another scenario which is just as credible where prolonged Russian supply cuts continue to drive up European energy prices.

There has never been a more important time for razor sharp proactive risk management of energy portfolios. Large players are now getting into existential trouble as illustrated most recently by Uniper seeking a bailout.

5 other emerging trends in H1 2022

Behind the headline grabbing price rises, there are several other structural trends that have emerged across the first half of this year. We’ve picked out 5 below that we’ve been experiencing first hand through our client work:

- Policy intervention: Price caps, rationing, volume mandates & nationalisation have all featured in H1 and look set to continue. Watch out for unintended side effects.

- European pivot to LNG: Attempting to replace 30% of European gas supply via a shift to LNG is having a profound impact on market pricing & portfolio values.

- Focus on security & flexibility: The penny has dropped that security of supply & energy transition both depend on investment in flexible power assets. Battery deployment is accelerating across Europe but is not enough.

- Hydrogen momentum: H2 policy focus is being accelerated by the push to wean off Russian gas. Investors are doing the numbers but still need clarity on support mechanisms.

- Risk management: Investment in energy portfolio value & risk management capability is surging, in response to extreme price movements, basis risks, poor liquidity and funding challenges.

As usual we are taking a short break from publishing feature articles across the summer. We’ll be back in mid August with more features and some exciting news about significant growth in the Timera team. We will be continuing to publish regular blog snapshot pieces in the meantime.

The Timera blog has seen strong growth in reader numbers across the first half of this year – we thank you for your ongoing interest. Feel free to subscribe if you haven’t already (it’s free).