Europe’s ability to navigate a parallel power & gas crisis across the next two years depends strongly on its ability to reduce demand.

“The conversation is being driven by politics… not a level-headed assessment of market implications”

Why is demand so important? Because supply side response is constrained by significant investment lead times. In the case of gas it takes at least 4 years to bring on new LNG supply, even if regas capacity bottlenecks can be alleviated in the meantime. Investment in new flexible power capacity typically takes at least 2 years (assuming no planning & connection hurdles).

The EU has recently announced its energy crisis policy response package. Reductions in gas & power demand are at the top of the priority list… at least on paper. But policy measures being implemented in practice at a country level are focused on broad based consumer price caps. These inherently undermine demand reduction incentives.

In today’s article we summarise the key elements of the EU’s policy response announcement and contrast this with practical policies being implemented at a country level. We also look at the evolution of power & gas demand reductions across 2022 and set out a 5 point logic as to why the European energy crisis is far from over.

EU policy response package in a nutshell

The crisis response policy measures that the EU has announced so far are summarised in Table 1.

Source: Timera Energy

A clear policy on price caps is conspicuously absent from these announcements.

A wholesale gas price cap is still being fiercely debated. Unfortunately the conversation here is being driven by politics rather than a level headed assessment of the market implications of a price cap. We set out recently why we think a wholesale gas price cap would be a mistake.

Despite no clear direction at an EU level, there has been no lack of action on consumer price caps for power & gas. In fact price caps have been the primary policy implementation focus of governments across Europe at a national level.

The political race to cap prices

European politicians are faced with a tough set of choices currently. Economic activity is being crushed by high energy prices. At the same time producer and consumer price inflation are at their highest levels since the 1970s. The political path of least resistance is to provide relief to industrial, commercial & residential consumers… and to provide it now.

This has seen a wave of consumer price cap measures implemented. These are summarised for Europe’s 5 largest economies in Table 2.

Table 2: Crisis relief measures in Europe’s 5 largest economies

Source: Timera Energy

The common theme across measures being implemented is that they are mostly broad based rather than targeted at vulnerable consumers. This is effectively moving the burden of high energy prices from consumers to the government. In doing so it is directly diluting powerful market price signal incentives to cut demand.

A look at actual 2022 demand reduction

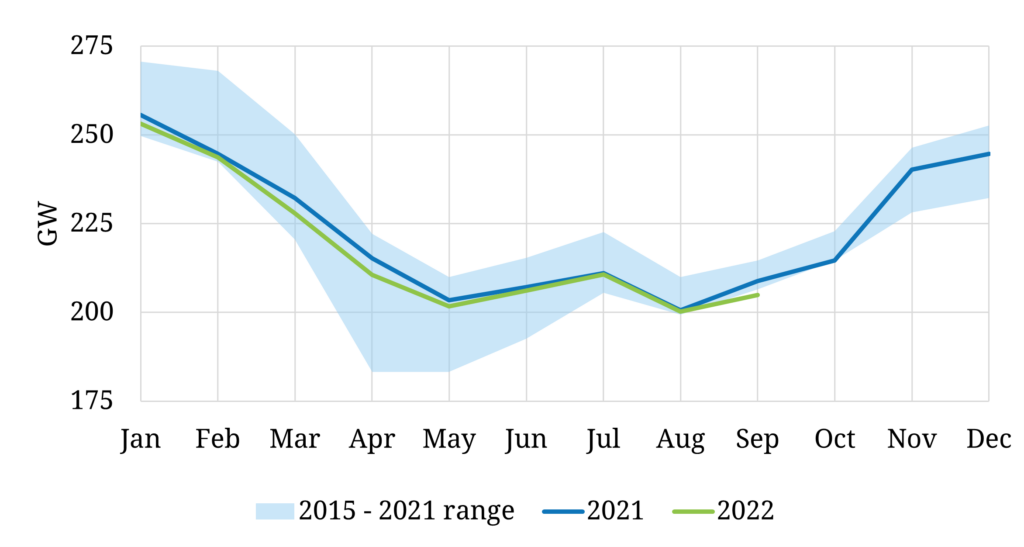

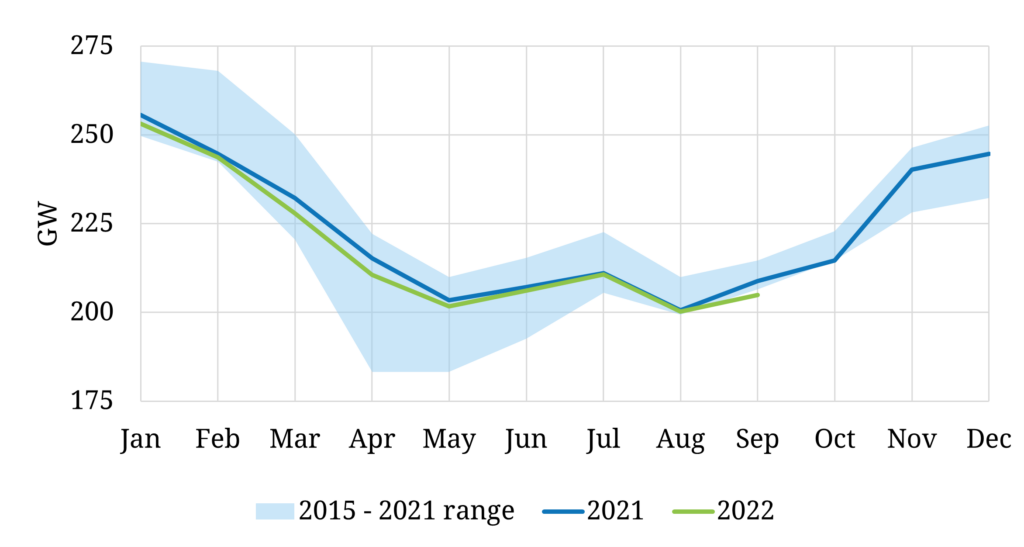

Enough politics. Time to return to the world of facts. The good news is that European power demand is on track to fall below its 5 year average and is tracking below 2021 levels as shown in Chart 1. The bad news is that this decline is a long way short of EU demand reduction target levels.

Chart 1: Power demand across 7 key European countries (DE, GB, FR, IT, ES, NL, BE)

Source: Timera Energy, ENTSOE

The EU’s policy target for 2023 is a 10% reduction in power demand (vs 5 year average). As things stand Europe is likely to achieve a 2-3% reduction in 2022.

Europe’s gas demand reduction across 2022 is likely to be somewhat deeper (estimated in the 7-9% range), mostly driven by shut in of large industrial consumers. However this is well short of the EU’s 15% reduction policy target across the coming winter.

5 point logic summarising Europe’s challenge

There has been an element of complacency evolving within Europe as to the current state of the energy crisis. This is in part driven by substantial declines in gas & power prices across the last two months in the anticipation of policy intervention measures, although price declines have been focused across the coming winter (vs 2023-24). The other driver is probably ‘crisis fatigue’ i.e. everyone would prefer to move on and think about something more inspiring.

At risk of adding to that crisis fatigue, we finish by summarising in 5 points why we think the crisis is far from over:

- Supply constraints: Europe cannot bank on supply response to solve its crisis given long investment lead times (bar a significant increase in Russian supply)

- Demand cuts: This means Europe needs to significantly reduce gas & power demand to alleviate the crisis

- Voluntary policy: Europe has adopted largely voluntary demand reduction targets to date

- Slow progress: Despite extreme price levels in 2022, observed declines in power & gas demand fall well short of targets

- Policy dilution: Market incentives to reduce demand going forward are being diluted by consumer price caps.

Policy announcements have pared back the risk premium priced into forward markets. But a structural solution to the crisis depends on Europe’s ability to reduce gas & power demand into 2023.

Timera recruiting: We are currently looking to recruit a technically focused analyst with strong coding & analytical skills. See here for a role specification. To apply please send a cover letter and CV to recruitment@timera-energy.com. For any questions contact jon.brown@timera-energy.com.