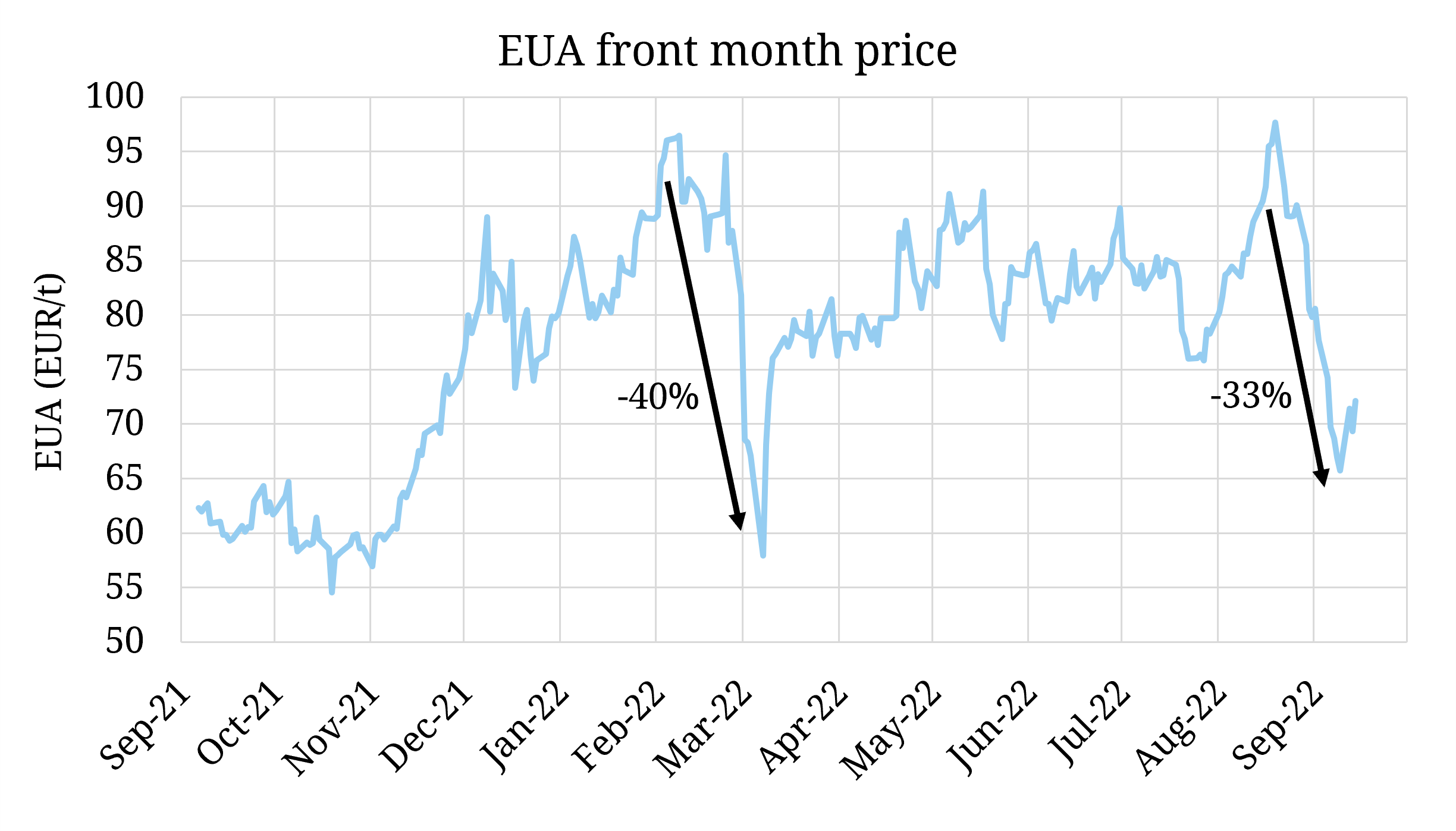

European carbon market prices have risen significantly over the past several years, driven by an accelerating policy momentum behind decarbonisation. These gains have been countered this year by specific market events however;

- A 40% drop in Feb – Mar 2022

- A 33% decline from Aug – Sep 2022.

The first drop was mainly driven by high margin call & collateral requirements across the energy complex in the wake of the Russian invasion of Ukraine causing an outflow of capital from the carbon markets. The most recent decline is a little more nuanced.

August started with the traditional August rise in EUA prices on the back of reduced monthly auction volumes. Higher expected coal output across the next few years also support compliance buying. The drop since is partly due to the significant rise that preceded it, coinciding with the spectre of collateral requirements once again as TTF prices spiralled after the shut down of NordStream1. Policy has played its part too. There have been calls for carbon market intervention amidst the energy crunch, including various proposals for reduced power demand, carbon price caps, EUA market suspension, and the selling of reserve permits to raise funds first floated as part of the RePowerEU plan. This plan aims to raise 20 b€, at current prices around 330 million permits, compared to a market balance of 1.45bn allowances as of end of 2021 TNAC. The MSR was already due to reduce around 350million permits from the auctions across 2021-2022, so it would seem as the intervention would largely net off the anticipated decline.