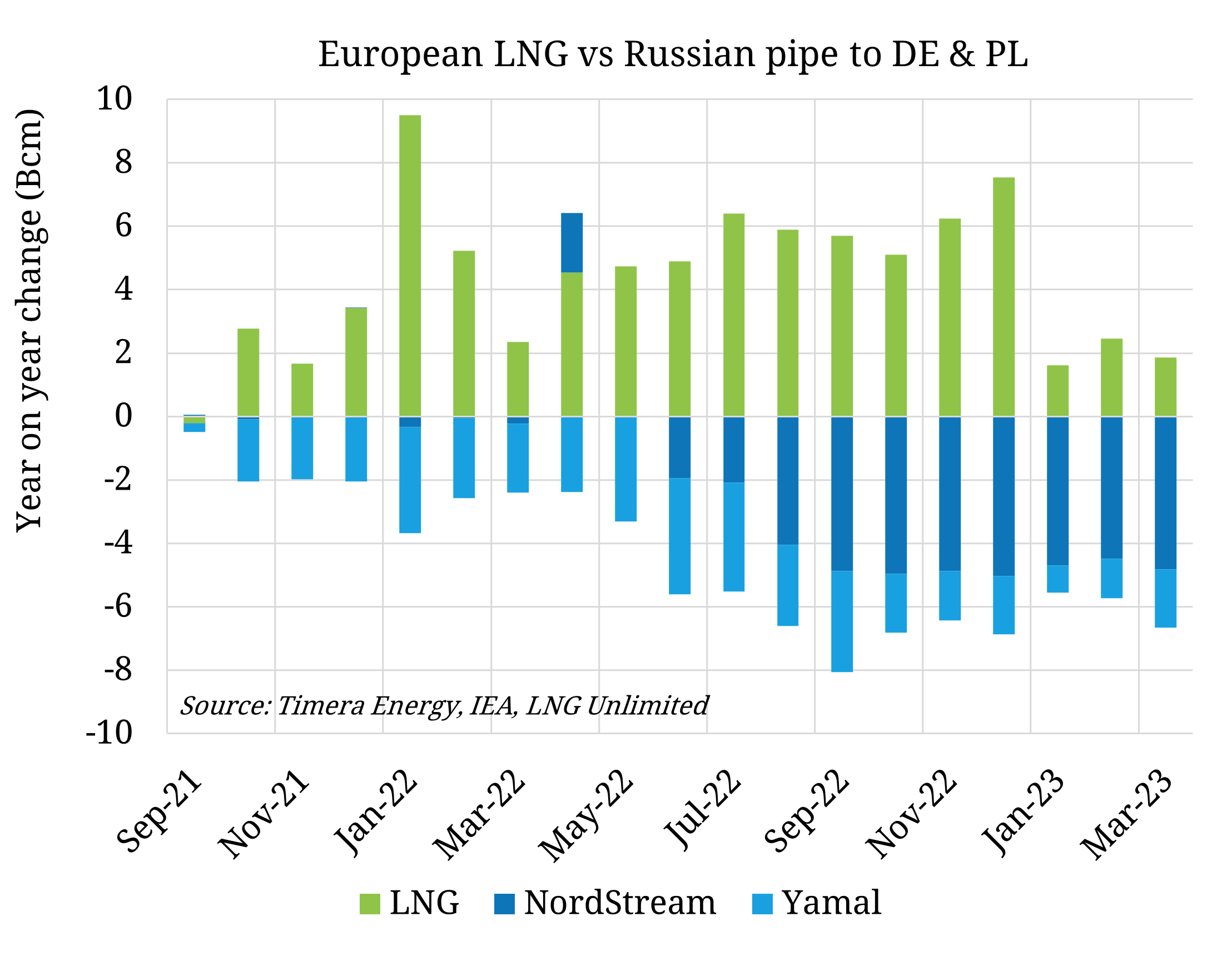

Russian pipeline flows to Europe* fell to 66 bcm in 2022, down 71 bcm from 2021, and over 100 bcm from 2019. Deliveries are set to fall further, with flows down a further 29.5 bcm Jan – April in 2023.

The RePowerEU plan to end imports of Russian fossil fuels by 2027 is underpinned by reducing demand (energy efficiency gains, accelerated decarbonisation), and supply diversification. Supply diversification in the gas space primarily relies on a pivot to LNG imports, which is being underpinned by (i) a significant expansion of European regasification capacity (ii) new global liquefaction capacity buildout to ease recent gas shortages.

In an effort to improve market confidence in investing into both European regas capacity and long term LNG supply deals, reports have emerged (i.e. from the FT) that the G7 & EU will look to agree a ban on Russian piped gas imports via routes on which flows have already ceased (i.e. via Poland and NordStream). While this would not be expected to impact prompt flows (e.g. via Ukraine and Turkey) or prices, given the market is not pricing in any immediate rebound in Russian piped deliveries, the intention is to counter the downside scenario risk seen by investors of a future where cheap Russian pipeline gas returns. The EU have also asked their member states not to sign any new Russian LNG supply contracts.

The wording and implementation will be key to watch out for however. Reports suggest the ban may prevent reopening ‘at least until there is a resolution of the conflict’ – a scenario in which a rebound in Russian flows are already unlikely.

*Europe defined as EU 27 + UK + SWTZLND