The introduction of a new ancillary service in Sep 2020 transformed GB battery asset returns. Dynamic Containment (DC) was specifically targeted at frequency response services from batteries. And System Operator demand for DC substantially outstripped BESS capacity in the GB market.

“Transition from ancillaries to energy arbitrage is set to shake up the BESS investment landscape”

This structural shortage in the DC market saw prices soar to a ‘soft cap’ level of £17/MW/hr. This is the equivalent of around 150 £/kW/yr of revenue, well above the required return on capital for investment in short duration BESS.

With the introduction of DC battery ownership had suddenly become a very profitable business. And after reform of the DC market in Nov 2021 that saw the ‘soft cap’ removed, returns have increased even more across some periods given acute system stress due to the energy crisis.

However as we set out recently, it is past midnight at the DC party as the market rapidly approaches saturation. This does not mean the end of strong BESS asset returns. But it does mean a sharp transition of the BESS revenue stack to focus on energy arbitrage.

In today’s article we look at evidence of DC saturation and the impact the transition to energy arbitrage will have on battery optimisers and investors.

Evidence of DC saturation

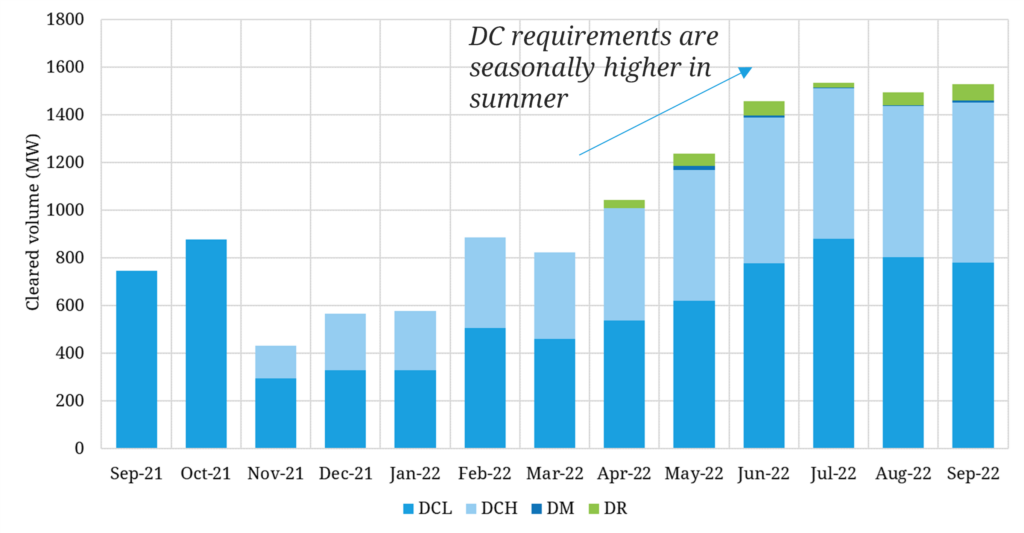

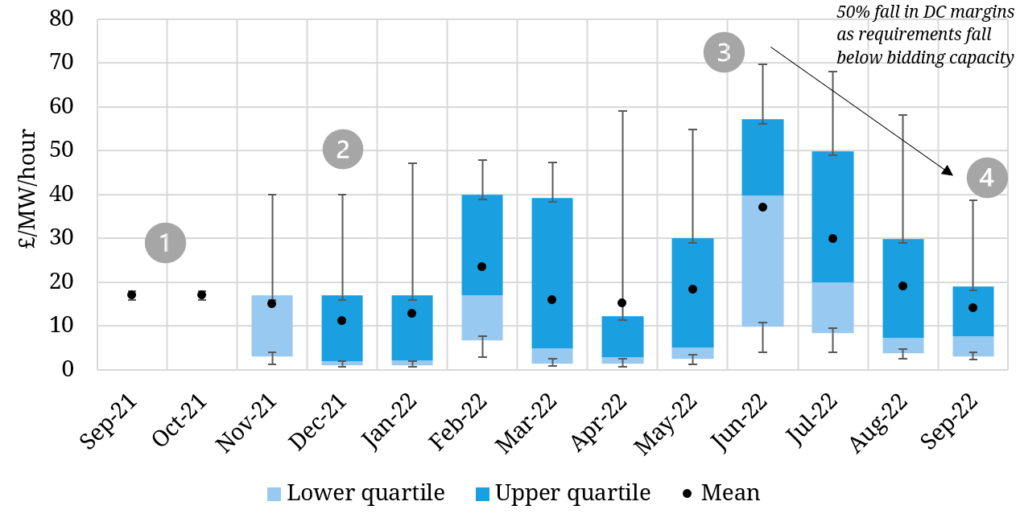

Grid’s demand for DC services (DCL & DCH products) has sat mostly in a 0.6-1.5GW range across the last year as shown in the top panel of Chart 1. DCH accounts for just under half of this demand and is a substantially lower value service compared to DCL.

Source: Timera Energy, National Grid ESO

The bottom panel of Chart 1 shows the price evolution of the higher valued DCL product across four periods:

- Single product: From introduction of DC in Sep 20 through to Oct 21, DC was capped at £17/MW/hr. As the market was structurally short there was little to no competitive pricing or interaction with energy arbitrage, with the market consistently clearing at the soft cap.

- Product split: The switch to separate products (e.g. DCL, DCH), move to 4 hourly EFA block pricing and removal of the cap, saw average prices decrease. Overnight and weekend DC prices fell, with the increase in peak hour prices not offsetting the fall. Lower seasonal demand requirements across winter also weighed on prices and saw switching to energy arbitrage.

- Strong summer: An increase in seasonal DC requirements across Summer 22, combined with the impact of the energy crisis (e.g. high gas prices, tight market) caused soaring DC returns, particularly in Jun & Jul 2022.

- Approaching saturation: Increasing evidence of DC saturation across Q3 2022 as installed BESS capacity increases alongside a seasonal decline in demand for DCL. Average DCL prices have fallen by around 50% from June to September with a shift in focus to energy arbitrage revenue capture.

Installed BESS capacity in the GB market is approaching 2GW into 2023. This is well above the upper end of the DC demand range. BESS capacity is set to grow above 3GW by the 2024 capacity year and to over 6GW by 2025.

The structural transition of the BESS revenue stack from ancillary services to energy arbitrage is underway and it will happen fast.

All optimisers are not created equal

While BESS asset returns remain strong for energy arbitrage, there are some structural differences compared to the DC focused revenue capture that has dominated battery returns since 2020. For example:

- Trading expertise: value capture from energy arbitrage is much more complex than for ancillary services given requirement for dynamic re-optimisation of batteries

- Analytics, systems & data: value capture does not just rely on strong trading expertise but on sophisticated models, systems & data analysis to support optimisation

- BM access & scale: some of the highest value opportunities from energy arbitrage will come from real time price volatility in the Balancing Mechanism; value capture requires BM access and the scale / expertise to ensure Grid will call on your BESS flex (vs your competitors).

Factors like these are likely to uncover substantial differences in optimiser capabilities to capture BESS value in an energy arbitrage focused world.

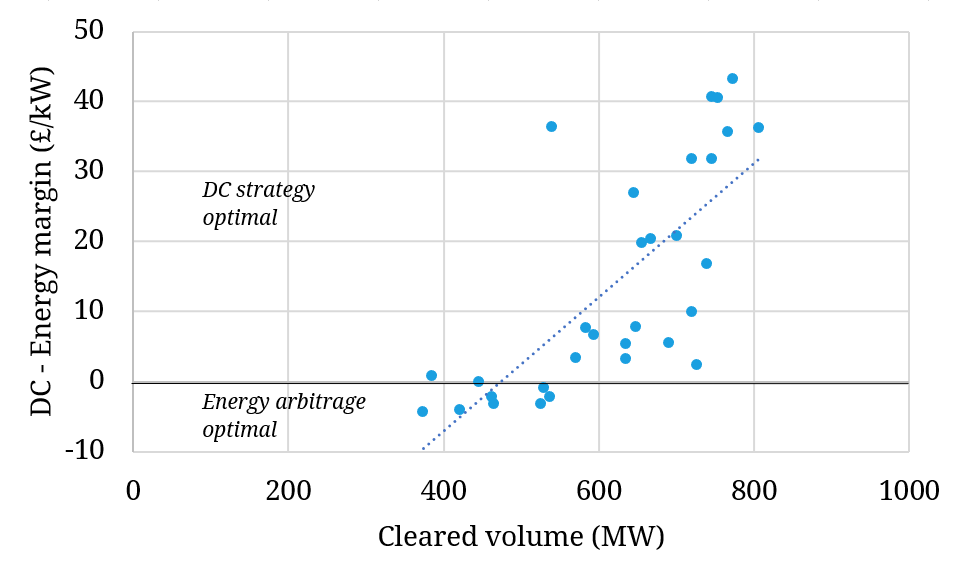

Chart 2 provides a simple illustration of the suboptimal dispatch of BESS assets that is currently happening, albeit with the revenue impacts being ‘disguised’ by high DC returns.

The vertical axis of the chart shows the premium of DC market returns over a very simple one cycle day-ahead energy arbitrage strategy. The horizontal axis shows cleared DC volumes. The blue dots represent different daily ‘DC premium returns’ vs cleared DC volumes across May 2022.

The chart shows 400-500MW of BESS capacity ‘sub-optimally’ bidding into the DC market on days where there were more attractive returns from energy arbitrage. Our 1 hour, 1 cycle benchmark is a simple but very conservative estimate for energy arbitrage returns i.e. this sub-optimal bidding behaviour is more pronounced than the chart shows.

5 impacts of transition to energy arbitrage for battery investors

The transition from ancillary revenue focus to energy arbitrage is set to shake up the BESS investment landscape into 2023. This does not undermine the GB battery investment case but it will drive a greater differentiation across projects, portfolios & optimisers.

In Table 1 we summarise 5 impacts to watch.

Table 1: Five BESS investor impacts of the transition to energy arbitrage

If you are interested in further details on DC saturation and the transition to energy arbitrage, feel free to join our upcoming webinar (details below).

Timera battery investment webinar

Webinar registration link

- Date: Thurs 24th Nov (2-3pm BST, 15-16 CET)

- Title: “Beyond ancillaries” – structural shift in GB battery revenue stack from ancillaries to energy arbitrage

- Content:

- Evidence of ancillary service revenue saturation (DC, FFR)

- Surging ‘energy arbitrage’ price signals (intraday price shape & volatility)

- Growing importance of Balancing Mechanism in driving BESS revenues

- Backtesting analysis of GB BESS asset revenue capture (2018-22)

- State of play: key BESS investment case drivers & risks.