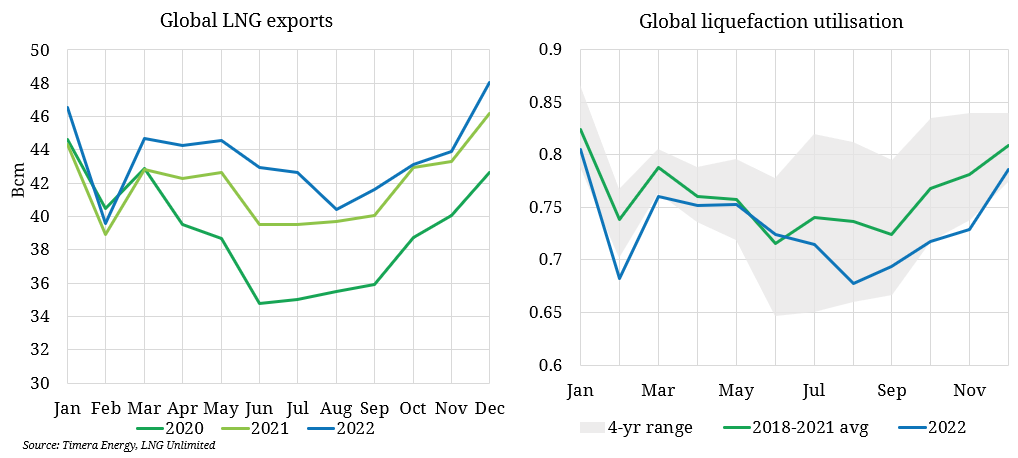

Global LNG exports ended 2022 at historical highs of 49 bcm in December, as global utilisation bounced back from below 70% in August to closer to 80% (though still at the lower end of the recent range). The increase was driven by ramping supply from new plants such as Calcasieu Pass, and maintenance returns elsewhere.

Further supply increases of 20-30 bcma growth in 2023 are possible from a combination of:

- Freeport return: last week Freeport LNG exported its first cargo since an explosion shut the US liquefaction facility in June. The facility is currently operating at partial capacity but can bring up to 20.5 bcma of LNG once full restart is approved by the FERC.

- The ramp-up of facilities that started in 2022 (i.e. Calcasieu Pass), and projects that returned from maintenance (e.g. Hammerfest).

- New capacity: up to 11bcm of new capacity scheduled to come online in 2023 e.g. Tangguh T3, Tortue FLNG.

Downside risks remain, as the operation of facilities at as high a utilisation as possible (in response to high prices) brings an elevated risk of maintenances and/or unexpected outages. As we look forward into 2024, supply increases are set to diminish further before the next wave of LNG supply kicks off in 2025.