Battery investment has been gathering pace across Europe for the past 12 months, as Covid related demand shocks have increasingly highlighted the need for new forms of flexible capacity.

“Both the Capacity Market & Fast Reserve routes can provide long term signals for battery investment… but there are 3 important caveats”

Whilst the UK has been at the forefront of battery investment, Italian policy makers and the System Operator TERNA are now stepping up support. TERNA has introduced two long-term stackable revenue streams that support battery investment. In today’s article we look at how these are helping to underpin the revenue stack and Italian battery investment cases.

The battery investment hurdle

Batteries generate money in the very short-term power markets and rely on power price volatility rather than absolute power price levels. This makes batteries an ideal diversification option for renewable portfolios, which both contribute to power price volatility and are exposed to power price & balancing risk. Despite this, an inability to lock in forward revenues on batteries and the lack of structural long term revenue support can prove a challenging investment hurdle.

The UK has moved away from longer term support mechanisms, such as the 2016 Enhanced Frequency Response (EFR) auction, towards short term auctions of ancillary services products (e.g. FFR & Dynamic Containment). Despite the lack of long term contracts, UK battery investment is surging in 2021.

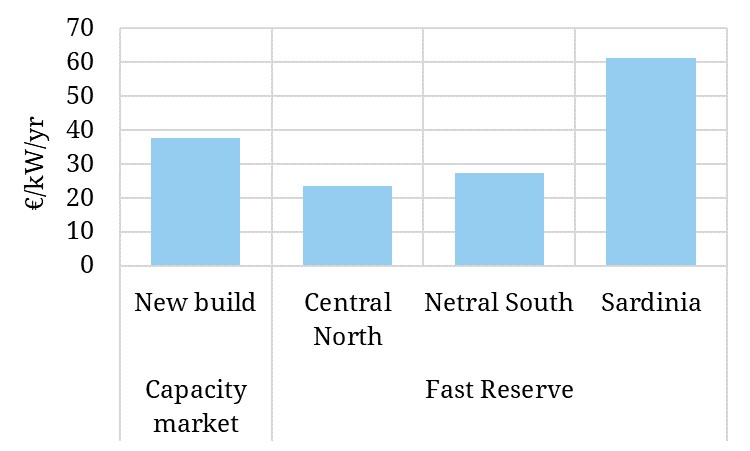

The Italians are pursuing the long term contract route to help support battery investment. TERNA has introduced Capacity Market and a Fast Reserve auctions, offering up to 15 year and 5 year contracts respectively. Both the Capacity Market and Fast Reserve have so far sent relatively attractive price signals to battery investors.

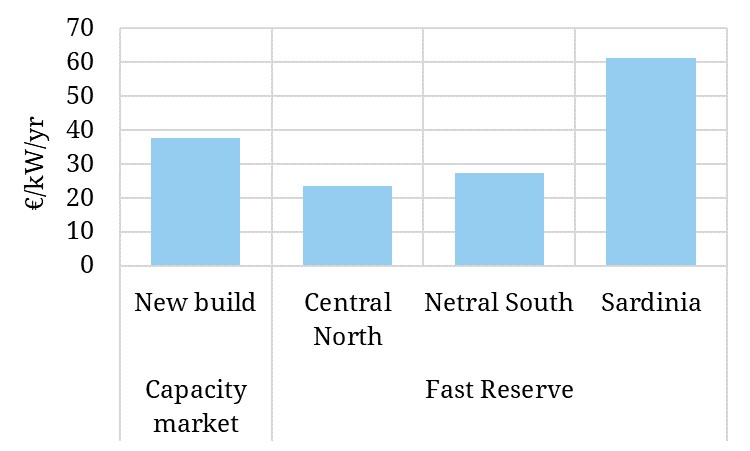

The chart below shows how the recent auctions have priced to support battery investment in Italy.

Figure 1: De-rated clearing prices across Capacity Market & Fast Reserve auctions

Source: Terna, Timera Energy

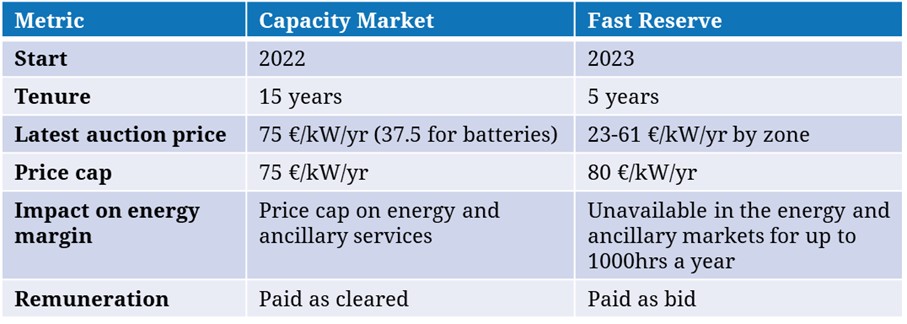

Participation in the Fast Reserve and Capacity Market auctions are mutually exclusive, and so investors must choose which route best underpins their battery investment case. Moreover, whilst both the Capacity Market & Fast Reserve are stackable with wholesale revenues, they impose different constraints on battery optimisation as summarised in Table 1.

Both the Capacity Market or Fast Reserve routes can provide long term signals for new build battery investment but there are 3 important caveats:

- Capacity prices may decline: The first two capacity auctions cleared at the price cap (75 €/kW), after the initial registration process wrong-footed many international investors and led to limited competition.

- Low barriers to entry: The recent Fast Reserve auction saw an over-subscription of capacity, driving prices down compared to the capacity auctions and suggesting a pipeline of ready to go battery projects.

- Lack of transparency: The future timeline & scale of additional Capacity Market and Fast Reserve auctions is still taking shape, with more clarity expected in Q2-21.

Energy market revenues remain a key driver

Whilst Capacity Market and Fast Reserve provide a financial underpinning for battery investment, batteries still rely on wholesale market & balancing margins to support the 10%+ unlevered IRR returns required by most battery investors.

Italy is unlike most other European power markets: it is heavily congested and has zonal pricing for both wholesale and balancing services. This presents both challenges and opportunities, with more advanced battery optimisation modelling required but with the carrot of higher volatility, particularly across the South and islands.

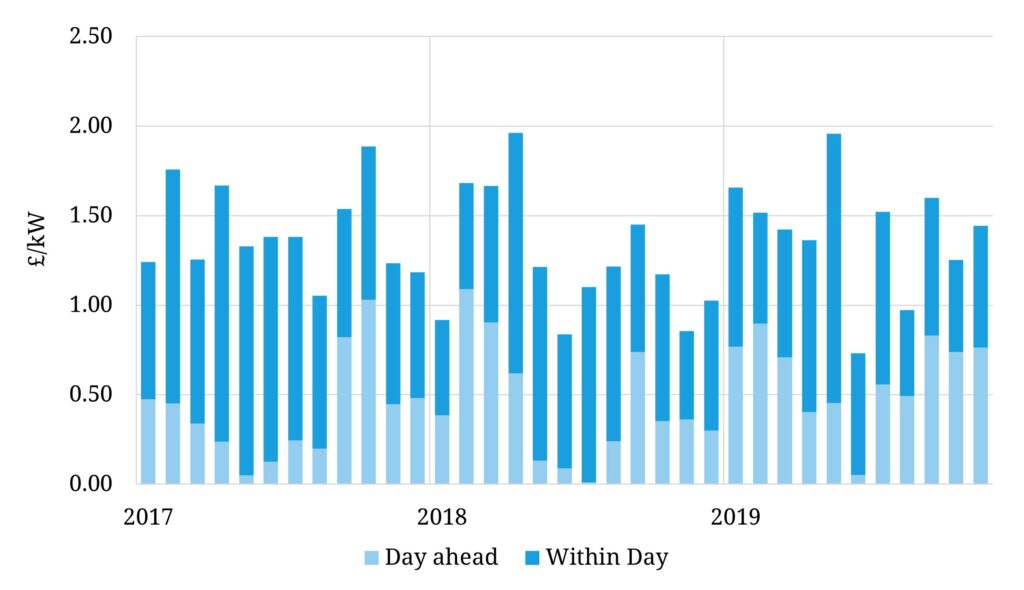

In the chart below, we breakdown theoretical wholesale margins from battery dispatch across 2017-2019 for a 1 hour battery against prices in Italy’s ‘Sud zone’.

Italy is undergoing a similar transformation of the power mix seen elsewhere in Europe, with retiring coal fleets, ageing CCGTs and large scale growth of renewable & distributed capacity.

Given Italy’s already congested power grid and ambitious solar targets (50GW by 2030) the conditions are in place for price volatility to rise significantly. This is set to boost battery margins in wholesale & balancing markets from levels around €20/kW/yr seen over the past few years.

The Italian opportunity

Both the Capacity Market and Fast Reserve provide a reliable long-term contracted revenue stream to underpin Italian battery investment cases. Bankable projects still depend on building a robust wholesale & balancing market revenue stack above this. But with fundamental drivers supporting rising power market volatility, Italy is looking increasingly attractive to battery investors.

Italy’s solar resource also offers upside for renewables investors, presenting opportunities to co-locate batteries alongside solar and in some cases wind, reducing capex and improving project IRR.

For the Italian battery investment wave to really gather pace however, Terna need to provide certainty around future auction timelines and regulations. Progress is likely here over the next 6 months, with Italy having just launched an application to the EC to approve the next wave of capacity auctions. The pieces look to be falling into place for Italy to be the next big growth market for batteries in Europe.