The upheaval in the global gas market this year is also being felt in the LNG shipping market. LNG charter rates have sunk in 2014 alongside gas prices. Healthy LNG vessel order books in anticipation of new liquefaction capacity are resulting in a wave of new deliveries from shipyards. At the same time the fall in demand for gas in Asia is reducing vessel journey times. The fall in LNG charter rates is having an important knock on impact on LNG shipping costs which are becoming an increasingly important driver of global gas price differentials.

The weight of supply

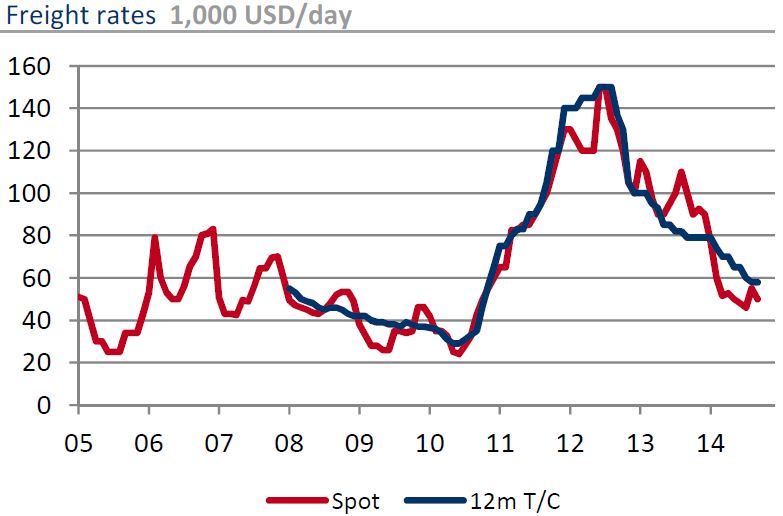

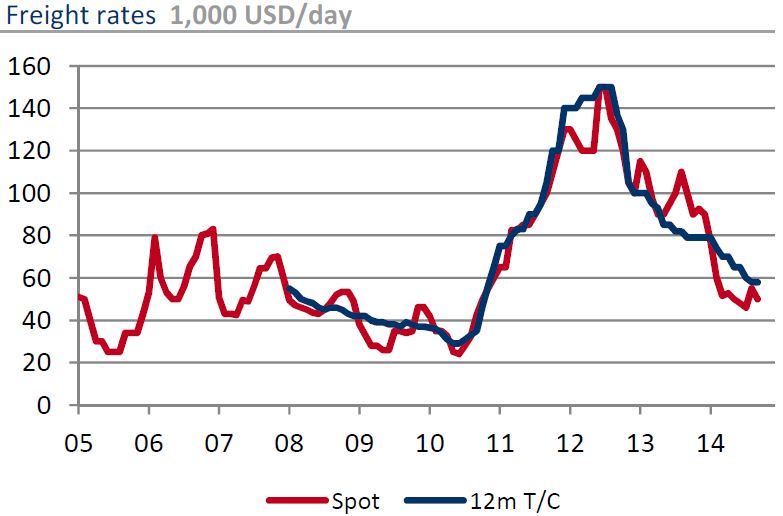

We published an article at the start of January on ‘Steam coming out of the LNG shipping market’. Our conclusion was that given the weight of a substantial order book for LNG vessels “2014 may mark the start of the next glut in LNG shipping capacity”. Spot charter rates have fallen from levels around 90,000 – 100,000 $/day in 2013 to around 50,000 $/day last month. 12 month term charter rates have also fallen to around 58,000 $/day in sympathy as shown in Chart 1.

Chart 1: LNG spot and 12 month term charter rates

Source: RS Platou Monthly (Sept '14)

These rates are now back below those required to support new build of LNG vessels. It also appears that the post-Fukushima boom in shipping charter rates is giving way to a period of oversupply, similar to that seen from 2008 to 2010.

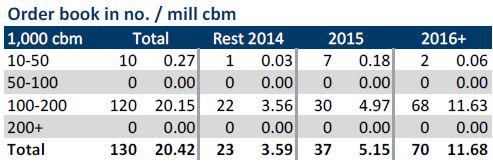

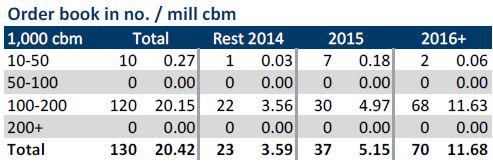

New orders for LNG vessels are drying up. But there is a lot of inertia in the existing order book given the time lag between order and delivery. Existing orders have been driven by higher LNG prices and charter rates post-Fukushima and a wave of enthusiasm around new liquefaction capacity coming to market in the second half of this decade. Chart 2 gives an indication of the number of vessels to delivered over the next 3 years. While many of these vessels are under long term contract in relation to new liquefaction capacity, there are also a number that are not under contract. These may further weigh on shorter term charter rates.

Chart 2: Global LNG vessels order book

Source: RS Platou Monthly (Sept '14)

Changing LNG shipping costs and flow dynamics

As well as a healthy order pipeline, the other factor weighing on LNG charter rates in 2014 is changing patterns of vessel utilisation. The sharp fall in Asian spot LNG prices over the summer has seen a reduction in the diversion and reloading of European LNG supply to Asia. This in turn reduces average journey time and unballasted voyages, factors which have supported shipping demand and charter rates over the post-Fukushima period.

Weak spot gas prices and falling charter costs have also reportedly led to a number of vessels being used for storage plays for up to 6 months, i.e. gas can be stored in the summer and re-sold as prices recover into winter.

Vessel charter rates are the largest component of LNG shipping costs. So the fact that charter rates have more than halved since 2012 has significantly reduced the cost of moving LNG. Chart 3 shows the impact of the recent fall in charter rates in reducing shipping costs for cargo diversions from Spain (Huelva) to Japan (Sakai).

Main assumptions:

- Laden leg only, 147k MT vessel, 600 MT fuel oil price

- 10,014 NM journey via Suez canal, 19 knots average speed,(~22 day voyage)

- USD 400k canal transit charge (one way), other costs including port fees, brokerage and insurance.

Source: Timera Energy

The primary driver of LNG flows is locational price differentials. It appears that we are entering a new phase of global gas pricing where these price differentials may be narrowing (as we set out here). A reduction in LNG charter rates will likely act to reinforce global price divergence by reducing the cost of moving LNG between locations. As global LNG market tightness subsides, shipping costs are likely to become increasingly important in driving global pricing. We look at some of the implications of shipping costs on LNG pricing dynamics in an article to follow shortly.