The oil market is reeling from two parallel shocks. Demand expectations have been slashed as a result of measures to prevent the spread of Covid-19. At the same time the Saudi & Russian cooperation underpinning the OPEC-Plus group of oil producers has fallen apart, inducing a supply side price war.

“While the majority of European gas contracts have shifted from oil to gas price indexation, there is still a large prevalence of long term LNG contracts indexed to crude.”

In the first two weeks of March alone, prices plunged more than 50%, before recovering a little last week. It is tough to find any historical comparison of oil prices declining at that speed.

The impact on long dated Brent contracts has been much smaller. The market is pricing the impact of both these shocks as being focused on 2020. The relatively short investment cycle of US shale plays remains the key driver of longer term oil prices. Longer dated Brent has fallen to around 45 $/bbl, at the lower end of production cost estimates for shale producers.

That leaves the Brent forward curve in very steep contango. The pace and dynamics of the oil market shock have important implications for the LNG market (and in turn the European gas market).

Why do LNG desks care about an oil price slump?

While the majority of European gas contracts have shifted from oil to gas price indexation, there is still a large prevalence of long term LNG contracts indexed to crude.

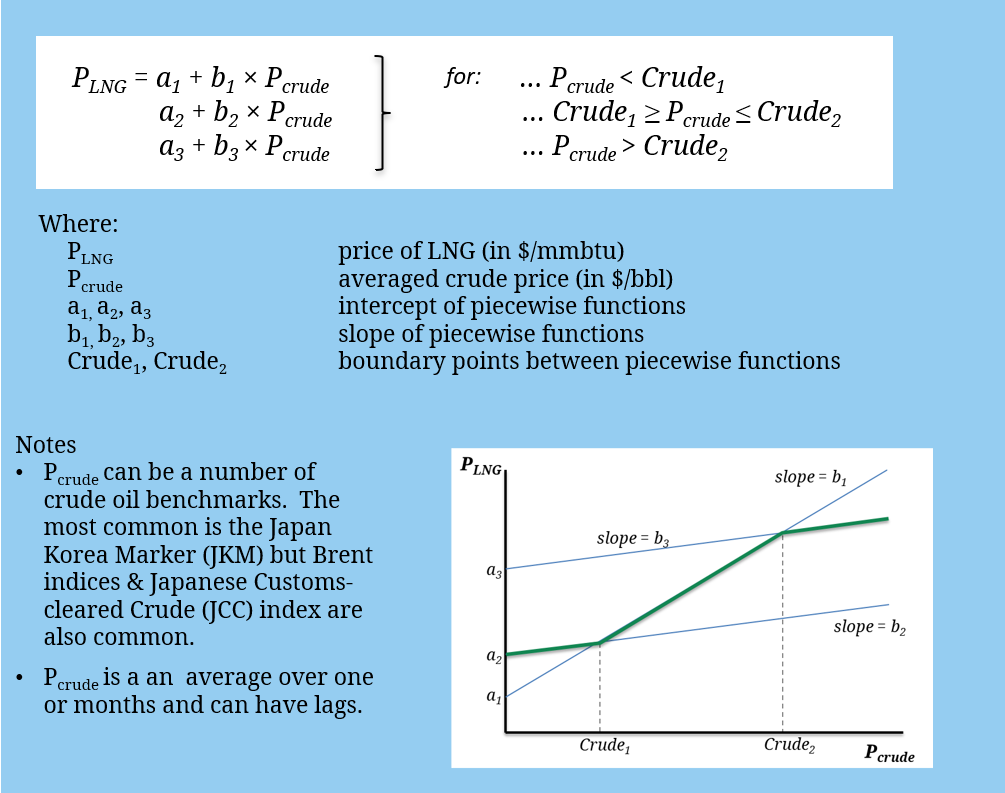

In Chart 1 we set out the key pricing formula components of a typical long term crude indexed LNG contract.

A key component of these price formulas is the slope coefficient that determines the relationship between movements in the price of crude and the LNG contract price. This can often have an ‘S curve’ incorporated where the slope coefficient changes at different levels of crude price. The relationship to crude prices can also be impacted by time lags and averaging.

So in summary, there is a direct & important relationship between crude prices and the cost that buyers pay for LNG under long term contracts.

What are the commercial implications of the crude price shock?

Lower prices for buyers

The most obvious impact of a sudden plunge in crude prices is cost relief for LNG buyers. Before crude fell, buyers of oil indexed contracts faced contract prices well above current hub prices. As a simple example, a 50 $/bbl crude price and 10% slope gives a contract price of around 5 $/mmbtu.

This month’s fall in crude will act to substantially reduce the gap between LNG contract and spot prices. For example a 30 $/bbl crude price and 10% slope means a contract gas price around 3 $/mmbtu. Lower crude will typically take some time to feed into settled LNG contract prices due to averaging and lagging. But on a forward basis the impact is immediate (to the extent that exposures haven’t been hedged).

Major portfolio adjustment

The sharp drop in crude futures prices creates opportunities to reoptimise LNG portfolio positions. e.g. adjusting Annual Delivery Programs (ADPs) and cargo buys / sells to unlock additional value. Robust portfolio analysis tools underpin a company’s ability to capture this value as we set out here.

Crude moves are also catalyst to adjust forward hedges. This process is made more difficult by embedded options (e.g. price caps and floors) and complex indexation (e.g. “S-curves” with different slopes). These features in contracts mean that contract exposures to oil depend on current crude prices.

Because of the contract complexity even the most sophisticated LNG players will hedge oil exposures based on prevailing prices (i.e. intrinsic hedge exposures). This month’s rapid fall in the oil price will have had a sharp impact on many LNG contracts, quickly reducing intrinsic oil exposure. This in turn triggers hedge unwinds which can be tough when selling into a falling market. Many S-Curve structures will have also transitioned to lower slope coefficients requiring crude exposures to recalculated and adjusted.

The commercial impact of this plunge

We have set out some of the ‘front office’ commercial impacts on trading desks above. As well as a sudden plunge in prices, crude volatility has surged and market liquidity has been eroded. This makes the daily job of traders more difficult in dynamically managing exposures.

These market conditions also have a big impact on middle office and risk teams. For example recalibrating and rerunning LNG portfolio models to update value and risk metrics.

From an overall market perspective the gap that had opened up between long term oil indexed contracts and gas hub prices will now narrow substantially. That translates into further resistance to gas price recovery, at least across the Covid-19 demand shock horizon in 2020.