Our unique 2 step modelling process

Timera uses a sophisticated two step stochastic modelling process to analyse power markets & project asset margins:

1. Stochastic power market model– a detailed simulation based hourly supply & demand balance ‘stack optimisation’ model, that feeds pricing data into the asset models.

2. Stochastic asset margin models– a suite of simulation based asset dispatch optimisation models that project asset margin distributions.

We have specific asset models for batteries, hydro, long duration storage, interconnectors, electrolysers, CCGTs & gas peakers.

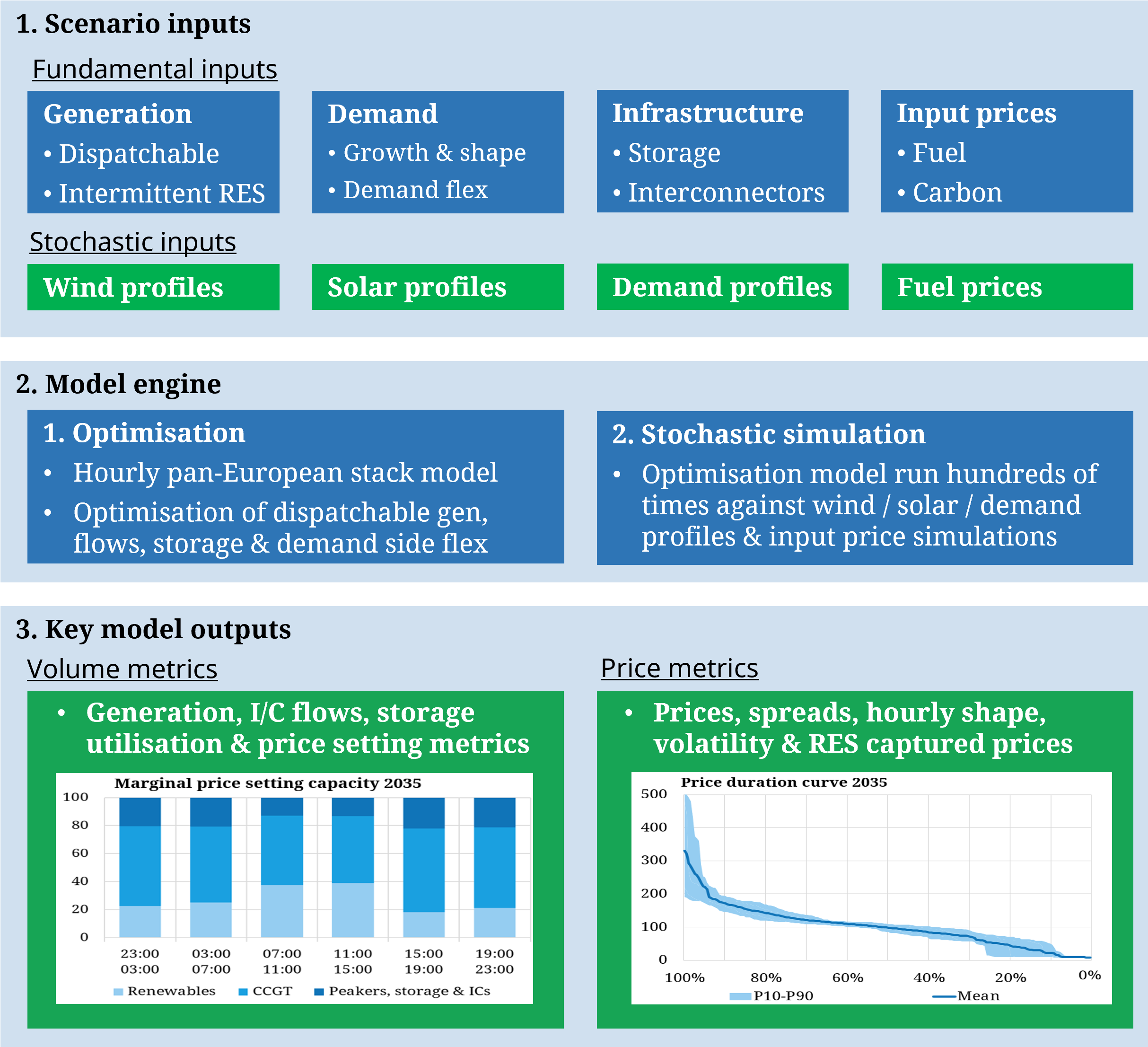

1. Stochastic power market model

Our market model has a pan-European coverage and dispatches capacity at an hourly granularity, as well as dynamically optimising storage capacity and interconnector flows against market prices.

The market model optimises capacity against hundreds of wind, solar, demand profiles & input fuel prices, informing our outlook on price shape & volatility evolution. This simulation based approach is key for robust analysis of system flexibility requirements & the dispatch of flexible assets.

Features of the model

1. Granular unit representation of supply & demand sources

2. 100s of simulations of correlated load, wind, solar profiles & fuel prices

3. Optimised dispatch of flexible assets against each simulation path

4. Dynamically models storage & interconnector flows across Europe

5. Unique modelling of market pricing & volatility dynamics

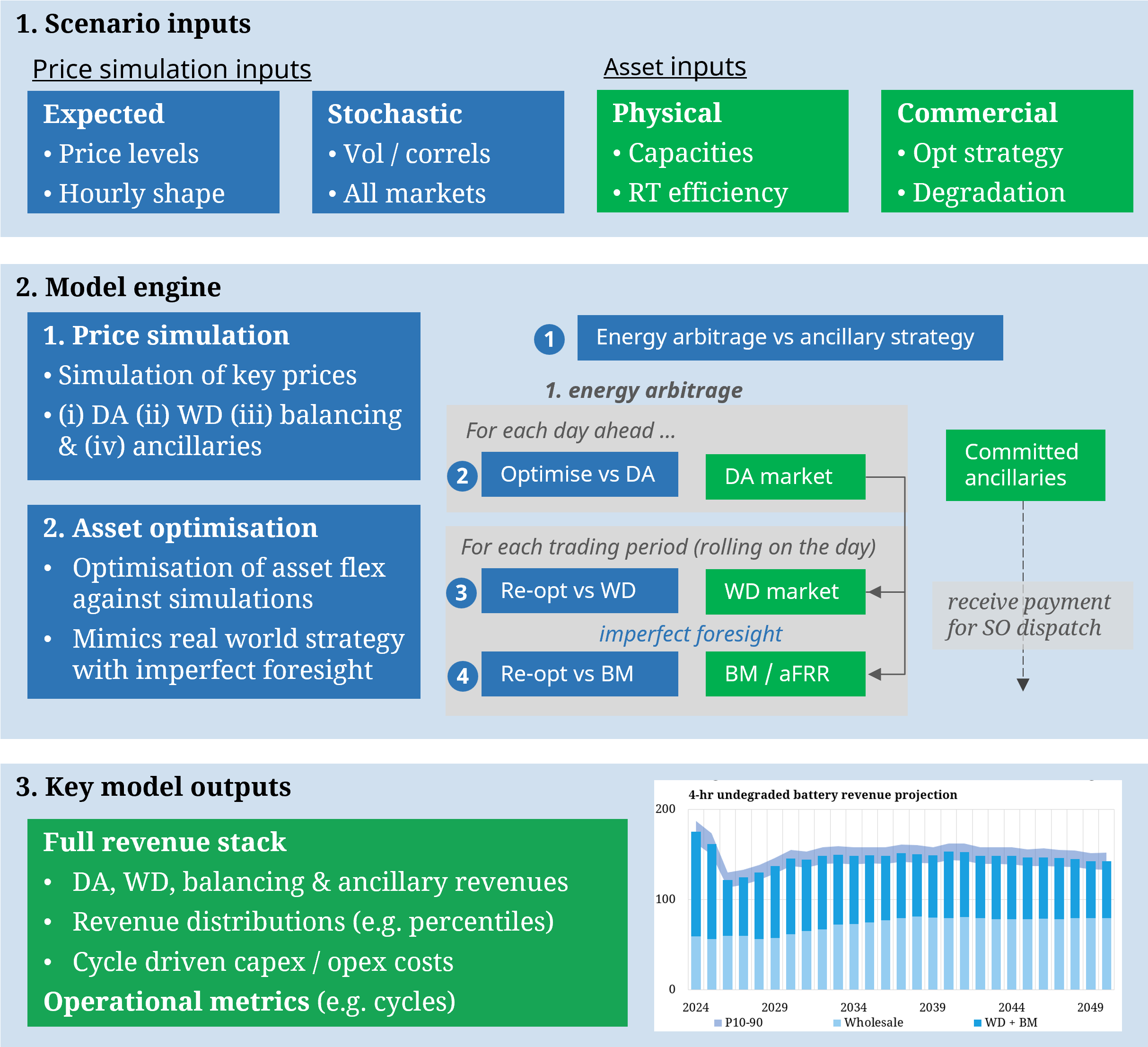

2. Asset margin models

We have specific asset models for batteries, hydro, long duration storage, interconnectors, electrolysers & thermal (CCGT, coal & gas peaker capacity).

Each of these models is simulation based and draws on inputs from our stochastic power market model. The models optimise asset dispatch against simulated price paths to generate projected margin & asset operational metric distributions (e.g. mean, P10, P90).

Features of the model

1. Replicates actual decision making process of asset operators / traders

2. Regularly calibrated against backtested asset performance

3. Captures physical characteristics / constraints & impact of imperfect foresight of market prices on captured margin

4. Robust modelling of interdependent stackable revenue streams

5. Detailed margin distribution outputs to inform risk/return decisions