Europe saw a wave of regas terminal investment in the 2000s. This was in anticipation of strong growth in LNG imports that never arrived… until the current gas crisis.

“NW European regas slot prices have increased more than 10 times across the last year”

Across the 2010s, strong Asian demand growth and the Fukushima disaster saw flexible LNG supply flowing to Asia. During this period Europe structurally increased its dependence on Russian gas imports. Owners of European regas capacity were left paying high fixed costs for low utilisation.

All of this has changed across the last few months. European regas capacity value has surged with structural access constraints and price divergence across hubs.

Europe is embarking on a second wave of investment in regas capacity in 2022 to try and alleviate these constraints and reduce dependence on Russian imports.

In today’s article we set out the current drivers of European regas capacity value and its role within LNG portfolios. We also use a practical case study to quantify the incremental portfolio value created via adding regas capacity.

Why is European regas capacity in focus?

We recently set out the new LNG market regime triggered by the European pivot from Russian gas to LNG. This is causing a structural increase in LNG imports into Europe, as well as triggering more dynamic flow patterns across the Atlantic & Pacific basins.

The most obvious driver of increasing European regas capacity value is higher imports volumes. Capacity constraints across Europe are causing substantial divergences across prices received for delivering LNG into Europe. This is both for:

- Primary capacity into different markets, as onward pipeline constraints drive a significant gas hub premium for countries with limited regas access (e.g. Netherlands, Italy, Germany) versus those with higher regas volumes (e.g. UK, Spain).

- Secondary capacity pricing into NW Europe i.e. prices for regas slots traded in the secondary market (e.g. primary capacity owners reselling slots not required for own portfolio use).

Regas capacity constraints in Europe have driven up the secondary market cost for slots in key terminals as high as €30m across the last few weeks (vs €1-2m this time last year). Constraints have also seen NW European spot LNG prices driven to a substantial discount versus TTF hub prices.

Another important factor behind the scramble for regas capacity is its ability to provide access to liquid European hubs. Collateral & margining constraints are resulting in an increasingly illiquid LNG market. Regas allows LNG portfolios the ability to monetise & hedge cargo exposures e.g. at TTF or NBP vs being exposed to less liquid NW European spot LNG prices.

To buy or not to buy?

We work with a broad range of large LNG portfolio players on portfolio construction and valuation. Most companies are currently re-assessing the role of European regas capacity within portfolios.

A key strategic question under consideration is whether or not to buy regas capacity to unlock value and manage risk under the new LNG regime.

Importantly there are different ways that portfolios can gain access to regas slots. For example:

- Buying primary capacity: contracting capacity directly with a terminal, which involves a structural fixed cost commitment to own slots (needing to be weighed against portfolio value uplift).

- Buying secondary capacity: contracting slots as required in the secondary traded market, with a higher physical volume risk of placing the cargo and exposure to market basis risk (but avoiding fixed costs).

- Buying structured access: Using option based contract structures to access slots (paying option premium vs structural fixed costs).

Let’s now use a practical case study to illustrate the LNG portfolio value impact of regas access.

The case study portfolio

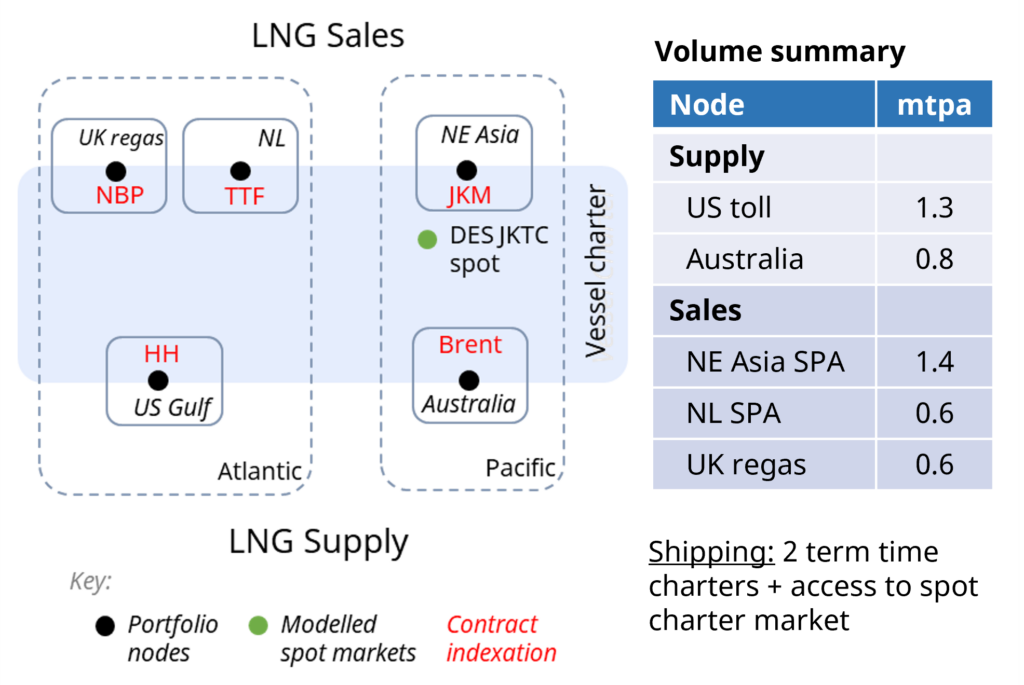

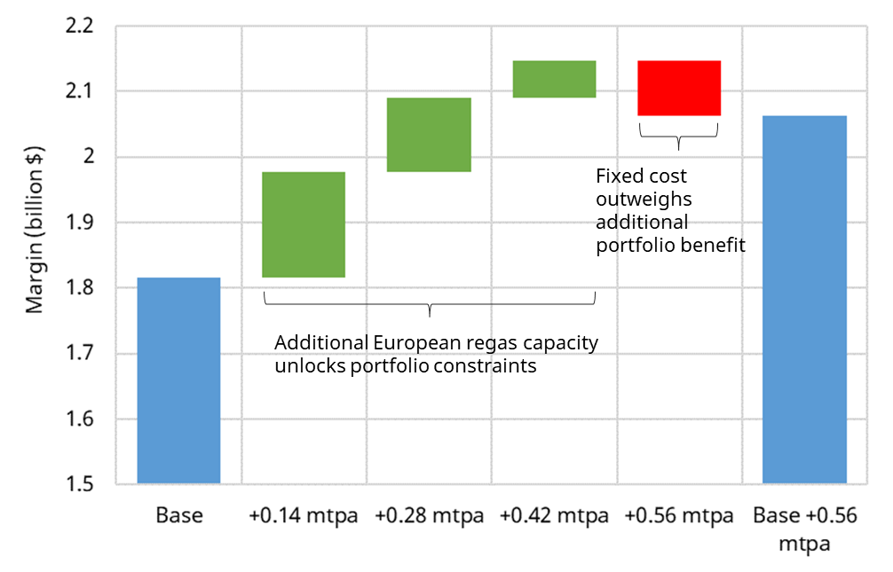

We use the same portfolio as defined in our portfolio value case study two weeks ago. As a recap, the portfolio is summarised in Chart 1 and has 2 supply nodes, 3 sale nodes, spot market access and shipping.