Europe’s power systems have been designed and developed around a core principle of centralisation. Swings in customer site demand have historically been serviced by large grid connected generators (e.g. gas, coal & hydro). We are rapidly moving towards a very different system as renewable penetration increases and technology evolves.

“Total demand is set to rise substantially with peak demand growing at a slower rate”

As wind & solar output rises, there is a growing divergence between generation and demand profiles. Intermittent renewable generators produce according to weather conditions rather than being dispatched to follow demand profiles.

The requirement to balance wind, solar & demand are creating a strong requirement for low carbon sources of supply flexibility e.g. battery storage. On the other side of the equation, technology and software is also evolving to facilitate more demand flexibility.

We recently published an article on the impact of electrification on annual & peak power demand volumes. We follow on from this in today’s article by exploring how demand flexibility may evolve to change intraday system load profiles.

Hurdles to engaging demand flexibility

Before considering a future of engaged & flexible demand we need to confront an inconvenient reality: power demand is currently mostly inflexible and price insensitive.

Table 1 sets out 5 major hurdles to overcome to enable more flexible demand.

If these seem like simple hurdles to overcome then you are a raging optimist. For all the conceptual visions of demand flexibility balancing power systems the reality is currently very different.

Technology & software are making steady progress (despite a lack of clear policy incentives), but there is very little action on the infrastructure, policy, tariff and customer behaviour fronts.

Case study: deconstructing demand flexibility

It is useful to consider a GB market case study to get a more tangible view of how flexible sources of demand may shift load across the day as the energy transition gathers pace.

For the purposes of the case study we deconstruct sources of demand flexibility into 4 categories:

- EVs

- Electrolysers

- Residential heating

- Industrial, Commercial and Other Residential

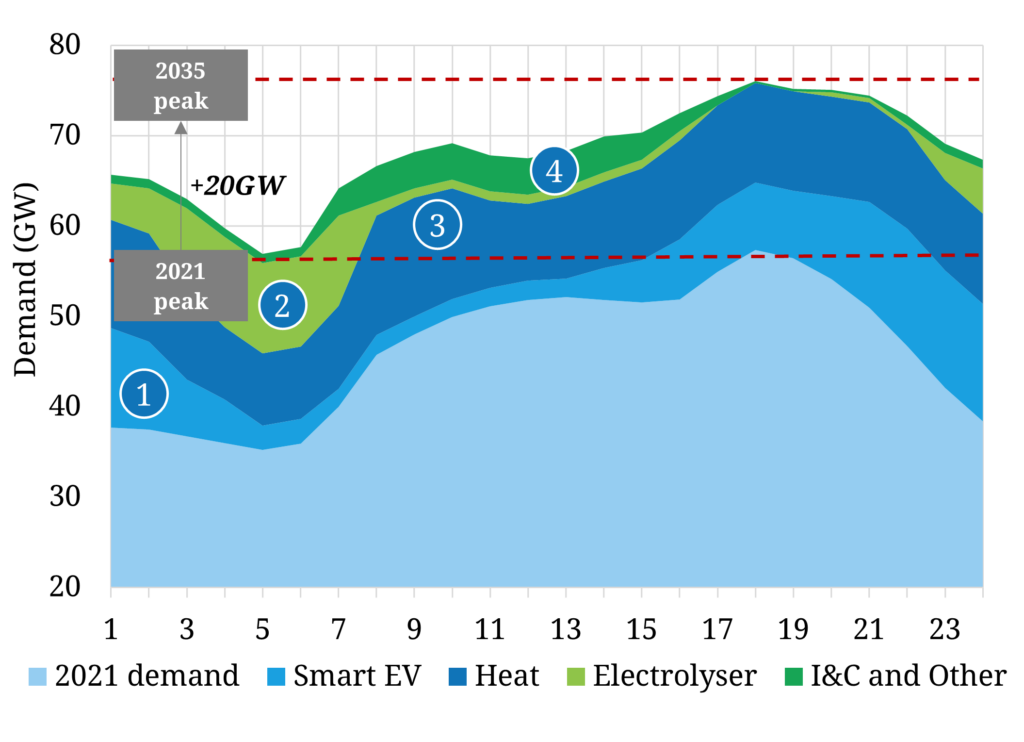

Chart 1 shows a representative 2021 intraday GB demand profile (shaded light blue). It then illustrates the overlaid impact of these 4 sources of flexibility on (i) demand level and (ii) demand shape in 2035.

In the case study, annual demand is projected to rise 107 TWh (37%) by 2035, with peak demand rising by 20 GW (32%).

Electric Vehicles

EVs are set to have the most imminent impact on demand. Car manufacturers are already locking in a major transition of production lines from ICE to EV. EV adoption is also likely to be accelerated by cost parity from the mid-2020s. This is further supported by policy targets being implemented across Europe.

EV charging profiles are conceptually quite flexible with smart charging, but in reality constrained by consumer behaviour. For example a commuter plugging in at 6pm may have some flex across a 12 hour charge window, but wants a charged battery in the morning to make it to work the next day. There are also significant distribution network, software and tariff hurdles to overcome to allow EV storage flex to be dynamically harvested.

EV charging profiles depend on the evolution of a number of factors such as capacity of batteries, speed of charging, availability of on-the-go charging, EV ranges & charging behaviour. Chart 1 illustrates the potential for significant shifting of charging load into offpeak periods. But the scale of extra demand increases peak demand by more than 8GW in 2035.

Electrolysers

Electrolysers are likely to be the most flexible & price sensitive source of demand, given direct access to wholesale and ancillary market price signals. Flexibility may however vary significantly depending on (i) local hydrogen offtake constraints e.g. given industrial process demand and (ii) volume of hydrogen storage to facilitate electrolyser production flexibility.

Electrolysers have a significant impact in increasing total demand, but a much smaller impact on peak demand. This is because electrolyser production is more focused into low priced, low demand periods.

Residential heating

Residential heating demand for power is likely to be primarily driven by heat pump load. This is both highly seasonal and relatively price insensitive. Heat pump demand therefore has a major impact in increasing peak demand (e.g. +12GW by 2035 in GB case study).

Residential heating could potentially offer some further flex through either fuel switching (power to hydrogen) or heat storage, but these fall into the longer term conceptual category.

Industrial, Commercial and Other Residential

This is a bit of a ‘catch all’ category across the net of all other demand impacts. For example increased electrification of industrial & business processes is set to steadily increase demand. There is definitely potential here for price sensitive flexibility but will likely be constrained by working hours, output constraints, and other consumer behaviour.

Much of the ‘low hanging fruit’ in this category has been harvested already as DSR but load shifting will continue to evolve with technology. There is meaningful growth potential but a lot of this comes back to overcoming the 5 hurdles in Table 1.

Implications for power supply

Let’s finish with 5 key takeaways:

- Total power demand is set to rise substantially as other sectors electrify in order to decarbonise

- As demand grows there is significant potential to shift load patterns across the day (to reduce impact on peak demand)

- As a result, peak demand is set to grow but at a slower rate than total demand

- Dynamically harvesting price sensitive demand flexibility is more challenging (because of the 5 hurdles in Table 1)

The 5th takeaway is an implication of the first 4. Decarbonisation of other sectors via electrification is going to require huge investment in low carbon flexible supply (e.g. batteries, LD storage, peakers & interconnectors) to support both demand growth and rising wind & solar balancing requirements.

If you are interested in further analysis see our briefing pack on the requirement for investment in flexibility in order to facilitate power sector decarbonisation.