The latest T-1 UK capacity auction cleared at 0.77 £/kW on Wed last week. That is 87% lower than the last T-1 clearing price (at 6 £/MWh). 77 pence represents back pocket change. If you tipped a waiter this amount you’d risk your having your coffee ‘spilled’ all over you.

Shock is a natural first reaction to a near zero capacity price. How will the market deliver capacity to keep the lights on if there is no price signal?

But there are important reasons why last week’s auction has little relevance as a guide for future UK capacity prices. Today we look at the causes of such a low price and consider implications for the UK power market.

The auction in context

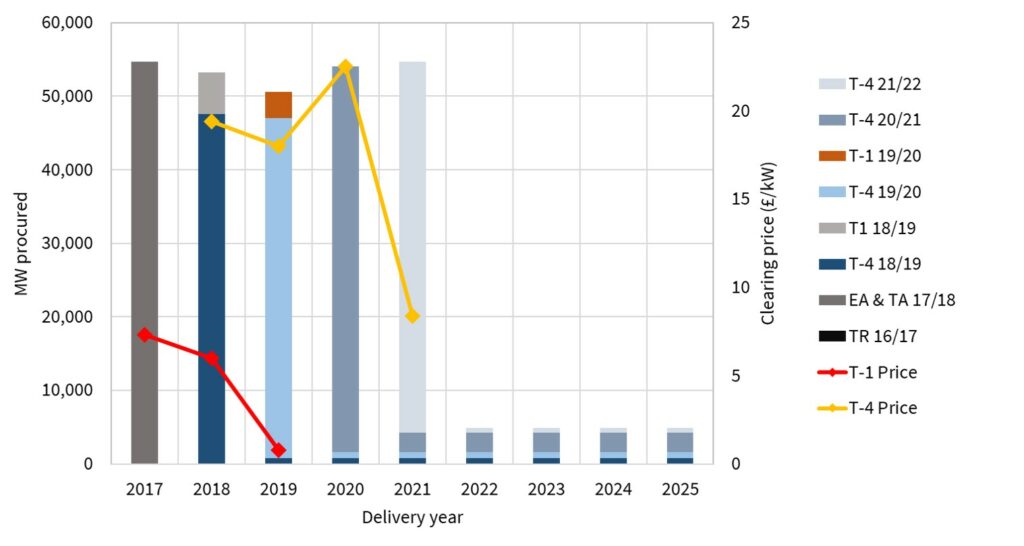

The first important point to note is that the T-1 auctions are essentially ‘top up’ or supplementary auctions to balance any capacity discrepancies from the main T-4 auction. Only about 5% of 2019-20 capacity is actually subject to the 77p price. The remaining capacity will receive much higher T-4 prices, with the main T-4 auction for 2019-20 clearing at 18 £/MWh as shown in Chart 1.

The receipt of any capacity payments (T-1 or T-4) is of course dependent on the reinstatement of the capacity market (currently suspended after the ECJ ruling). But the government has indicated it expects to make retrospective payments on capacity to cover any delays.

Why did the price clear near zero?

The most obvious cause of a low clearing price was that the auction was very well supplied. 9.4 GW of capacity was competing to meet a 3.6GW demand target.

This overhang of capacity was exacerbated by several factors that weren’t anticipated at the T-4 stage e.g. survival of the 1.2GW Peterhead CCGT (as a result of a favourable transmission charge ruling) and the early commissioning of the NEMO interconnector and a number of gas engine and waste energy generators.

All capacity that cleared, except the last few marginal MW, was effectively priced at zero i.e. owners were committed to providing capacity regardless of price outcome. As well as capacity that came online earlier than anticipated, it appears that several of the larger existing thermal units also bid zero e.g. Centrica’s Kings Lynn, Killingholme and Peterborough plants.

This is where the relevance of the auction was undermined by a very short timeline to delivery. An auction in mid June for a capacity year starting in October, represents a 3.5 month lead time. There is very little that capacity owners can practically do in response to the auction price signal over that time frame.

Over the usual 9 month T-1 horizon, capacity owners have more flexibility to consider responses such as mothballing or delaying investment decisions. But at the 3.5 month stage, most costs involved in operating capacity are already sunk (or unavoidable). In that situation the rational response is to bid capacity at or very close to zero price levels. These conditions effectively undermined the purpose of the auction.

Impact & implications of a low price

A near zero price has dashed any remaining hopes of larger thermal units that didn’t secure a 2019-20 capacity agreement at the T-4 stage. 3.5 GW of coal plants will close over the next 9 months: 2GW Cottam (EDF) in Sep-19 and 1.5 GW Fiddlers Ferry (SSE) in Mar-20. West Burton A (EDF) has a capacity agreement in 2020-21, but may have to run at a significant cash loss if it stays open to fulfill this. Another 0.5GW of gas-fired plant (ESB’s Corby and Centrica’s Brigg) are on the highly endangered list.

But beyond these closures, the dynamics driving last week’s T-1 auction have virtually no bearing on pricing of the main T-4 capacity auctions.

The ‘top up’ nature of T-1 auctions mean that supply, demand & pricing dynamics differ substantially from T-4 auctions. T-1 capacity volumes are relatively low, with what are typically steep and ‘chunky’ supply stacks. If the market is oversupplied at the T-1 stage, prices lurch to low levels. But the opposite is also possible if the market is tight e.g. because of unanticipated closures and capacity shortfall at the T-1 horizon.

Step forward to next T-4 auction and there are a number of factors supporting higher capacity prices:

- Engine headwinds: Achieved gas reciprocating engine margins across the last 12-18 months have been significantly lower than expected, effectively acting to increase capacity bids on future investments.

- DSR: The success of DSR from previous auctions is set to be substantially impacted by revenue reductions resulting from rule changes set to be implemented under the Transmission Charging Review.

- Coal economics: The economics of remaining coal units have deteriorated significantly across 2018-19 as gas prices have fallen & carbon prices risen. This will likely lift the bids of the remainder of the UK coal fleet.

- Batteries: Steep reductions in battery de-rating factors and declining frequency response returns have stemmed the tide of batteries bidding aggressively into the capacity market.

The 77p capacity price is an unwelcome outcome for the 5% of capacity owners that will receive it across the next year. But it has little bearing on what happens going forward in the UK power market.

Timera is recruiting analysts

We are looking for analysts to join our growing team. Very competitive & flexible packages. Further details at Working with Timera. |