Centrica Storage Limited announced on the 12th April that there will be no injections at the Rough storage facility until May 2018 at the earliest. This leaves Rough effectively crippled for at least a year.

Rough could return to operation in some constrained form in 2018, but there appears to be a growing threat of permanent closure. There are substantial technical challenges facing the ageing facility relating to well integrity. Even if these can be partially overcome, it is unlikely that current seasonal price spread levels would justify the capex investment required. Closure also allows Centrica to monetise the substantial volume of cushion gas in the reservoirs by flowing this into the grid .

In an article last year we looked at the threat of reduced flexibility from Rough. In today’s article we consider the impact on the UK gas market of the closure of Rough.

Space vs deliverability

The UK market is less dependent on Rough flexibility than it was a decade ago. This is because of major investments in connectivity with the Norwegian Continental Shelf (Langeled, Vesterled), interconnection with the Continent (BBL) and incremental regas capacity (at Dragon, South Hook & Grain).

This new supply infrastructure means that the UK has ample import capacity to meet annual demand and to support seasonal flexibility. The gas market’s vulnerability is to shorter term constraints in supply deliverability to meet gas demand on any given day.

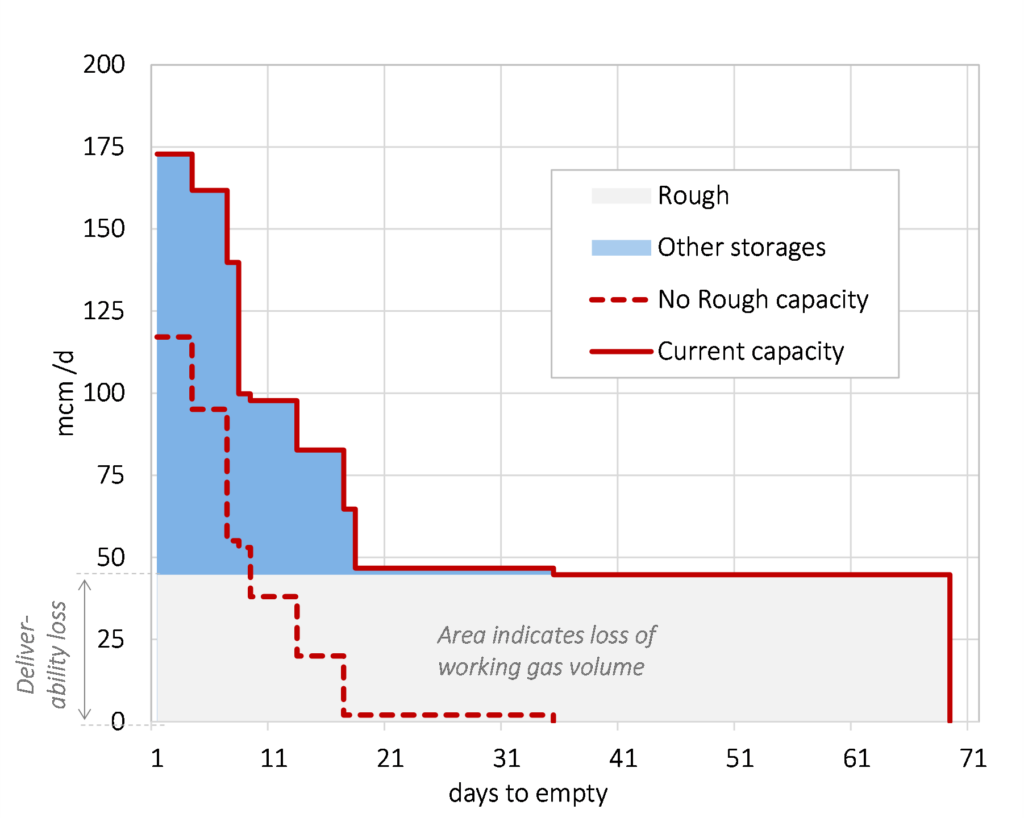

Rough makes up an impressive 70% of the UK’s storage working gas volume. This can be contrasted with Rough’s contribution to the UK’s daily deliverability, at around 25%. And it is the deliverability that the UK market will miss most. The impact of Rough closure on deliverability is illustrated in Chart 1.

The solid red line in the daily deliverability profile of aggregate UK storage capacity including Rough, assuming continuous withdrawal from full inventory. Deliverability quickly falls past the first 1-2 weeks as fast cycle facilities exhaust their working gas volume, with Rough providing the only significant delivery capability beyond a two week horizon. The impact of losing Rough is illustrated by the dotted red line.

Impact on pricing

The chart illustrates the two main impacts of Rough closure:

- A 25% fall in deliverability reduces the ability of the UK market to respond to short term swings in the supply/demand balance (e.g. import infrastructure outages, cold snaps), over a 1 -2 week horizon.

- A 70% reduction in working gas volume reduces the ability of the UK to cope with a more prolonged supply shock over the 2-6 week horizon period it can take for the LNG supply chain to respond a, e.g. as the UK faced in Mar/Apr 2013.

The loss of deliverability should boost spot price volatility as it reduces the buffer of supply flexibility available to respond to swings in daily demand. There is already evidence of volatility recovery in 2016, supported by the partial Rough outage. The loss of working gas volume is likely to mean that supply shocks (e.g. major infrastructure outages) have a sharper and more prolonged price impact.

The other interesting pricing dynamic is the spread between UK and Continental hub prices. The Rough injection season has historically acted to soak up UKCS summer production, supporting NBP prices. The loss of Rough may see a reduction in NBP prices relative to TTF in summer months and a fall in net UK to Continental export flows. This logic applies in reverse in winter when the UK will need to attract more gas from the Continent (or Norway) to replace Rough withdrawals.

Impact on asset values

The loss of Rough should increase the role that imports play in servicing daily demand swings. This is good news for the value of interconnector and regas terminal capacity. Value is likely to be impacted in two ways:

- Greater capacity utilisation as flows increase in the absence of the ability to store gas within the UK market

- A higher ‘insurance value’ associated with import capacity, given the reduction in deliverability means imports will play a more important role in servicing daily demand swings or providing supply shock response.

Rough closure is undoubtedly good news for UK storage assets, particularly fast cycle assets which are focused on providing deliverability. It means a lower volume of flexibility to respond to short term price volatility, as remaining slower cycling storage assets become more focused in backfilling the loss of Rough seasonal flexibility.

There is already a knock on impact being seen with pricing and demand for storage & transport capacity prices. This reflects anticipation of increasing returns on flexible capacity as a result of the Rough issues, as well as greater competition to acquire flexible capacity from other sources.

We recently set out evidence of a 2016 rise in spot gas price volatility after many years of decline. This is consistent with increasing UK import dependency, ageing flexible supply infrastructure and increasing gas swing demand from the power sector. The loss of Rough next winter, and probably permanently, is a big factor pointing towards a continuation of the volatility recovery.

Article written by David Stokes & Olly Spinks