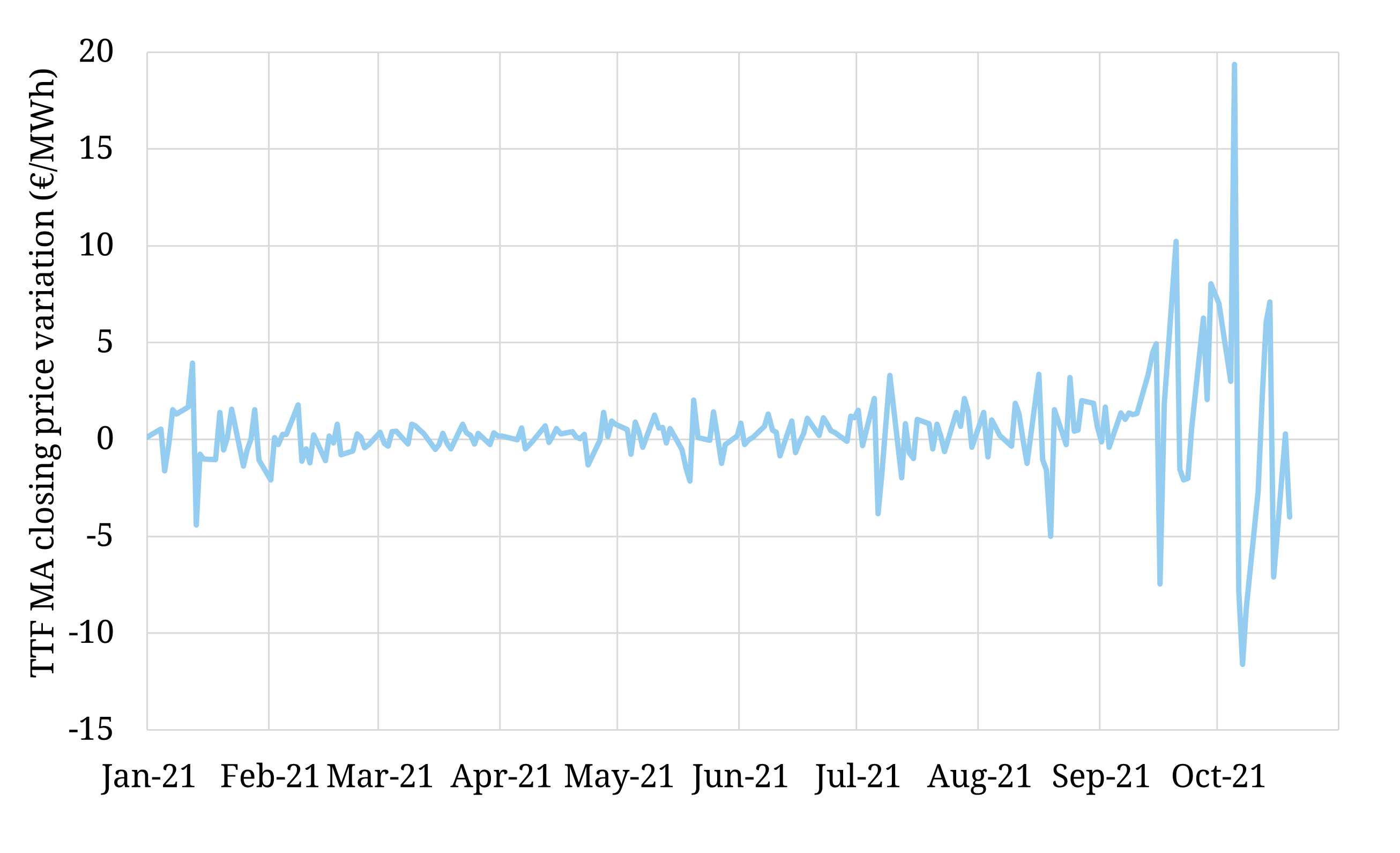

We spoke in our latest feature article about surging TTF price volatility and the resulting impact on gas storage value. The price moves shown in the chart highlight recent volatility dynamics, with an incredible 60 €/MWh intraday range on October 6th, the equivalent of around a $63m swing on the value of a standard LNG cargo.

The violent moves continued intraday on Monday this week. A soft open on expectation of higher Russian capacity bookings in November (following reports of high domestic storage levels along with supportive government comments on supplies) saw prices jump as limited capacity was booked on Yamal and none via Ukraine (where flows are currently below ToP as supplies to Hungary are rerouted). But the move back above 100 €/MWh for Winter 2021 prices was short lived, with prices falling back into an 85-95 €/MWh range.

Poor liquidity in both power & gas markets remains a key challenge, on top of very high absolute price levels. This is contributing to higher volatility & wider bid / offer spreads.