Battery investment momentum is surging in 2020. This is not the result of any specific market or policy related boost for storage economics. It appears to be a more organic ‘tipping point’, where investors are recognising the scale of the role storage will need to play to support decarbonisation.

“Battery returns, driven by price volatility, have stood up relatively well across the Covid-19 period.”

The UK is currently leading the push for storage deployment in Europe. This is the result of improving policy clarity and a relative maturity of the revenue streams that drive the battery margin stack (wholesale, balancing, ancillaries, capacity & network related).

Momentum is now also building behind battery investment in NW Europe (e.g. Germany, Benelux & France) and Southern Europe (particularly batteries co-located with solar in Spain & Italy).

While there is a broad range of battery investment cases, most are underpinned by wholesale & balancing market revenue streams. And a key challenge investors are facing is the absence of a clear performance track record in these markets, given battery deployment is relatively new.

In today’s article we look at some empirical evidence on storage value capture. Our analysis shows a UK market case study comparing wholesale & balancing revenue capture of shorter duration batteries compared to longer duration pump storage.

But first we start with a bit of background on the practicalities of battery monetisation in the UK.

To BM or not to BM

UK battery operators currently face an important choice as to how they monetise their asset. The dominant monetisation strategy currently, is focused on optimisation of batteries across wholesale market and NIV (Net Imbalance Volume) chasing (trying to forecast system imbalance in order to generate positive cashout revenues). This income is supplemented by FFR revenues (from the main frequency response market), other ancillaries and network related benefits.

NIV chasing has been an attractive strategy given revenue is supported by volatility of ‘sharp’ cashout price signals. However UK battery monetisation strategy is set to change. Increasing volumes of batteries and engines are chasing relatively small net imbalance volumes. This increases cashout price forecast error and reduces expected returns from NIV chasing.

As a result, battery operators are shifting their focus to the Balancing Mechanism (BM). Policy changes (e.g. Project TERRE and the introduction of Virtual Lead Parties) are making the BM more accessible to a range of flexible asset owners. And it is likely that within two or three years, the majority of UK batteries will transition away from NIV chasing to participate directly in the BM.

The BM is a ‘paid as bid’ market. In other words, assets submit bid prices (at which they are prepared to reduce output) and offer prices (at which they are prepared to increase output). So price risk from a NIV chasing strategy is replaced by volume risk in the BM, given an operator does not know in advance whether bids and offers will be accepted. The challenges around Gate Closure management for shorter duration batteries mean that some operators may choose not to remain focused on NIV chasing.

Projecting storage revenues in the BM requires complex analysis. This means that benchmarks for achieved historical revenues are even more important.

A case study on wholesale & BM storage margins

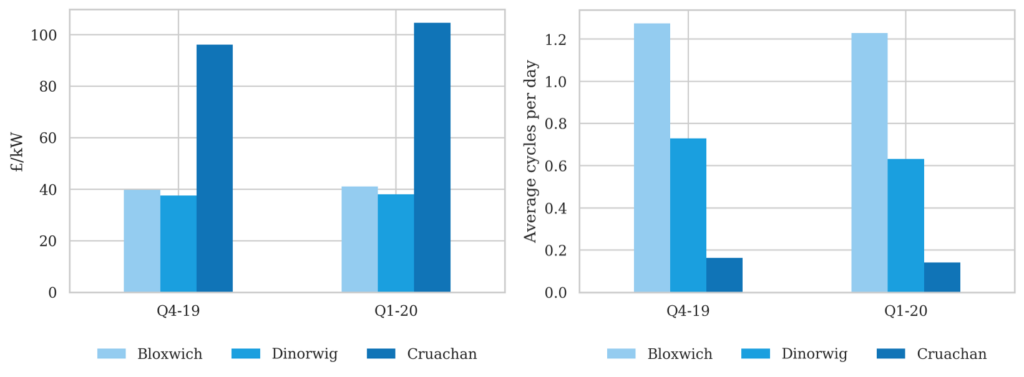

Chart 1 shows an analysis of achieved storage margins and cycling performance for 3 assets across Winter 2020:

- Arenko’s 41MW Bloxwich battery

- First Hydro’s Dinorwig pump storage asset in Wales (wholesale & BM focused units only)

- Drax’s Cruachan pump storage asset in Scotland