The evolution of Europe’s hydrogen economy has been largely conceptual to date… a lot of talk & slides but not much committed capital. 2023 is shaping up to be the year where this begins to change. It is increasingly likely we see hundreds of millions of EUR of H2 projects reaching FID across Europe this year.

“Two key policy triggers in 2023 should kick start larger scale project FIDs”

The UK is leading the way in delivering tangible policy support to kick start investment (with the Netherlands in close second). The UK has a 10GW H2 production target by 2030 (across both green & blue H2). It has also set a more immediate target of 2GW by 2025. Achieving that effectively requires multiple larger scale project FIDs this year.

In today’s article we provide an update on the key policy support mechanisms falling into place to enable UK project FIDs.

What’s driving UK hydrogen investment in 2023?

The cost of producing hydrogen is currently substantially higher than alternative energy sources (e.g. gas). To develop a viable H2 project this cost gap needs to be plugged via policy support.

There are two key forms of policy support to enable H2 project investment:

- Upfront capex support to develop the project (NZHF)

- Ongoing operational subsidy to bridge the cost gap vs alternatives (HBM).

The two policy support mechanisms the UK is implementing to address these are summarised in Table 1.

Table 1: Upfront (NZHF) and ongoing contractual (HBM) hydrogen support

We set out details of NZHF and HBM hydrogen project support mechanisms in a previous article.

Two key policy implementation steps are targeted for 2023 which should kick start larger scale project FIDs and investment:

- Allocation of 1st round NZHF funding to initial successful projects to cover upfront costs

- Finalisation & award of 15 year LCHA contracts (hydrogen CfDs) to support the first wave of projects online by 2025.

Timelines here are pretty challenging which means a lot is happening in parallel, much of it behind closed doors in bilateral conversations between developers, offtakers and the UK government. But by the end of 2023 it should be clear which projects will lead the push for the 2GW by 2025 target.

This first round of policy support should also provide a framework that allows scaling of H2 production in annual allocation rounds, targeting 10GW by 2030.

15-year contract support

The UK’s success in developing large volumes of wind capacity has been underpinned by CfD support. The 15-year Low Carbon Hydrogen Agreement (LCHA) is based on the AR4 CfD structure. These LCHA contracts provide hydrogen projects with a 15-year operational subsidy to bridge the gap between the cost required to produce H2 and the price offtakers are willing to pay for it.

The LCHA contracts provide both price & volume support for H2 producers as we summarised in Q4 2022. More details have now been clarified on the implementation of both these areas of support.

Price support

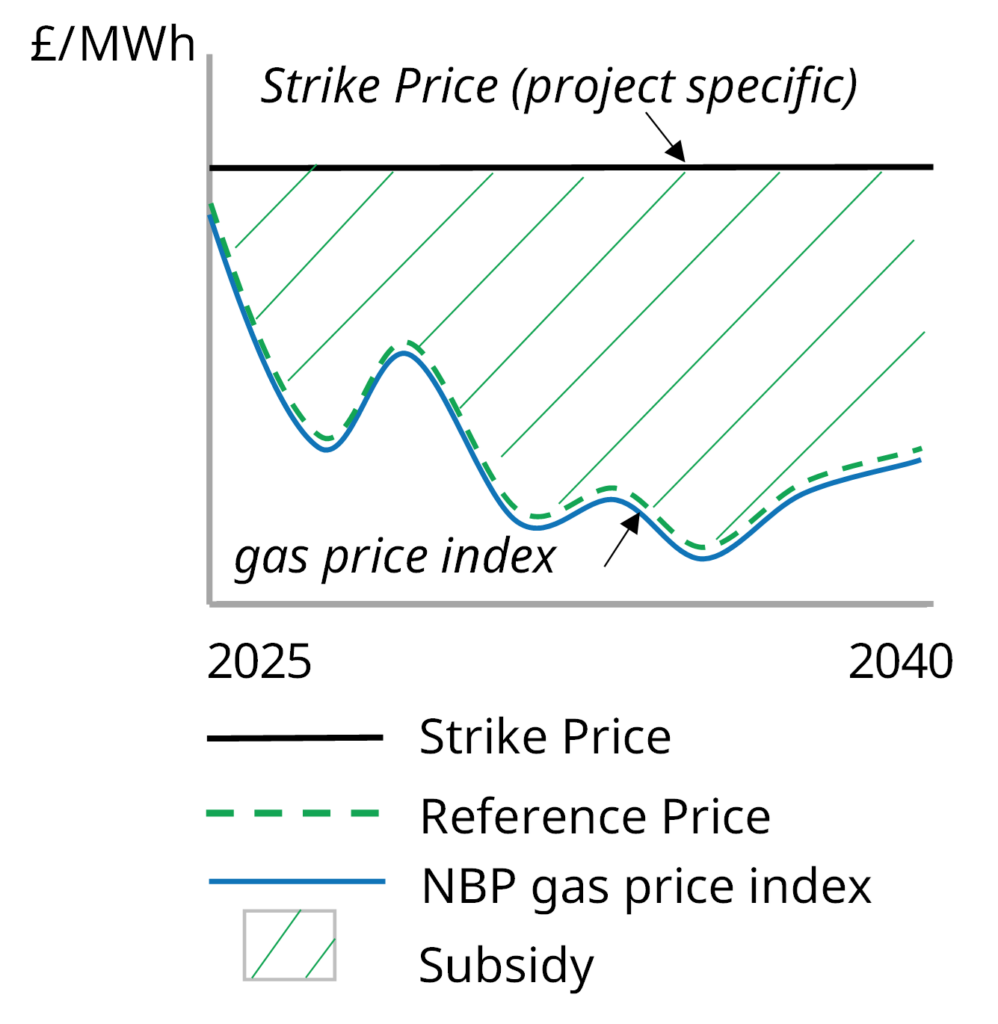

Chart 1 illustrates how LCHA price support provides an ongoing subsidy to H2 producers. There are 3 prices which define the level of support payments:

- Strike Price: H2 price required to earn a viable return on the project (negotiated by producer with the government; reflecting individual project cost structure)

- Reference Price: producer’s achieved H2 sales price e.g. via offtake contract

- Gas Price Index: front month NBP gas price index (effectively a floor for the Reference Price)

Hydrogen producers receive support payments on the difference between the Strike Price (black line) and Reference Price (green dashed line).

The core LCHA structure incentivises H2 producers to maximise support payments by indexing the Reference Price to the NBP gas price as illustrated in Chart 1. However a key aim of the scheme is to encourage producers to sell H2 at a premium to gas prices over time as demand for low carbon H2 increases with broader decarbonisation.

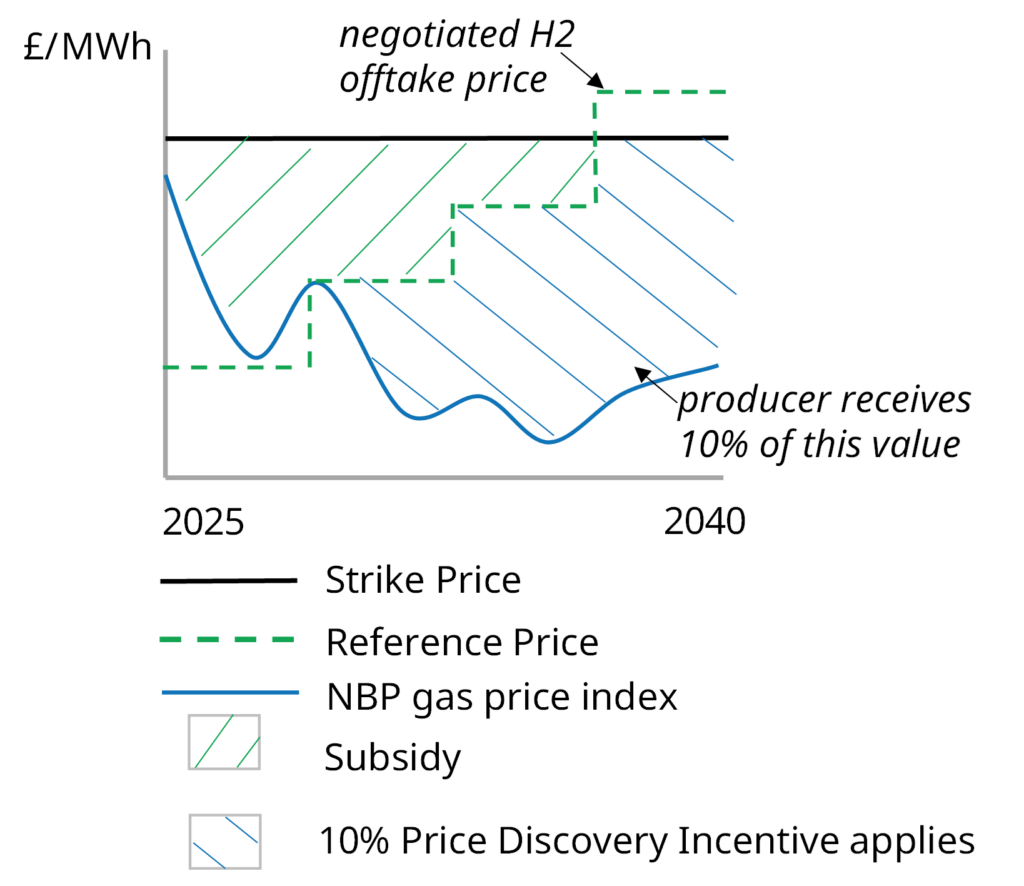

This is where the Price Discovery Incentive comes into play. Producers receive a bonus payment of 10% of any premium of negotiated H2 sales price over the NBP Gas Price index as illustrated in Chart 2.

Although the 10% benefit goes to the H2 producer, it opens up a pool of additional value that can implicitly be shared by negotiation with the offtaker. This 10% benefit is capped at the Strike Price.

Volume support

The first thing to note on volume is that there are conditions that need to be met for H2 produced to ‘qualify’ for price support set out above. Qualifying volumes need to meet a Low Carbon Hydrogen Standard. They also must be purchased by a qualifying offtaker (for feedstock or own consumption). This excludes:

- Sales to 3rd party risk takers e.g. traders

- Blending into the gas network

- Exports beyond UK borders.

Volume support for producers on these qualifying volumes comes in the form of a ‘sliding scale’ support mechanism.

The LCHA is negotiated and signed based on a defined production volume. Any excess production above this volume can be sold by the producer, but without receiving any subsidy. If production volumes decline more than 50% below the negotiated level, then support per unit of production ramps up (i.e. the strike price effectively increases).

The aim of this sliding scale support is to protect producers from the risk of periods of low production e.g. due to high input energy costs. There is however no support for zero production (e.g. in the case when offtake is halted), which strongly incentivises producers to sign ‘take or pay’ offtake contracts with creditworthy counterparties e.g. refineries or chemical plants.

What to watch for next

The LCHA combination of both price & volume support across 15 years is a key win for H2 production projects. It effectively transfers a substantial portion of project risk onto either (i) the government / consumer or (ii) offtakers.

A lot of activity is set to happen pretty quickly across 2023 from both a policy and investment perspective. It will become clear which projects & companies pave the way with the first allocation of NZHF funds and LCHA support contracts. This in turn sets up project financing and FIDs.

Even accounting for some slippage in timelines, the UK hydrogen investment landscape should be a lot clearer by the end of this year. And that is going to attract a lot of new investors & projects.

Interested in the European battery investment landscape? See details of our upcoming webinar below.

Timera EU battery investment webinar

Webinar registration link – register here

- Date: Thurs 20th Apr (2-3pm BST, 15-16 CEST)

- Title: “Targeting battery value” – revenue stack, opportunities & challenges for BESS investors across EU

- Content:

- Ranking BESS investment potential across EU markets

- BESS revenue stack structure (energy arbitrage, ancillaries, capacity)

- Evolution of key price signals & revenue drivers

- Investment challenges (e.g. policy, network charging)

- Key BESS investment case drivers