Peaking flexibility is a major challenge as power markets decarbonise. Batteries are currently the only scalable form of low carbon peaking flex. But batteries are net consumers of energy and currently have limited duration (1 to 4 hours). As a results, the UK still depends strongly on gas peakers to provide flexible energy in periods of lower renewable output or system stress.

“The market is signalling an acute shortage of peak energy”

Gas reciprocating engine capacity has grown rapidly in the UK across the last 5 years. Engines have alongside batteries dominated flexible capacity build. And this has acted to curtail the requirement for new CCGT capacity as ageing coal, nuclear and gas plants retire.

Gas engines have some key advantages over CCGTs. These include lower capex & opex, very fast ramp rates, low start costs and the ability to earn returns from providing distribution network services (embedded benefits).

Against the backdrop of the UK’s new net zero power sector pledge, gas engines also carry less decarbonisation risk than CCGTs. This is driven by shorter capital payback periods and an easier path to retrofitting engines with low carbon fuels e.g. hydrogen. In this sense engines represent both a bridging technology to net zero but can also retain a role beyond.

In today’s article we look at the evolution of UK gas engine margins, which have surged in 2021 against a backdrop of market stress. We look at the drivers behind rising margins as well as backtesting engine performance.

Engines harvest power price volatility

UK power prices have been extremely volatile this year, driven by a combination of capacity offline (e.g. nuclear outages, mothballed CCGTs), issues with explicit interconnection nominations, the IFA interconnector outage & periods of low wind & solar output.

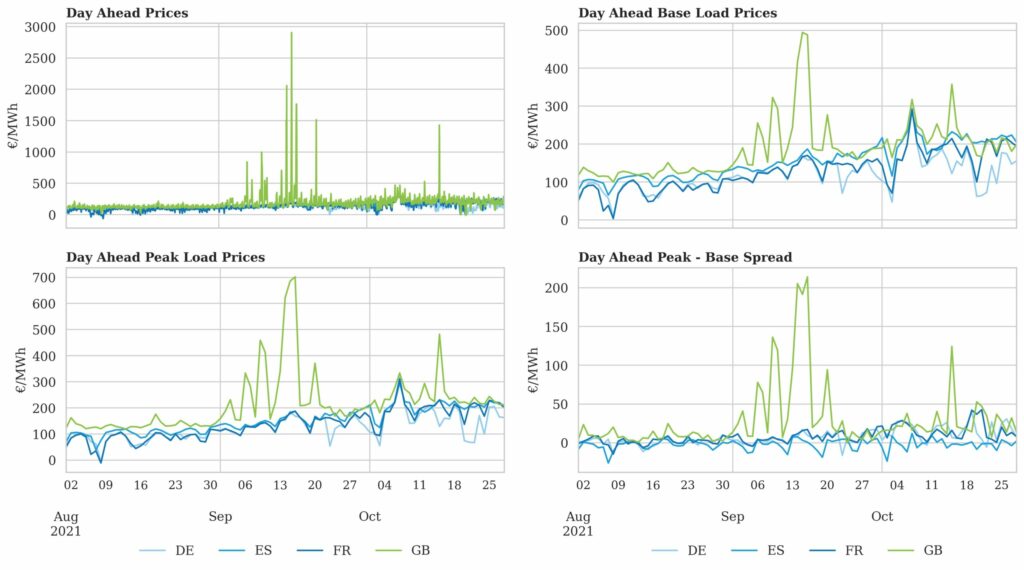

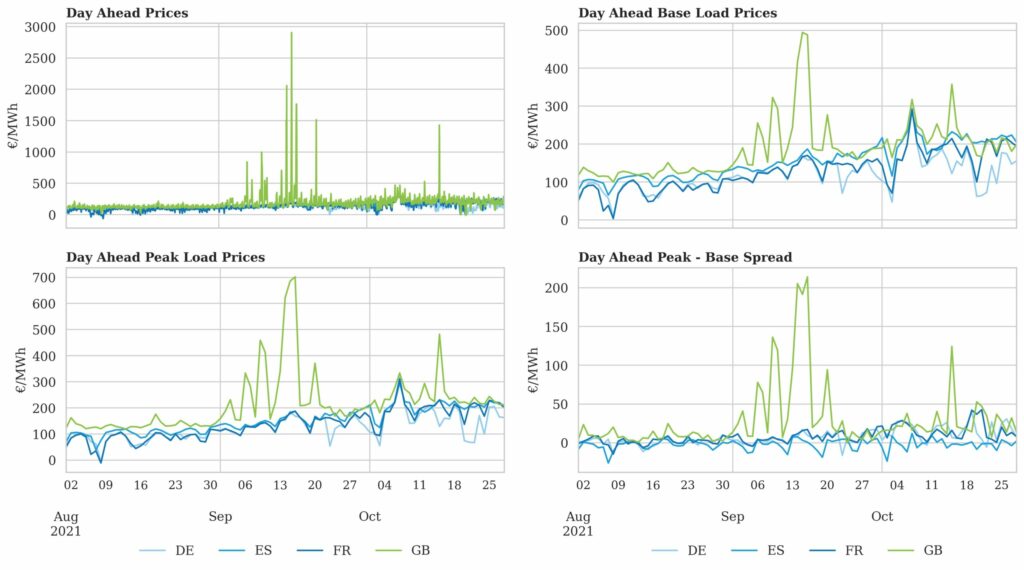

Price volatility across the last 3 months is illustrated in the 4 panels of Chart 1.

Chart 1: UK Day-Ahead price dynamics Aug – Oct 2021

Source: Timera Energy, Nordpool, ICE

UK power prices have gone through regular bouts of volatility since the Covid shock of 2020. These tend to support shorter spurts of gas engine operation to provide energy & flexibility in periods of low renewable output and/or high demand.

That volatility has become more extreme heading into the current winter given major outages across the UK nuclear fleet, the IFA interconnector and the mothballed Calon CCGTs. Tightness is driving record thermal asset margins and for example saw a power plant paid 4950 £/MWh for 30 mins of generation in Sep – a record high.

Conditions are so tight this winter that as well as periods of pronounced volatility, gas engines have been ‘in the money’ on a peak clean spark spread basis. This is the market signalling an acute shortage of peak energy which is requiring engines to run on a more structural basis to maintain system balance.

Backtesting UK gas engine margins

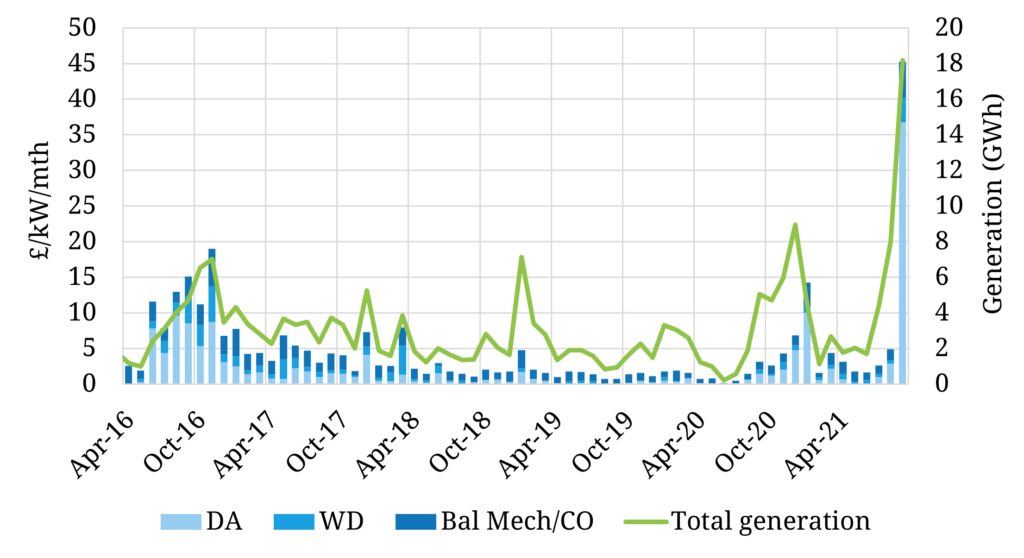

At Timera we have an industry leading stochastic asset dispatch optimisation modelling capability that allows us to project gas engine margin distributions looking forward. We can also run historical price series through our model to backtest margin capture as shown in Chart 2.

The chart shows energy margin capture across the last 5 years. In addition to energy margin, engines typically earn capacity revenues, embedded benefit revenues and ancillary revenues (e.g. from fast reserve & FFR). But it is energy margins that dominate fluctuations in engine returns.

A period of tight energy margins supported an initial period of strength for engine margins in Winter 2016. Major French nuclear outages reversed flows on UK interconnectors, creating very high prices & volatility. This was compounded by the SBR scheme (now defunct), which effectively removed a large volume of reserve capacity, acting to further tighten the market.

After a flurry of engine investment & development from 2016-18 (in part spurred by optimism from Winter 2016), engine margins went through pretty lean times in 2018-19.

But engine margins recovered sharply in 2020 as the UK capacity balance tightened and the Covid shock took hold. Margin momentum has continued into 2021 as the system has tightened further, culminating in an explosion in engine margins in Sep 2021. Engine margins were in the order of 300% higher than previous monthly margin peaks.

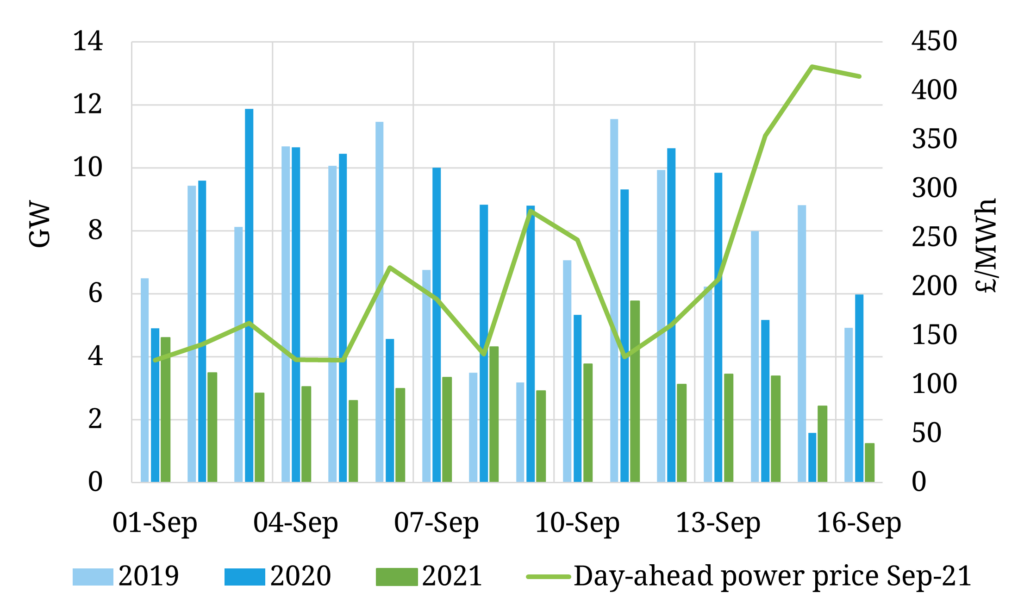

A key driver of such a surge in engine returns was low wind output across Sep 21 which when combined with the UK’s other capacity issues, caused very high power prices as shown in Chart 3

The role of engines

More than any other market in Europe, the UK is dependent on gas engine capacity. Engines have effectively displaced what could have been a new fleet of CCGT plants to replace retiring coal, nuclear and gas plants.

From a margin perspective engines are very different from CCGTs. Engines are effectively ‘out of the money’ options that realise extrinsic value in periods of high price volatility. Retirement of thermal assets and rapid renewable deployment is structurally supporting power price volatility and therefore peaking asset margins.

The UK faces a huge challenge decarbonising the carbon footprint of its gas fired fleet by 2035. But engines are currently playing a key role in maintaining system stability and keeping the lights on.