“Strap in for a lightning round review of 10 surprises from 2025”

Below are 10 energy market surprises that caught our attention in 2025, followed by a snapshot of where our clients focused time and capital this year.

Let’s jump straight in.

1. Global consensus on the energy transition frayed

A breakdown in negotiations at COP30 in November illustrated the increasing challenges of sustaining collective global climate action.

This reflects diverging agendas of the two largest players: the US and China. The Trump administration pivoted the US sharply towards lower energy costs & industrial-policy protectionism. In contrast China continued to pursue low carbon tech scale and export dominance, flooding global markets with low-cost solar, batteries and EVs.

Europe remained committed to the transition, but national approaches diverged. Germany slowed and re-profiled parts of its RES rollout; France doubled down on its nuclear-centred strategy; the Netherlands scaled back offshore wind and hydrogen ambitions; and the UK reoriented policy toward energy security and affordability, pulling back on aspects of its decarbonisation ambitions.

2. RES capture prices tumbled

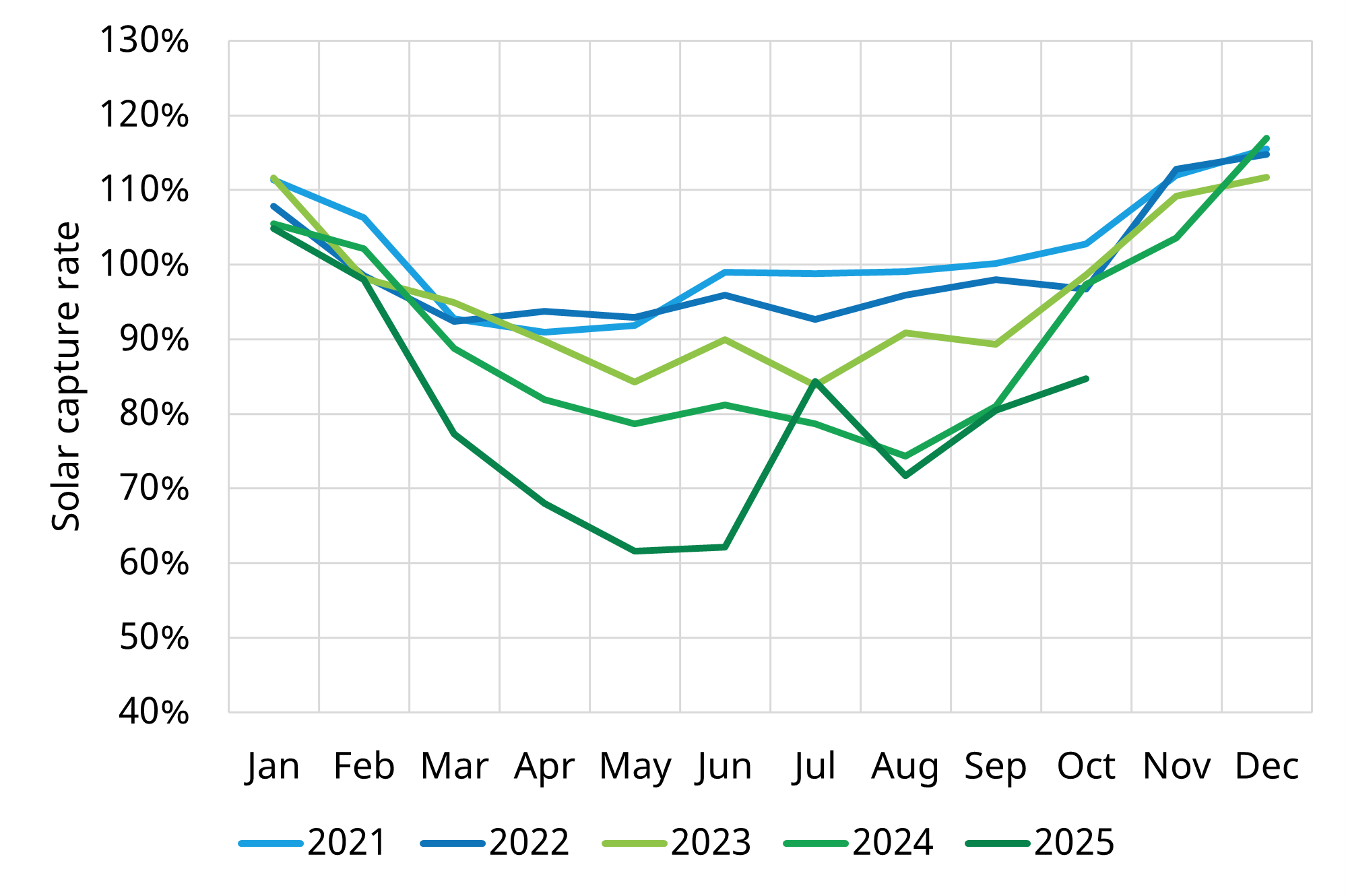

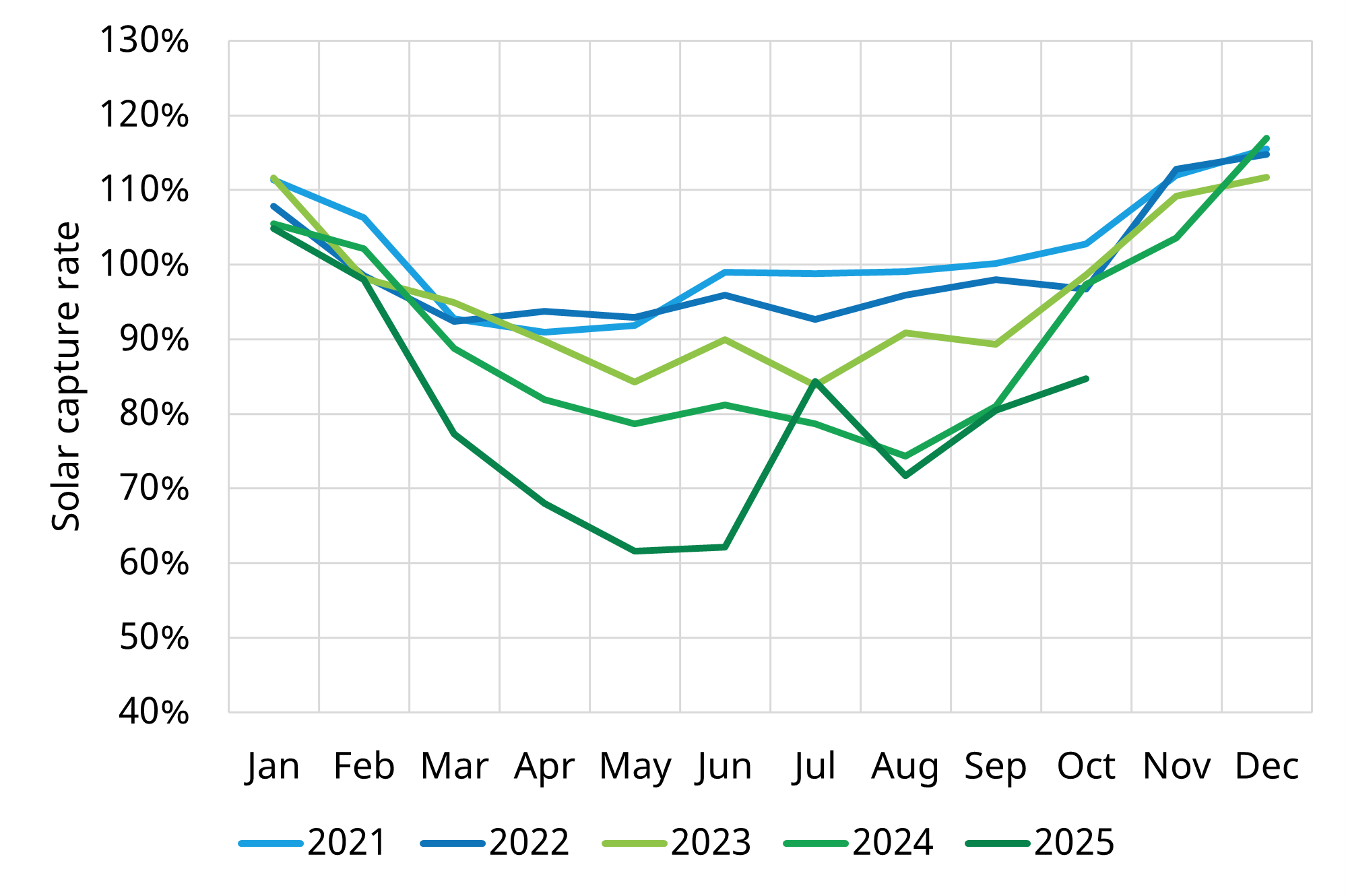

Increased solar and wind penetration, more frequent negative prices and tighter interconnector constraints all weighed on capture rates, particularly for merchant solar portfolios. This was a pan-European trend in 2025, but particularly pronounced in markets with higher solar penetration e.g. Germany (see Chart 1) & Spain.

Chart 1: Solar capture rates in Germany

Source: Timera Energy, EPEX

The result was a sharp repricing of merchant RES risk, renewed interest in hybrid RES-plus-storage structures, and a stronger focus on PPA floors and downside protection.

3. Spanish power blackouts exposed a European flex crunch

2025’s Spanish blackouts provided a stark illustration of what happens when you push RES penetration hard without a matching investment in flexibility. A combination of high wind and solar output, low thermal availability, weak hydro conditions and transmission bottlenecks led to major loss of load events.

The issue was system stability, not renewables per se: inertial support, ramping capability and backup capacity were inadequate given the volatility of net load.

The episode sharpened focus across Europe on the value of thermal flexibility, storage and demand response, and on how to design capacity and ancillary service markets that incentivise these.

4. LNG investment surged despite a looming supply wave

Coming into 2025 there was already a clear market concern as to the huge LNG supply wave coming online across the next 5 years. Instead of slowing, liquefaction investment accelerated as shown in Chart 2.

Chart 2: Incremental LNG supply FIDs in 2025

Source: Timera Energy

More than 60 mtpa of new LNG capacity was sanctioned in 2025, well above market expectations. Buyers in Asia, the Middle East and parts of Europe locked in long-term offtake. The result is an even fatter supply bulge on the horizon – but also a more complex set of optionality and exposure management dynamics for portfolio players to manage.

5. Orsted collapses as RES deployment hits headwinds

Renewables were supposed to be the ‘easy’ part of the transition story. 2025 challenged that assumption.

Germany’s decision to scale back and re-profile RES targets signalled a more cautious approach, driven by grid constraints, permitting delays and mounting concerns around power prices and competitiveness. At the same time, offshore wind ran into a storm of cost inflation, supply-chain stress and higher financing costs.

The implosion of parts of Ørsted’s offshore wind pipeline became emblematic of the sector’s difficulties. Other big players such as RWE, Iberdrola & Vattenfall also pulled back on capital deployment into RES.

The structural RES investment drivers remain intact, but 2025 underlined that policy ambition alone is not enough – capital discipline, grid build-out and credible support frameworks matter just as much.

6. Henry Hub pushing higher… as Brent weakened

The front of the Henry Hub (HH) futures curve has been flirting with the 5 $/mmbtu level in 2025, after languishing below 4 $/mmbtu for most of the last 10 years (although pulling back sharply from the $5 level last week).

A tighter US gas market balance has resulted from stronger-than-expected US power demand, weather-driven volatility and robust LNG exports.

Chart 3: Front month Brent vs Henry Hub

Source: ICE, CME

Price strength challenged the long-held assumption that US shale would anchor Henry Hub at structurally low levels, despite surging US LNG exports. This is impacting LNG contract pricing and has been a key current focus for LNG portfolio monetisation & investment strategies.

Despite stronger than expected global growth and a continuation of Russia – Ukraine conflict in 2025, Brent crude prices have remained weak. This has been helped by the Trump administration leaning on Saudi Arabia to maintain supply.

7. Italy’s MACSE battery auction cleared well below expectations

A standout 2025 surprise came from Italy’s first MACSE auction, which cleared at around €15–20/kWh-yr – far below the €20 – 30/kWh-yr level many investors had assumed was needed to underwrite new BESS projects.

The outcome was driven by ENEL’s dominant, very low bids in the South, leveraging portfolio synergies to accept returns that independent developers could not match. This has seriously challenged the investment case for much of the Southern Italian BESS pipeline.

Capital interest has pivoted toward Northern zones, where merchant value remains stronger because of lower incumbent concentration and Capacity Market opportunities.

8. Zonal power pricing suddenly looked a lot less trendy

A few years ago, zonal power pricing was held up as the obvious next step for European markets: better locational signals, more efficient use of the grid and improved investment incentives. 2025 delivered a reality check.

Persistent congestion, counter-intuitive flows and highly volatile within-zone price spreads triggered a political backlash. Concerns around regional equity, industrial competitiveness and consumer price volatility meant that several governments (e.g. GB & DE) cooled on further reforms, and pushed to dilute or slow zonal implementation.

9. LNG shipping charter rates crash & then surge

LNG vessel charter rates hit record lows in Q1 2025, before surging higher into Q4.

The price slump stemmed from an oversupply of vessels, liquefaction project delays, and shorter voyage durations. Spot charter rates fell as low as $5k/day in Q1 2025 as shown in Chart 4.

Chart 4: Spot LNG charter rates in 2025

Source: Spark Commodities

The chart also shows the sharp surge in charter rates that we’ve seen across the last 6 weeks. This has been driven by a pick up in winter demand, the ramp up of US LNG liquefaction terminals (structurally increasing vessel demand) and an increase in floating storage demand.

Swings of this magnitude materially affect LNG portfolio value, shaping delivered costs, netbacks and flexibility economics.

10. Capital push into European flex assets

If 2024 was a big year for flexible power investment, 2025 took it up a gear.

Transactions included:

- TotalEnergies’ stake in EPH reinforced the strategic value of large, flexible generation portfolios.

- The Grain LNG stake changing hands to Centrica / ECP underlined enduring appetite for midstream LNG infrastructure post Russian supply cuts.

- Energia’s sale to Ardian and APG’s large-scale investment into Return Energy, highlighted strong institutional interest in integrated portfolios of flexible assets.

- FIDRA’s 1.4GW Thorpe Marsh BESS project secured debt financing, illustrating the depth of lender interest in large well structured assets.

The common thread: investors are increasingly allocating capital to flexibility, both to diversify RES risk and because flex value now appears structurally underpinned by higher volatility and policy uncertainty.

Timera client focus areas from 2025

Our client base is an interesting barometer for activity across power & gas markets. Let’s take a look at key focus areas this year.

Power transactions:

We provided buy side market & commercial due diligence support for a range of major M&A transactions across Europe, including:

- APG’s large-scale investment in Return Energy (NWE BESS)

- Equitix’s acquisition of the Greenlink interconnector

- Ardian’s acquisition of utility Energia

Debt financing: We saw a sharp increase in BESS and flex-asset lending, including Pulse Energy’s £220m facility.

BESS investment: 2025 was another record year for BESS investment valuation & DD support, with strong demand for our GB, DE & IT BESS subscription service products.

Offtake support: We supported hundreds of MW of BESS offtake across GB, DE, BE and NL – from structuring through to HoT negotiation.

CCGTs & peakers: We saw an increase in valuation work for CCGTs and peakers, reflecting data-centre demand and security-of-supply priorities.

LNG & gas transactions: Demand for market & commercial DD support for gas & LNG investors was strong, for example:

- UK Grain regas terminal transaction (& other EU regas terminals)

- Supply & midstream portfolio bids

- LNG Carrier investment support

LNG valuation & strategy support: Deal flow support has also been strong e.g. including:

LNG Bridge: Our LNG Bridge portfolio valuation model continues to be implemented by leading LNG companies (including a major new Asian focussed supplier). Our LNG Bridge client base now covers more than 25% of global physical cargo volumes.

Midstream gas: We continue to support European pipeline & storage asset owners / capacity buyers as they navigate structural shifts in gas flows and volatility, across contracting & monetisation strategies

Last but not least we’ve continued to expand our team of flex experts & our analytical modelling capability – with the release of two major stochastic pan-European power & global gas market model upgrades.

Flexibility is the unifying factor across all of our work, supporting energy transition, system resilience and capital deployment.

We wish everyone a Happy Christmas, and look forward to catching up in 2026!