The issues gaining most attention currently include how Europe gets through winter with sufficient gas supply, and the avoidance of punitive blackouts. In the meantime, coal & carbon pricing have been almost as choppy as their gas & power counterparts.

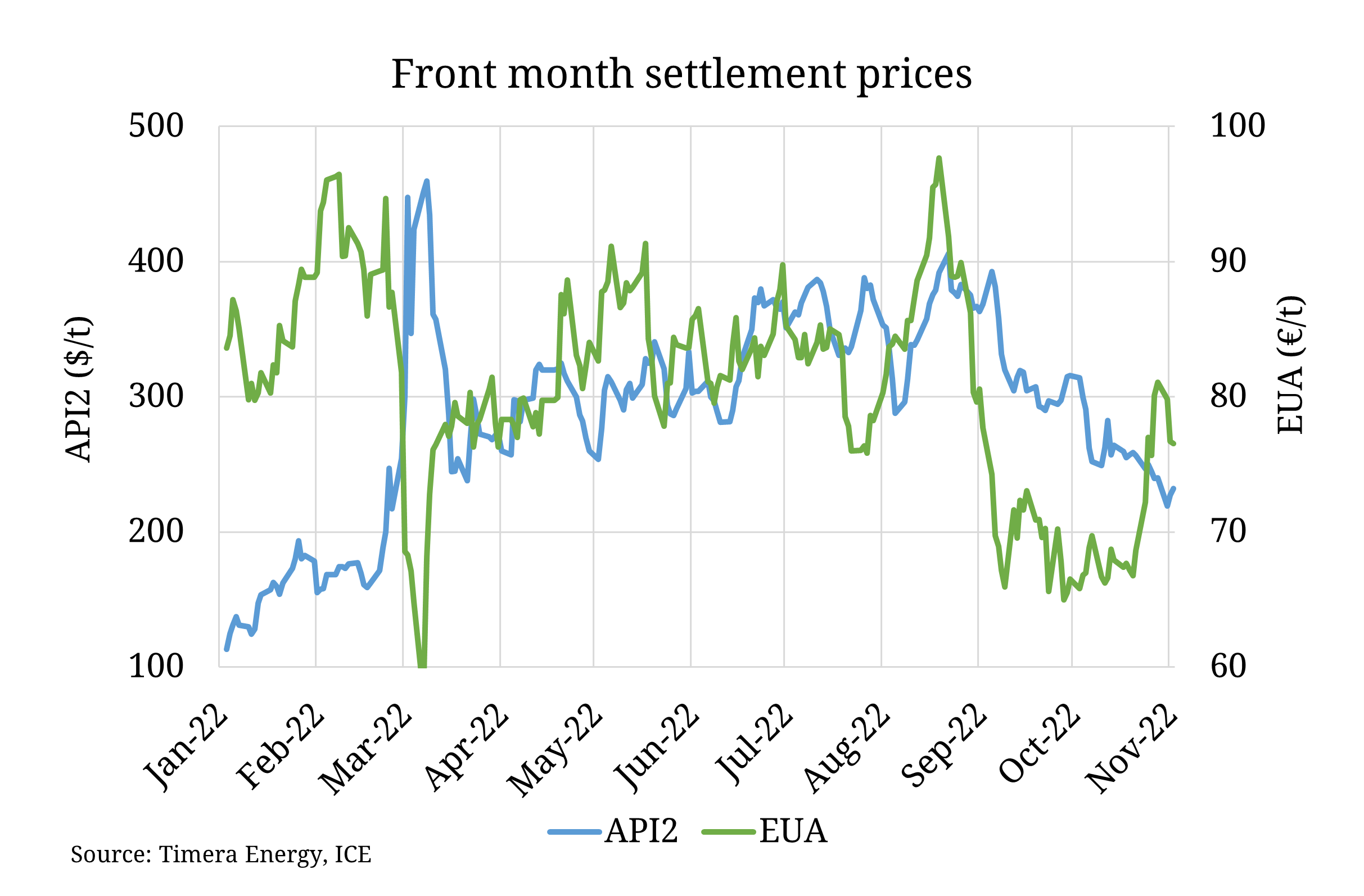

European coal prices (API#2) have rocketed this year, with Europe needing to re-source up to 45% of its coal imports that it typically receives from Russia. Prices have since fallen by almost 50% in 2 months, despite moves by numerous European governments to increase coal capacity by either delaying closures or reinstating reserve units. Winter supply fears have reduced as South African swing supply has pivoted towards Europe, and Russian coal finds it way to new markets.

We posted about carbon’s tumultuous period back in September, where prices have been affected by collateral requirements, policy risk, and reduced carbon-intensive industrial demand. Prices have recovered by ~20% since the latest plummet, as coal plant load factors remain strong and softening prompt fuel & power prices spark anticipation of some increase in industrial carbon demand.

On Monday our attention will move back to European gas prices, with an animated view of the TTF forward curve evolution across the recent crisis, and the current state of play.