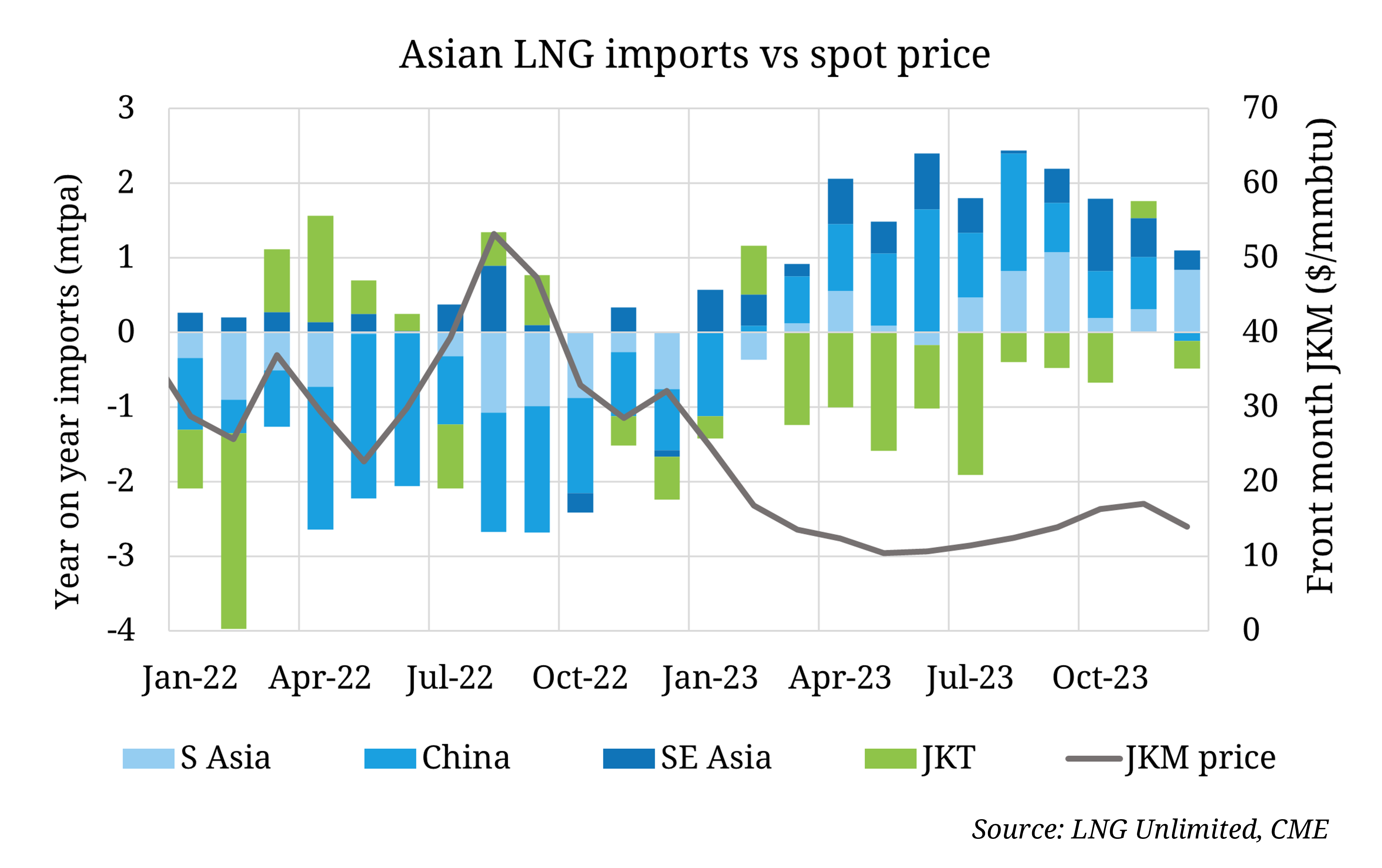

Asian LNG demand continued its “year-on-year” recovery in December, driven by lower global gas prices, although it still fell short of the levels observed in 2021. Throughout 2023, China & South Asia recovered around 50% of the demand drop of the year before, while SE Asia continued its structural demand growth. Japanese & Korean demand however continues to head in the opposite direction as a combination of reduced overall electricity demand, lower industrial consumption, and the return of nuclear plants have stymied gas demand.

2024 so far has seen global gas prices continue their downwards trajectory, with JKM & TTF reaching c. 10 $/mmbtu, despite ongoing canal transit issues. This decrease is occurring as European storage levels remain significantly elevated, overshadowing incremental weather driven demand in the first half of January as Europe went through a cold snap. TTF prices have dropped towards the bottom of the European coal to gas switching range, meaning further Asian demand flexibility is set to be required to clear the global gas market.