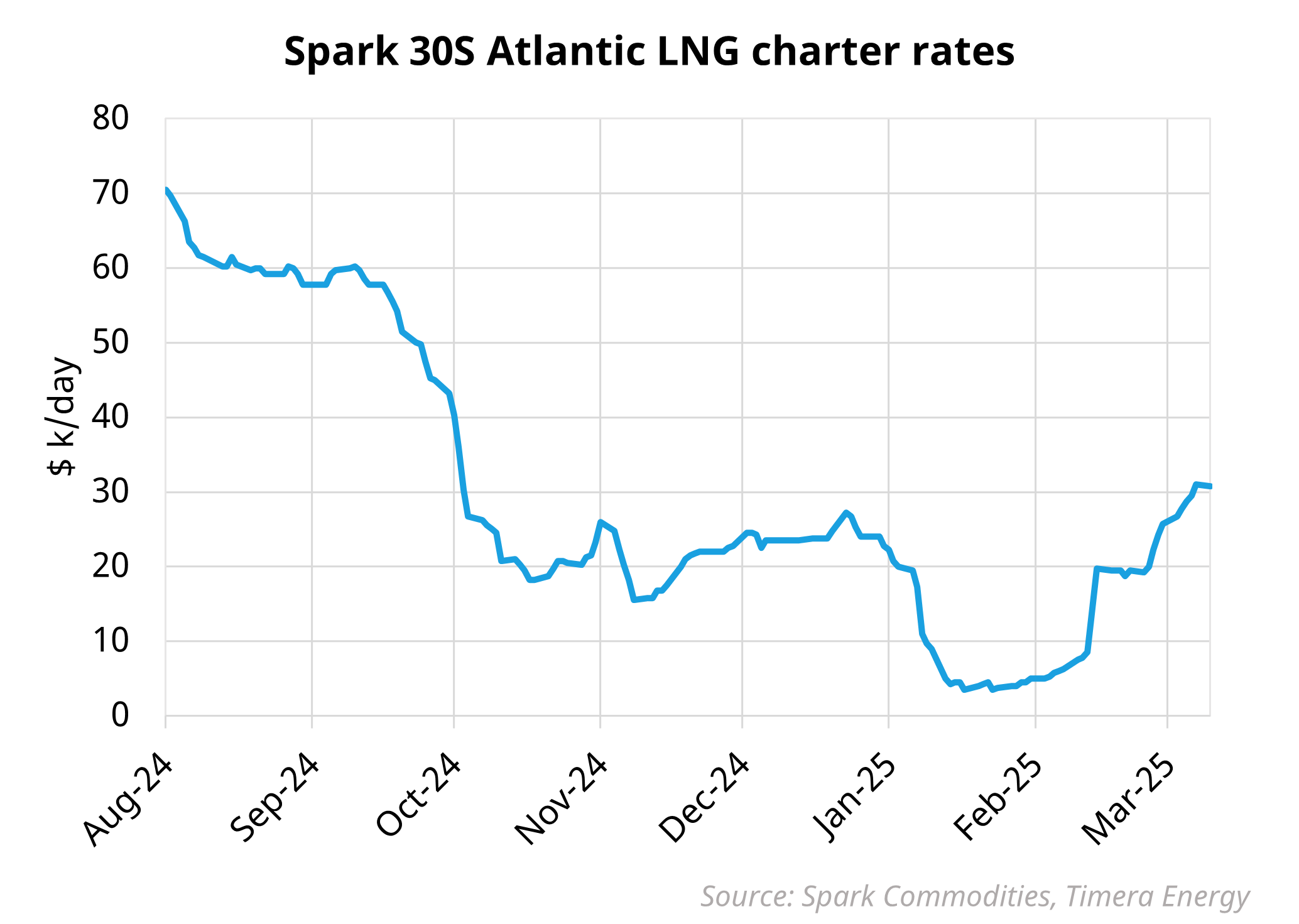

In January & February 2025, LNG charter rates plummeted to an minimum of 5 $k/day, down from an average of ~ 40 $k/day in 2024, driven by a surplus of vessels and low demand in Asia reducing the average journey distance for marginal Atlantic supply as cargoes flocked to Europe. However, recent market dynamics have spurred a recovery in these rates:

- European LNG demand and supply risks: Despite entering winter with strong gas inventories, a cold Q1 2025 led to significant drawdowns, prompting restocking efforts ahead of summer. This low level of stock and the cessation of Russian pipeline deliveries through Ukraine necessitated a greater proportion of US cargoes heading to the Atlantic basin as the US front-month arb pointed toward Europe. We are now seeing a reversal in this relationship, Asian prices recovering relative to Europe, increasing journey distance, and aligning with the single day change of +$11,250 in Spark 30S rates on the 28th February.

- Vessel availability: Earlier in the year, an oversupply of LNG carriers hit the water due to the commissioning of new vessels without the export capacity to fulfil their volumes, suppressed charter rates. As some US export projects are ramping up (Plaquemines, Corpus Christi S3) this surplus has partly been absorbed, tightening vessel availability and contributing to the recent uptick in charter rates.

Timera will soon be publishing our Q1 2025 Global Gas Service update to subscribers. We provide deeper analysis on the current state of the market & our future outlook of supply, demand, pricing, and drivers. For more information on the Timera Energy Global Gas Service, or further information on the bespoke services we offer, feel free to contact David Duncan (Director, Gas & LNG) david.duncan@timera-energy.com