As has become tradition, our last article before the Christmas break reviews the major surprises for the year.

We do this review in two parts. Firstly, we look back at the 5 potential surprises we set out back at the start of the year… and consider if there was actually any surprise. Secondly, we apply the benefit of hindsight to set out 5 observed surprises in 2019 (+ a list of several others).

A review of our 2019 surprise list

Let’s start with a quick progress check on our Jan-19 potential surprises. But before we start, the usual reminder that these surprises are not forecasts or predictions, but rather areas where we think it is worth challenging prevailing industry consensus.

1. UK capacity payments reinstated

‘Our first surprise for the year is that the issue of capacity payment reinstatement is substantively resolved in 2019.’ Jan-19

The UK power market started the year in a state of upheaval after the entire Capacity Market was suspended due to an ECJ ruling in late 2018. At the time there was substantial asset owner and investor uncertainty as to what might happen going forward (e.g. disbandment of CM, no payments this winter, no payments across suspension period). Step forward a year and we are essentially ‘back to business as before’, as we set out in a recent article.

2. Merchant battery investment takes off

‘Battery storage projects to date have been underpinned by ancillary services revenues… but the pick up in investment momentum behind merchant battery projects may be a surprise in 2019’ Jan-19

The investment case for merchant batteries in Europe is still a marginal proposition, although cost declines continue to help. But momentum has definitely stepped up in 2019, led by the UK and German markets (but also in France & Benelux). Perhaps the biggest story of the year in this space was EDF Energy acquiring Pivot Power’s 2GW pipeline of grid connected merchant batteries.

3. Gas demand shock

‘Global LNG demand has had a strong run since 2016… but a major demand shock in 2019 could cause a temporary slump in TTF & Asian spot prices, particularly if accompanied by falling coal & carbon prices dragging down power sector switching levels’ Jan-19

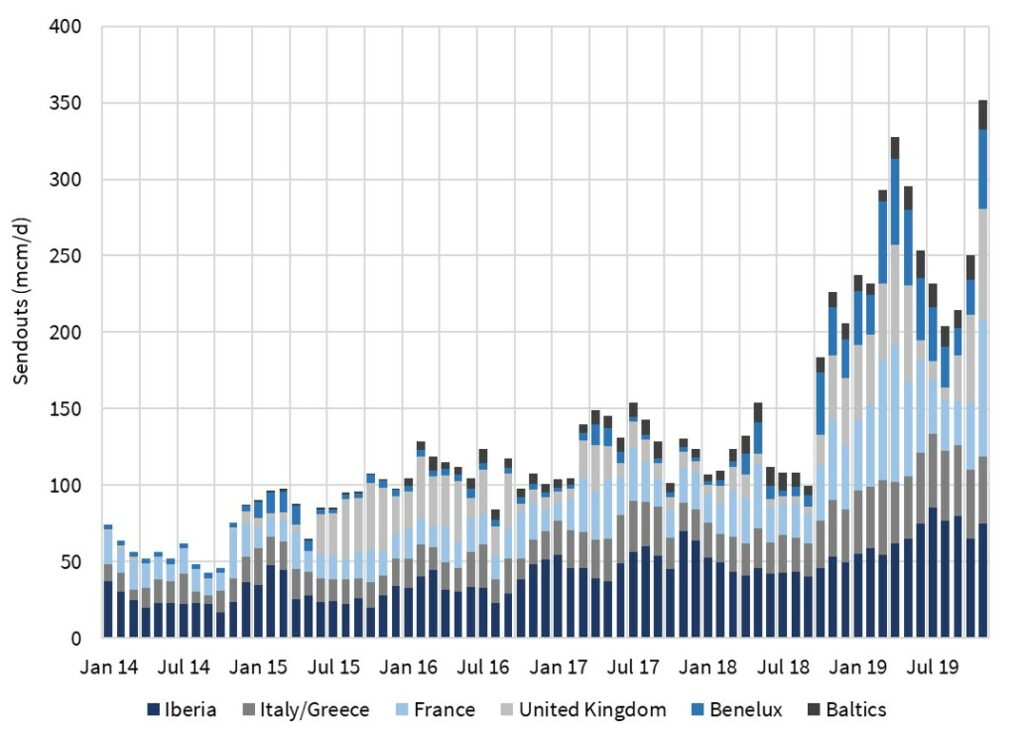

This really was the major surprise of 2019. Asian LNG demand ground to a halt. This caused a surge in European LNG import volumes this year as illustrated in Chart 1, which shows Nov-19 LNG send out smashing the Apr-19 all time record.

Weak global LNG demand also spawned some of 2019’s other surprises, which we come back to a bit later.

4. Gas storage closures

‘The funeral bells have been ringing for five years… but owner patience may be running out, particularly those suffering negative cashflows.’ Jan-19

This sounds pretty gloomy for storage asset owners. However we set out this surprise in the context of it driving a more sustainable recovery in storage asset value.

There has been some movement on storage closures in 2019 e.g. NAM announced closure plans for its large 2.8bcm Dutch Grijpskerk facility in Feb-19. But closures perhaps fall short of the scale you would call a major surprise.

The fact that there were not further closures was in part due to the 2019 recovery in storage price signals (which we come to below).

5. Rising cost of capital

‘Energy infrastructure developers have benefited from a historically low cost and easy availability of capital over the last five years. Could that be about to change in 2019?’ Jan-19

No was the answer! In fact the surprise was in the opposite direction. Cost of capital fell again led by a huge slump in long term interest rates between Q1 and Q3. Europe was awash with negative interest rates by the end of summer (yes that’s right… people paying to lend money). This is also pulling down equity hurdle rates as investors continue an increasingly desperate search for yield.

A few 2019 surprises with the benefit of hindsight

There was no shortage of other major surprises this year. In fact there have been so many it is difficult to select a ‘top 5’. But we have made an attempt in Table 1 below.

Some of these surprises relate to what we believe has been a major tipping point in decarbonisation momentum this year. 2019 will go down as the year when decarbonisation pushed its way onto centre stage as a global policy issue. It is hard to pinpoint exactly what drove this. Some combination of a scathing IPCC report (‘decade left to act’), the green new deal debate, accelerated corporate engagement, school strikes, millennial mobilisation & Attenborough’s ‘Our Planet’ series?

Table 1: 5 major surprises in 2019 (with the benefit of hindsight)

Just in case you’re not surprised yet, we finish with a list of a few other contenders: Groningen to zero by 2022, TTF price plunge sub 10 €/MWh (while the forward curve held up), Spanish hub prices falling below TTF, Saudi attacks (& pace of production recovery) and the UK power cut.

Timera into 2020

This is our last blog article for 2019. We will be back in mid-Jan 2020 with a new website and blog format. This is part of a brand refresh project currently in progress as Timera continues to expand.

It has been another interesting year of client project work with particular focus areas being:

- LNG portfolios: A surge in large LNG portfolio companies engaging us to work with them to design, develop & implement portfolio valuation analysis capabilities

- Batteries: Multiple projects working with investors on merchant battery projects/portfolios, as well as with battery owners on storage valuation & optimisation

- Transactions: Advising several large buy side transactions for separate portfolios of conventional power, battery storage, LNG midstream, gas storage and gas pipeline assets

- Regas value: Both capacity buyers and terminal owners engaging us to value European regas capacity and incremental value created within LNG portfolios

- Gas business model: Advising on the potential implications of gas market decarbonisation and associated impact on portfolio and business model evolution

- Flex optimisation: Working with owners of flex power assets on value capture and associated analytical capability to support this

- Gas storage: Working with storage operators to refine capacity sales & contracting strategies and improve asset value capture.

As a result our team has been growing steadily. We’ve had a fantastic injection of new senior expertise with May Mannes joining us as a Managing Director (25+ years Statoil, Eclipse) and Howard Rogers (30+ yrs BP, OIES) ramping up his involvement with Timera after stepping down as Chairman of the OIES Gas Programme. Steven Coppack (ex Total), Jon Brown (ex EDF) and Tommy Rowland (ex Smartest Energy) have also come on board bringing great experience. More hires to come in 2020, with a new Director joining at the beginning of next year (more on that to follow).

We appreciate your continued interest in the blog and have big plans for content expansion in 2020. In the meantime all the best for a relaxing festive season!