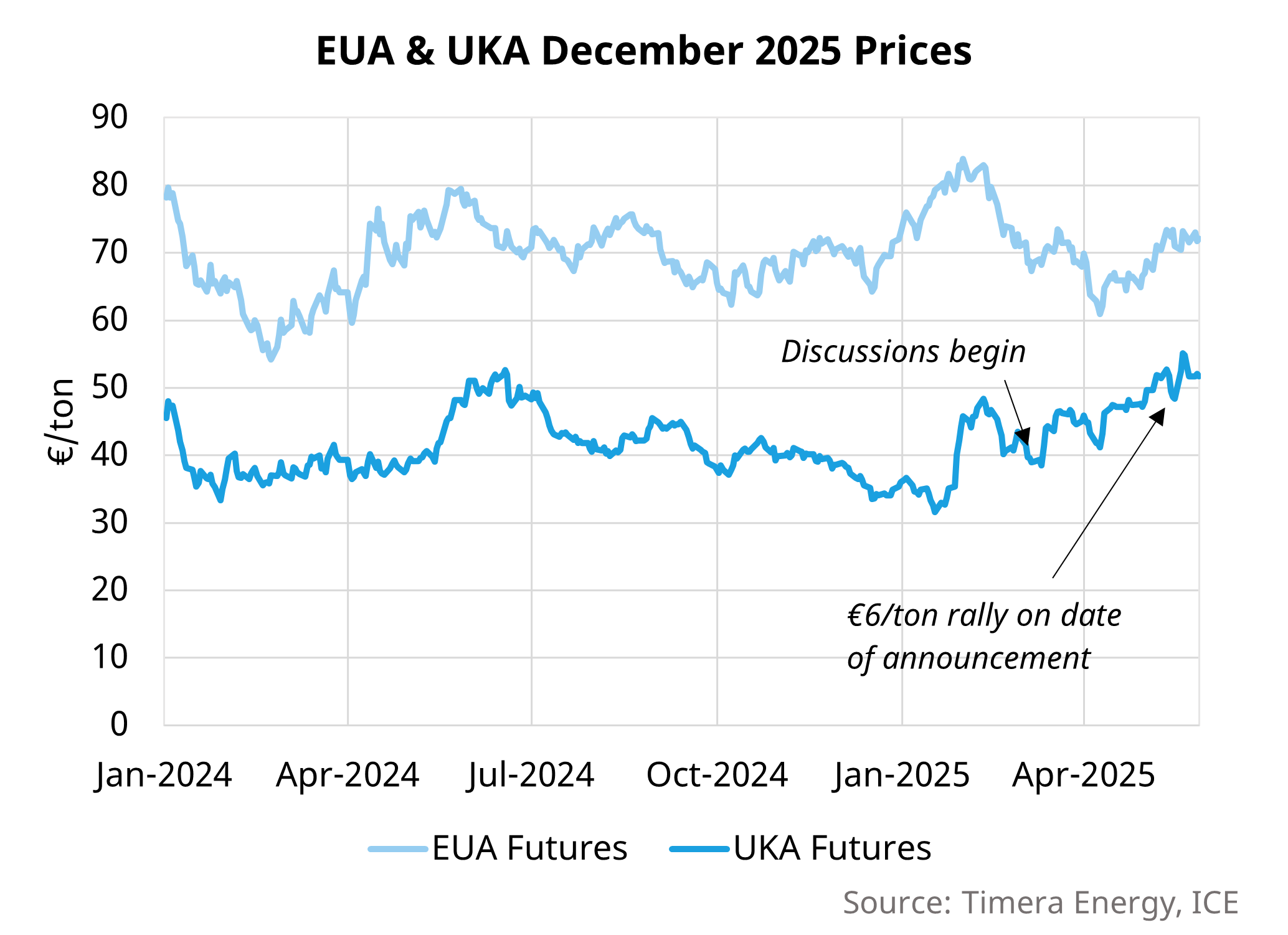

UK carbon allowance (UKA) prices have seen a 33% rally since March, driven by reports of a market linkage between the UK & EU ETS benchmarks. On 19th May 2025, a new trade deal between the UK & EU confirmed this linkage. Historically, UKAs have traded at a discount to EUAs, largely because the UK lacked a Market Stability Reserve (MSR) to control excess supply.

The prospect of a unified carbon price floor and tighter supply dynamics is expected to impact the value of flexible assets in the UK. Higher carbon prices improve the relative economics of low-carbon flexibility, particularly for battery storage (BESS) and hydrogen-ready peakers, while simultaneously increasing running costs for unabated gas assets.

Further, for the UK, joining the EU ETS will enhance carbon price stability and credibility by aligning with a more mature and liquid market, and may improve the effectiveness of long-term decarbonisation signals across UK industry and power generation. It will also ensure there is no new friction in UK – EU trade when the EU’s new CBAM (carbon border adjustment mechanism) is introduced (currently planned for 1st January 2026).

Finally, this will bring shipping activities in the UK under the scope of the ETS scheme (see our previous post on the market impact of new shipping emissions rules). For LNG shippers, this means there will now be a need to purchase carbon certificates when delivering to UK regasification terminals, as well as the EU.

For more information on how carbon pricing is driving flexible asset value in the UK & Europe, feel free to contact Steven Coppack (Power Director) at steven.coppack@timera-energy.com.