LNG continues to flood into the European gas market, constraining existing capacity. There is a different story on Russian pipeline supply however, driving volatility in European gas hub pricing. The two main headlines:

1.Rouble payments

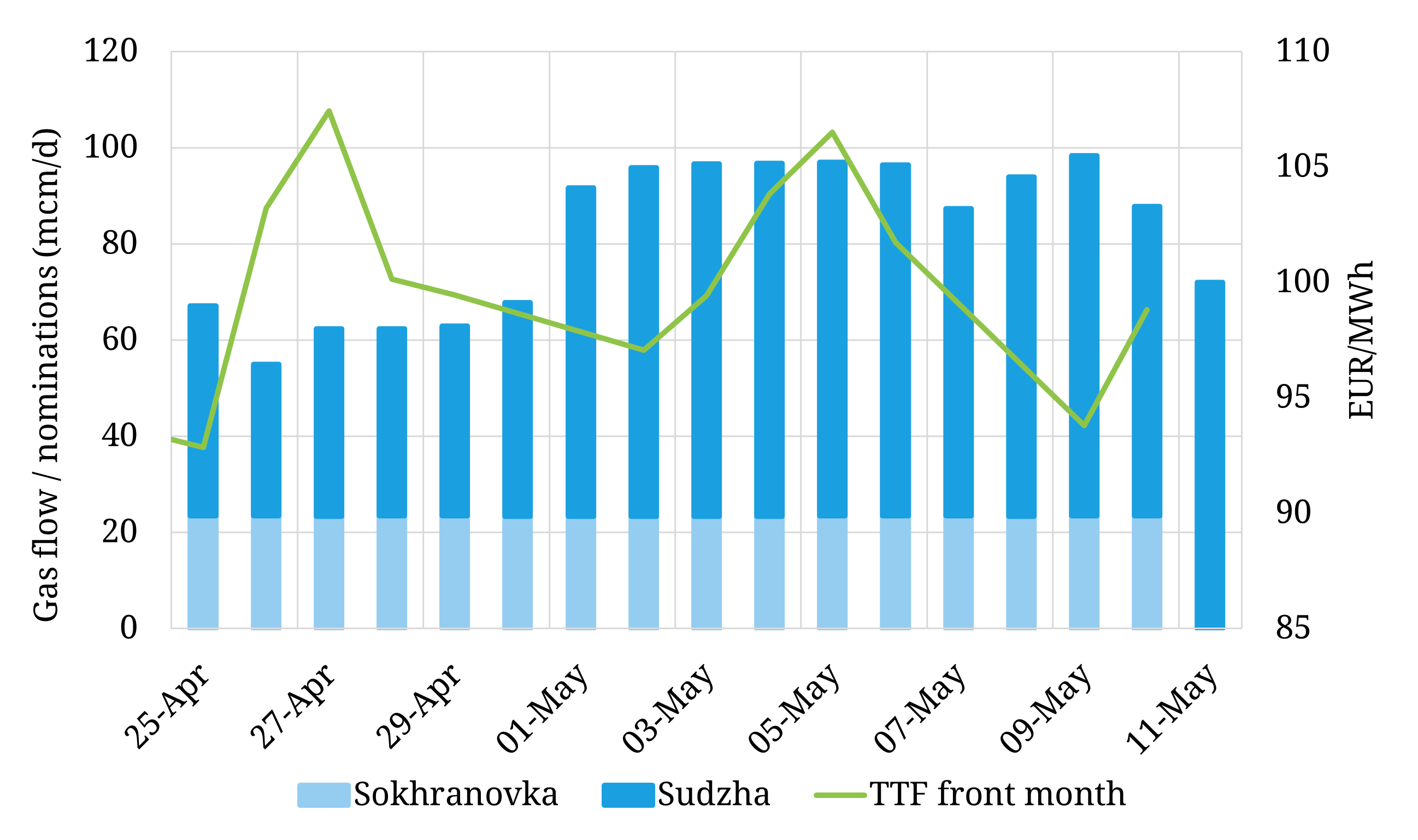

Exports to Poland and Bulgaria were halted by Russia on 27th April over their refusal to pay for supplies in roubles, causing a spike in TTF (green line). Both countries had already planned not to renew contracts expiring later in 2022 and in preparation Polish storages were close to 80% full, with alternate supply routes coming online this year (Baltic pipeline and Lithuanian link). Other EU companies have stated they will pay in euros to be converted into roubles, calming fears of a wider flow reduction, though market attention will be on next payment due later in May.

2.Suspension of gas flows via Sokranivka

The Ukrainian TSO called force majeure yesterday on flows via the ~30 mcm/d capacity Sokranivka entry point, as nominations for 11th May drop to 0 (light blue bar) with some knock on impact on nominations via Velke into the central corridor. The suspension is cited as being due to a lack of control over the Novopskov compressor station and unauthorised gas withdrawals. The 77 mcm/d Sudzha point is unaffected, with the TSO saying a temporary transfer of unavailable capacity between the two points is possible (though disputed by Gazprom).

While LNG imports remain high, it is clear that TTF remains responsive to Russian supply concerns.