Aggressive policy U turn and rate hikes

After more than 5 years of negative interest rates in Europe, borrowing costs have surged across the last 18 months.

The pace of central bank rate hikes across the developed world is unprecedented in modern history.

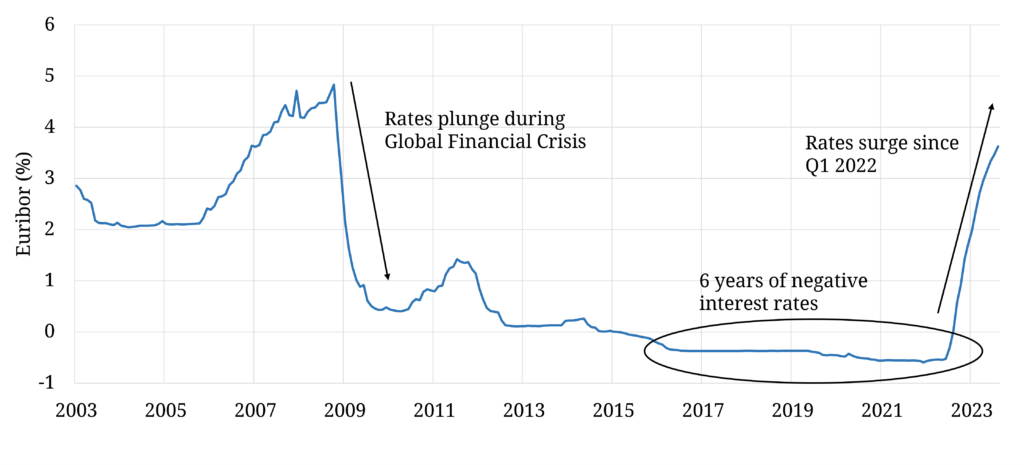

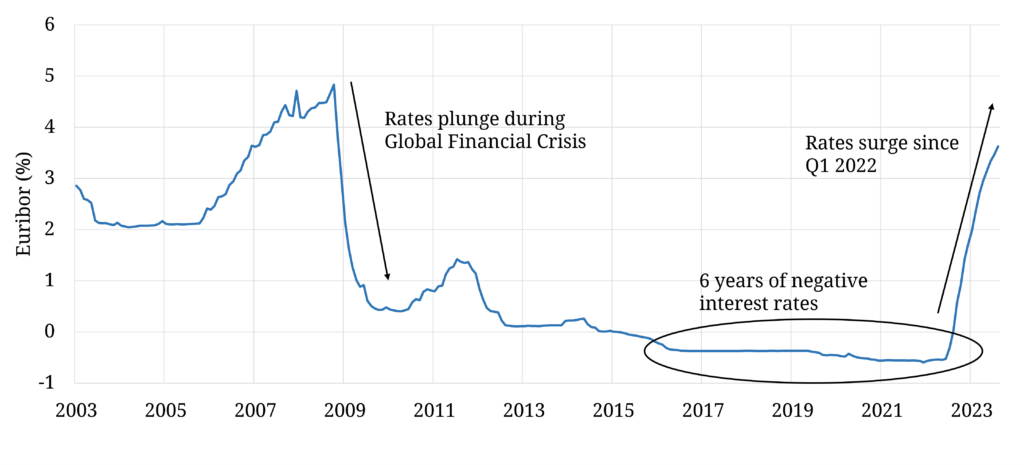

EUR interbank borrowing rates (Euribor) have risen 4% since Q1 2022 (as shown in Chart 1). GBP & USD rates have increased more than 5% across the same period.

Chart 1: Evolution of 1 month Euribor interest rate (2003-23)

Source: Timera Energy, ECB

Energy industry caught off guard by rate surge

An inflation driven central bank policy U turn lies behind these interest rate increases.

Across 2020-21 in the midst of Covid, central banks provided strong guidance that interest rates would remain low for a prolonged period given deflationary fears. Yet by Q1 2022 aggressive rate hikes were underway as inflation accelerated.

Cost of capital is one of the most important drivers of energy asset investment cases. It underpins the calculation of project returns as well as the cost of carrying risk.

The cost of capital input into an investment case is built on an assumption of debt & equity costs. Many energy investors & project developers have been caught off guard by the 4-5% surge in the risk free rate. This has driven up both:

- Debt financing costs, typically set at a margin above interbank lending rates

- Equity financing costs, which are underpinned by a risk free rate opportunity cost.

Projects with Final Investment Decisions (FIDs) based on very low interest rate projections are facing the reality of their returns being crushed by rising cost of capital.

Some projects & investors will be temporarily buffered from the impact of rate rises by having locked in terms via existing debt & equity facilities. But this protection just creates a lag effect. On the margin the rise in cost of capital is having a very real impact.

3 tangible impacts of higher cost of capital

The energy industry is very capital intensive given its heavy dependence on infrastructure. So a rapid rise in cost of capital is causing shockwaves. Let’s look at 3 practical examples:

- RES projects

Wind & solar projects are being hit by a combination of rising cost of capital and an increase in component costs (e.g. wind turbines, PV panels & inverters). Component costs themselves are rising in part due to higher capital costs.

Offshore wind project economics have been particularly hard hit due to very high upfront capex. Rising cost of capital with fixed forward pricing agreements for delivery of power are seeing project margins evaporate. In July, Vattenfall pulled out of its 1.4GW Boreas project in the UK, with Shell and Iberdrola pulling projects in the US. Watch for more project cancellations.

- BESS & peaker projects

Flexible power asset projects such as batteries & peakers which have merchant exposure typically source debt at 200 to 300 basis points (2-3%) over interbank lending rates. This means borrowing costs have soared from low single digits to 7-8% across the last 18 months, with cost of equity capital rising in sympathy.

In the UK (Europe’s fastest growing BESS market), this surge in capital costs is starting to take its toll. The risk of project delays in the 2025-26 time horizon is increasing, exacerbated by the recent bankruptcy of two BESS Engineering Procurement & Construction (EPC) companies.

The cost of delivering new BESS & peaker assets across Europe is also rising with capital costs, impacting project FIDs. This is a major challenge for policy makers who are facing the reality of an energy crisis which has exposed a structural shortfall of power market flexibility.

- Oil & gas projects

The marginal cost of funding US shale projects has increased substantially as US interest rates have surged and poor returns from previous cycles have enforced stricter capital discipline. This is contributing to recent upwards pressure on crude prices, given the important marginal supply role of US shale production.

Capital costs & availability are also impacting new US LNG liquefaction projects. Banks are requiring high levels of tolling cover (difficult to source) to secure financing & reach FID, and typically have little appetite for commodity price exposure (e.g. JKM, TTF). These conditions mean that future LNG supply growth is increasingly focusing on established oil & gas majors with the support of large balance sheets.

Energy transition impact

The combination of both higher cost of capital and persistent inflation points to upwards pressure on infrastructure project costs and commodity prices. This presents a major challenge for European policy makers, who are relying on energy transition to tackle both decarbonisation & security of supply goals.

The energy transition is enormously capital intensive. If Europe is to address its energy independence issues via accelerating the pace of energy transition it needs to adapt policy frameworks to reflect rising cost of capital.