How we model gas markets, assets & portfolios

Our work with LNG & gas clients is underpinned by three categories of sophisticated in-house models:

1. Global gas model – a detailed supply & demand balance and pricing model covering the global LNG market and European gas market

2. LNG Bridge model – an industry leading LNG portfolio valuation model that informs decision making on portfolio construction, value management and optimisation

3. Midstream asset models – a suite of simulation-based valuation models for gas storage & pipeline assets that project asset margin distributions.

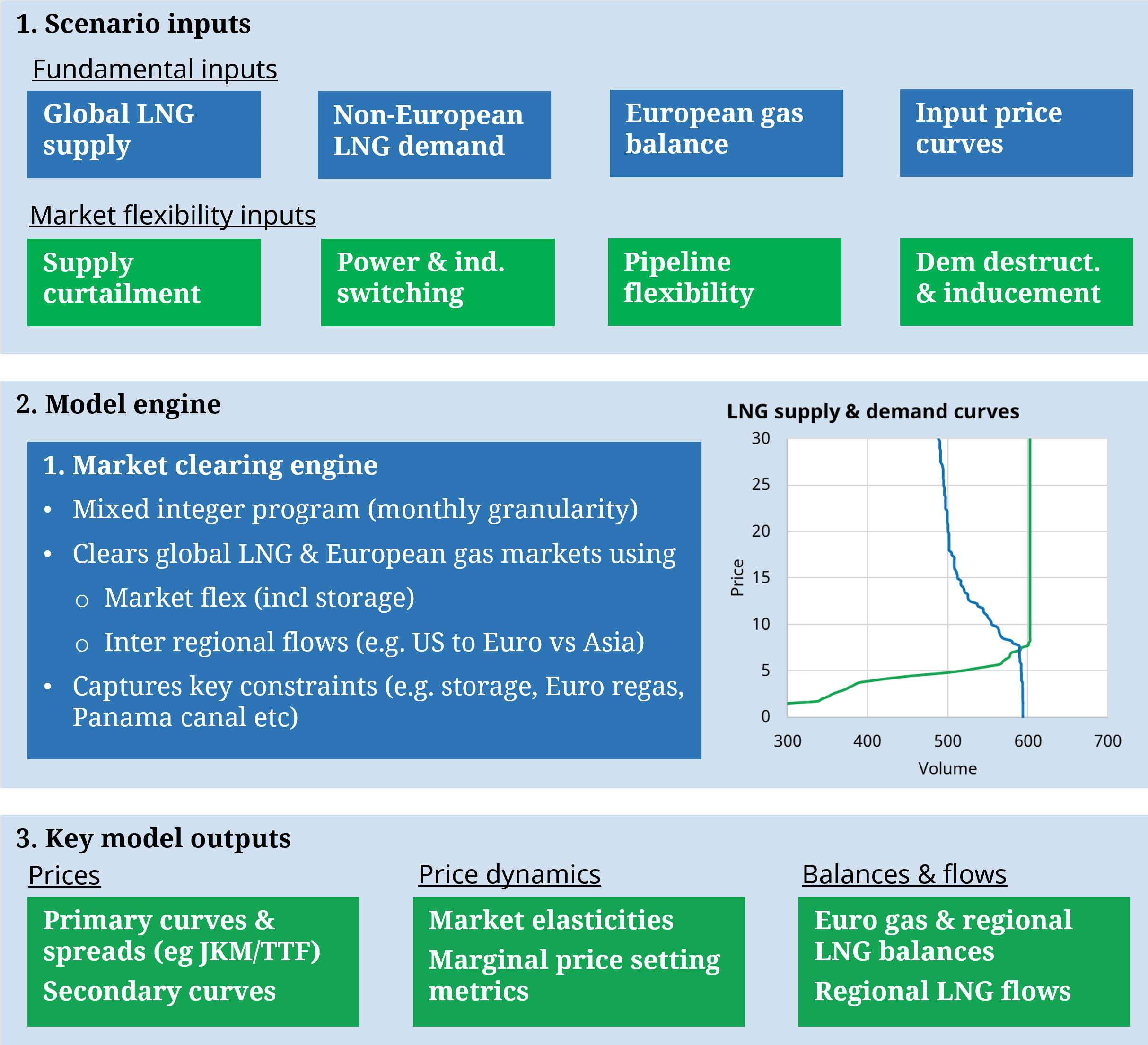

1. Global gas market model

Our global gas market model covers all global LNG markets and the European gas market.

The market model includes a robust build-up of the key supply and demand side flexibilities which interact to help clear the global market and set prices.

The blend of focusing on market clearing mechanisms and presentation of key physical constraints and flows allows for a robust projection of price level, key basis relationships & volatility evolution.

Features of the model

1. Captures key intermarket linkages (e.g. European power switching)

2. Focus on market flexibilities that act to balance the market & set prices

3. Robust analysis of regional pricing (e.g.TTF/JKM) through regional flows

4. Representation of key physical constraints (e.g. Panama canal access).

5. Analysis at the margin allows analysis of elasticity and volatility

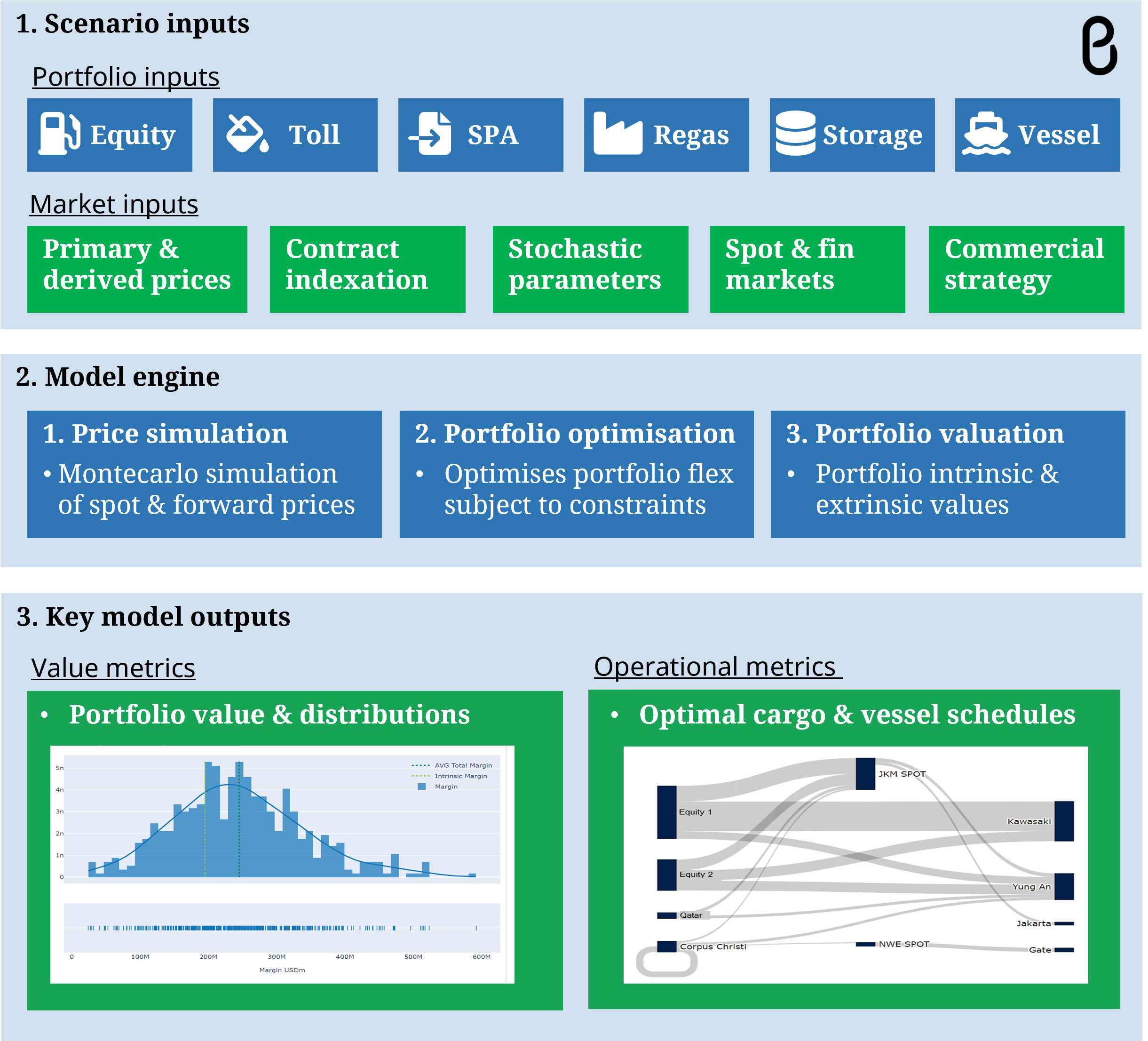

2. LNG Bridge model

LNG Bridge is an LNG portfolio analysis model which we both licence to our clients and use to support consulting work analysis.

LNG Bridge has quickly evolved into an industry leading solution, employed across a broad range of LNG portfolios (>15% of the physical market). It allows companies to quantify and manage the interdependent value of LNG assets within a portfolio.

Features of the model

1. Sophisticated price simulation & portfolio optimisation engine

2. Price simulation blends classic pricing model techniques with overlay of impact fundamentals

3. Portfolio optimisation engine captures interdependency of LNG portfolio value

4. Generates value distributions for individual assets & portfolio (e.g. mean, P10, P90)

5. Supports strategic, investment, trading, origination & risk decisions

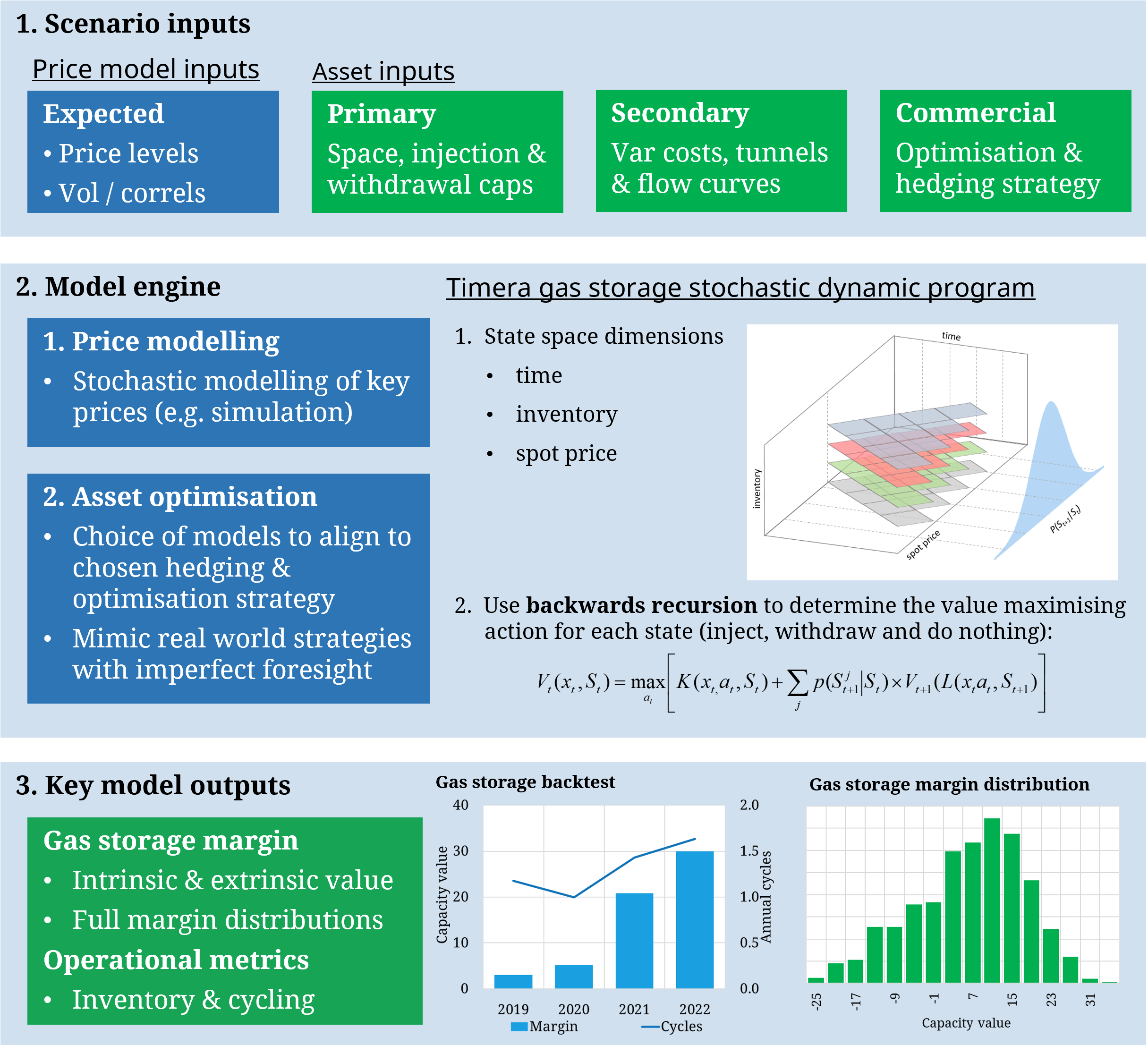

3. Midstream asset models

We have specific asset models for gas storage assets, swing contacts, pipelines, interconnectors & regas terminal capacity.

Each model includes stochastic modelling of key prices and draws on inputs from our global gas market model. The models optimise flexibility against stochastic price modelling to generate projected margin & asset operational metric distributions (e.g. mean, P10, P90).

Features of the model

- Replicates actual decision making process of asset operators / traders

- Regularly calibrated against backtested asset performance

- Captures physical characteristics / constraints & impact of imperfect

- Robust modelling of impact of forward hedging on asset margin

- Detailed margin distribution outputs to inform risk/return decisions