We have entered a new LNG market regime as a result of the European pivot from Russian gas to LNG. Historical sources of flexibility in the European gas market have become inhibited and Europe is now competing directly with Asia for LNG.

“The new market regime is having profound implications for LNG portfolio value & risk”

This is driving structurally higher price levels, higher volatility and changing correlations e.g. across TTF vs JKM vs Brent. We see in our work with large LNG portfolios that the new market regime is having profound implications for portfolio value & risk.

Market transition in 2022 is triggering major strategic reviews across large LNG companies. Focus areas are the impact on ‘molecules’ (supply), ‘capacity’ (regas & shipping flex) & ‘pricing’. In today’s article we look at a practical case study that quantifies the impact of the new market regime on the value & risk of a case study LNG portfolio.

The case study portfolio

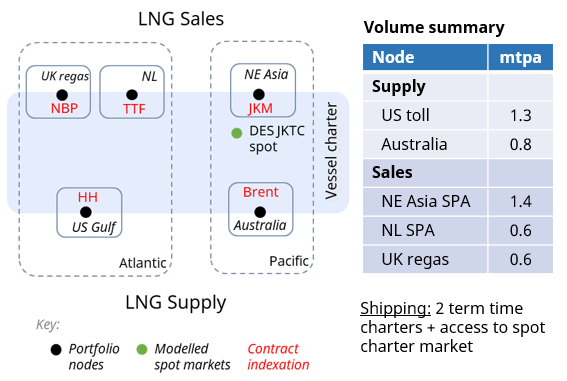

We have defined a portfolio that is relatively simple, but has a number of key elements common to large LNG company portfolios. Our case study portfolio is summarised in Chart 1 and has 2 supply nodes, 3 sale nodes, spot market access and shipping.

The portfolio is net long LNG (given ‘Take or Pay’ levels in sales contracts) and net long flexibility (e.g. from US toll, SPA flex, European regas & shipping capacity).

It also has some structural basis exposures: buying LNG on both a Brent & Henry Hub basis and selling it on a European hub & JKM basis. This captures the important impact of changing price correlations.

Case study analysis is done in Timera’s LNG Bridge portfolio analysis model which is used by a broad range of large LNG companies to quantify portfolio value & risk.

LNG Bridge simulates hundreds of correlated price paths consistent with prevailing market regime dynamics (e.g. price levels/volatility/correlations). The portfolio is then optimised for each simulation across a 5 year horizon to produce value/risk distributions, including extrinsic value of flexible exposures.

We consider two LNG market price scenarios:

- ‘Old’ regime (pre-Russian conflict)

- ‘New’ regime (current conditions).

What are the portfolio impacts of regime shift?

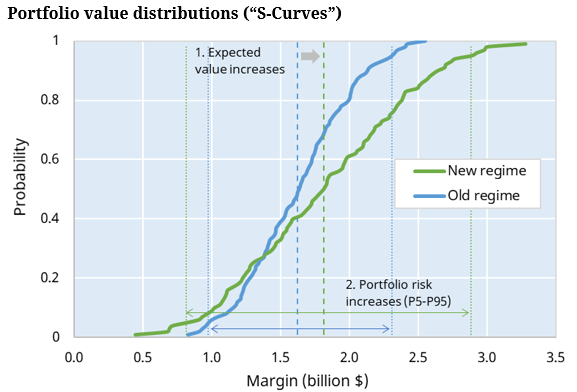

The impact of Old vs New regime conditions on portfolio value & risk are summarised in Chart 2. The ‘S-curves’ represent the distribution of portfolio value ($bn) across two sets of 500 simulated price paths reflecting Old vs New regime dynamics (from lowest value on the left to highest on the right). Expected values of the portfolio under each regime are shown with the dotted lines.

5 key conclusions from our analysis of regime shift impact on the case study portfolio:

- Portfolio value: Expected value increases given higher price levels & volatility under the new regime are value accretive for a portfolio which is net long commodity (LNG) & flexibility.

- Portfolio risk: Risk distribution (e.g. P5 – P95) widens significantly reflecting higher volatility and changing correlations, increasing the importance of hedging to manage margin risk.

- Portfolio construction: Substantial increase in both risk & value creation opportunities sharpens focus on effective portfolio construction via M&A, investments and structuring of SPAs e.g. acquiring incremental regas capacity in Europe (FSRUs or fixed terminals) or new LNG supply to backfill Russian volumes.

- Portfolio flexibility: Interaction across interdependent flexible portfolio components has increased as a value driver (e.g. dynamic optimisation of US diversion flex vs European regas and Asia/European sales), with an increasing portion of value being monetised across a near term (ADP) horizon.

- Risk management: Large increase in portfolio risk drives up risk capital & funding requirements, importance of managing sold vs bought flexibility and role of liquidity access to manage exposures.

In addition a number of large LNG companies are accelerating investment in capabilities and adjusting business models to facilitate more active portfolio value management (e.g. optimisation and hedging).

Seismic shift driving opportunities & risks

Europe’s pivot to LNG is spurring the next wave of growth in the LNG market. Market regime change is structurally impacting flows, pricing dynamics and portfolio value & risk.

Portfolio risk is increasing with market prices & volatility. This is being reinforced by changing price correlations and the growing importance of basis risks e.g. widening price spreads across NW European hubs and NWE DES price.

However regime shift and market growth are also presenting large value creation opportunities. These can be via:

- Unlocking value in existing portfolios e.g. via more dynamic management of portfolio exposures (e.g. DES NWE and TTF) as well as investing in people and analytical capability to bolster value capture

- Adding incremental portfolio components e.g. new supply nodes, regas (primary market access) & shipping capacity.

We set out the drivers of the new regime and their impact on LNG portfolio value & risk in more detail in a Briefing Pack we have just published which you can download here “Impact of a new LNG market regime”.

We are looking to recruit both Analysts and Senior Analysts into our LNG team. For more details please email us at recruitment@timera-energy.com.