We wrote several weeks ago on the price divergence across European gas hubs as a result of the Russian invasion of Ukraine. High LNG import volumes into the UK, and constrained regas and interconnector capacity in NW Europe, saw UK gas hub prices pushed sharply below TTF. These gas hub price divergences are also driving price differentials across European power markets given the dominant role of gas fired power plants in setting marginal power prices.

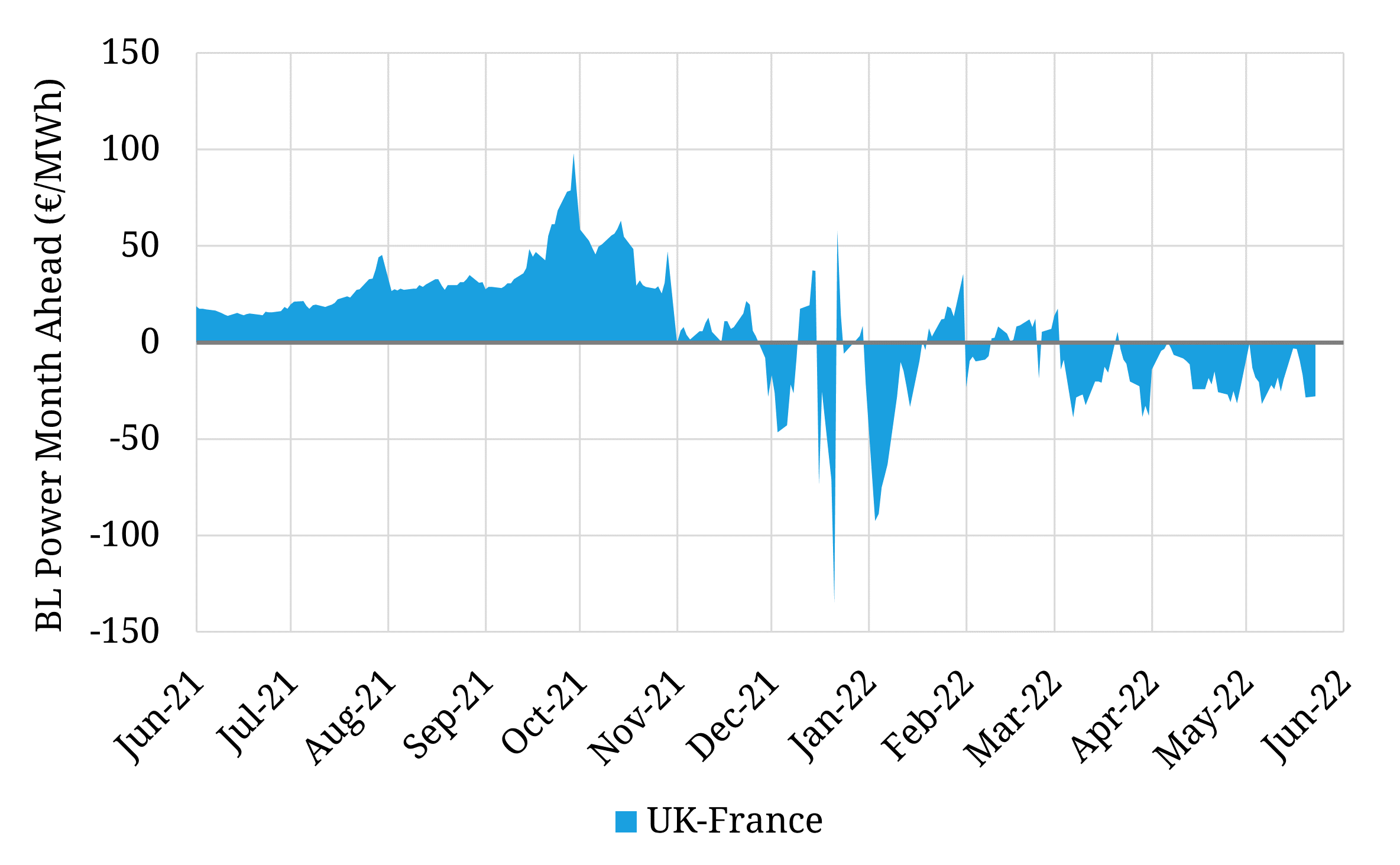

It is not just a UK gas price driven story. Further issues with the French nuclear fleet (latest update is that the 2022 output target has been cut by a further 5% to 280-300 TWh) have seen French baseload month ahead power prices jump to a premium to the UK since December.

The UK power discount has resulted in some atypical interconnector flows:

- April 2022 was the first month the UK has been a net power exporter since Nov 2017

- There have been periods of exports to Norway

- The first commercial flows on Eleclink (which increases UK-FR capacity by 33% are going from the UK to France.