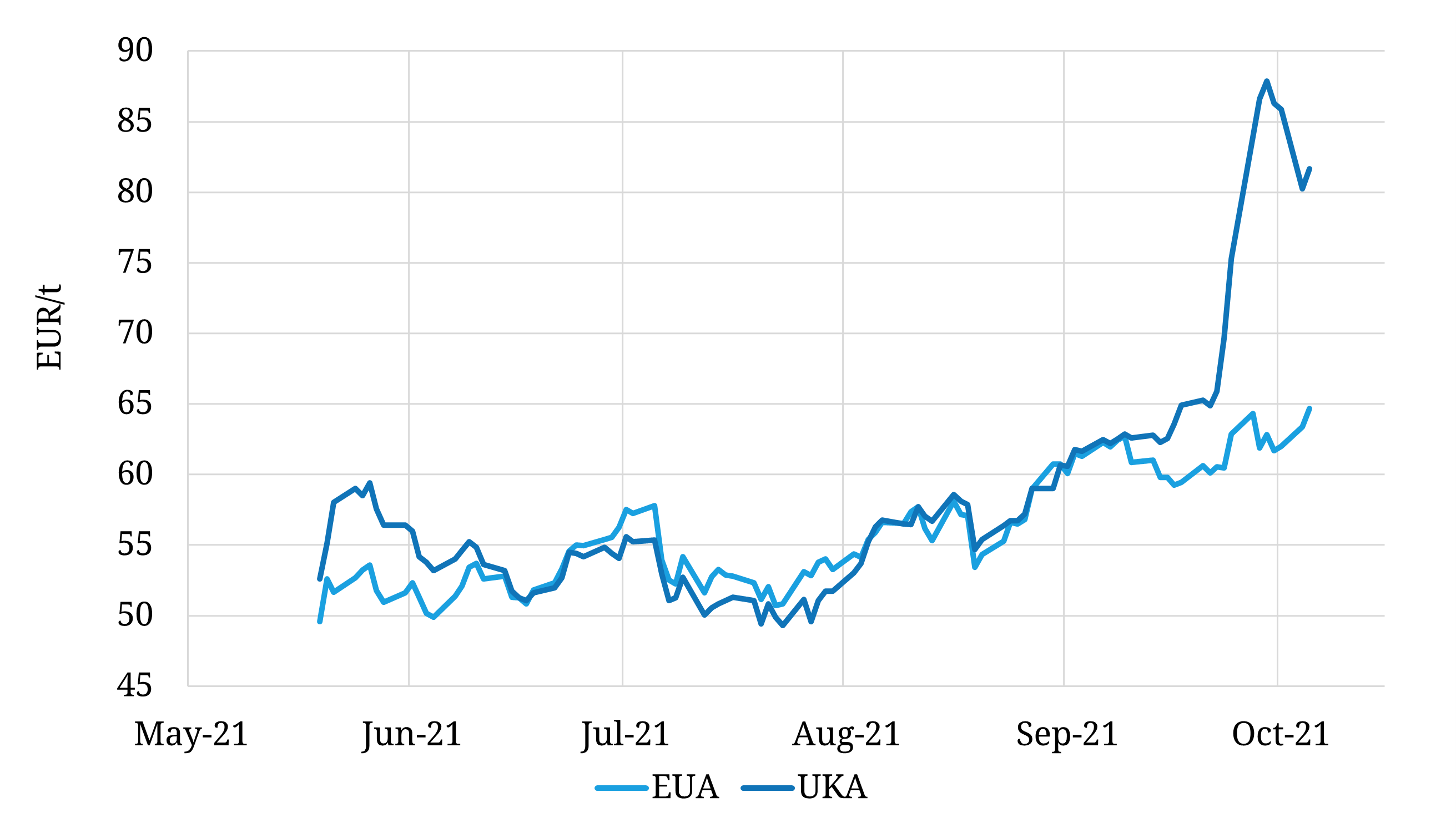

The UK carbon allowance (UKA) market was introduced in May 2021 as one of the consequences of Brexit. Having traded in a relatively tight range to the European carbon market (EUA), mid-September saw a sudden dislocation between the two as UKA – EUA reached a maximum spread of 25 EUR/t, coming on top of the additional UK Carbon Price Floor at ~20 EUR/t . The premium held by UKAs comes as a result of multiple factors:

- The UK carbon market has a structurally tighter design than its European counterpart, and no historic surplus due to introduction this year

- UK end users who had proxy hedged on EUAs before the UK system was established are required to buy UKAs and sell EUAs, while also having to overcome hurdles to trade in the secondary market

- High demand from thermal generators, as low wind drives a significant thermal gap despite record gas prices

- Lower flexibility than the European market as lower coal capacity reduces switching capability, along with less diversification.

The spread has since relaxed slightly to 17 EUR/t as prices rise above the trigger threshold for potential government intervention to increase or bring forward supply.