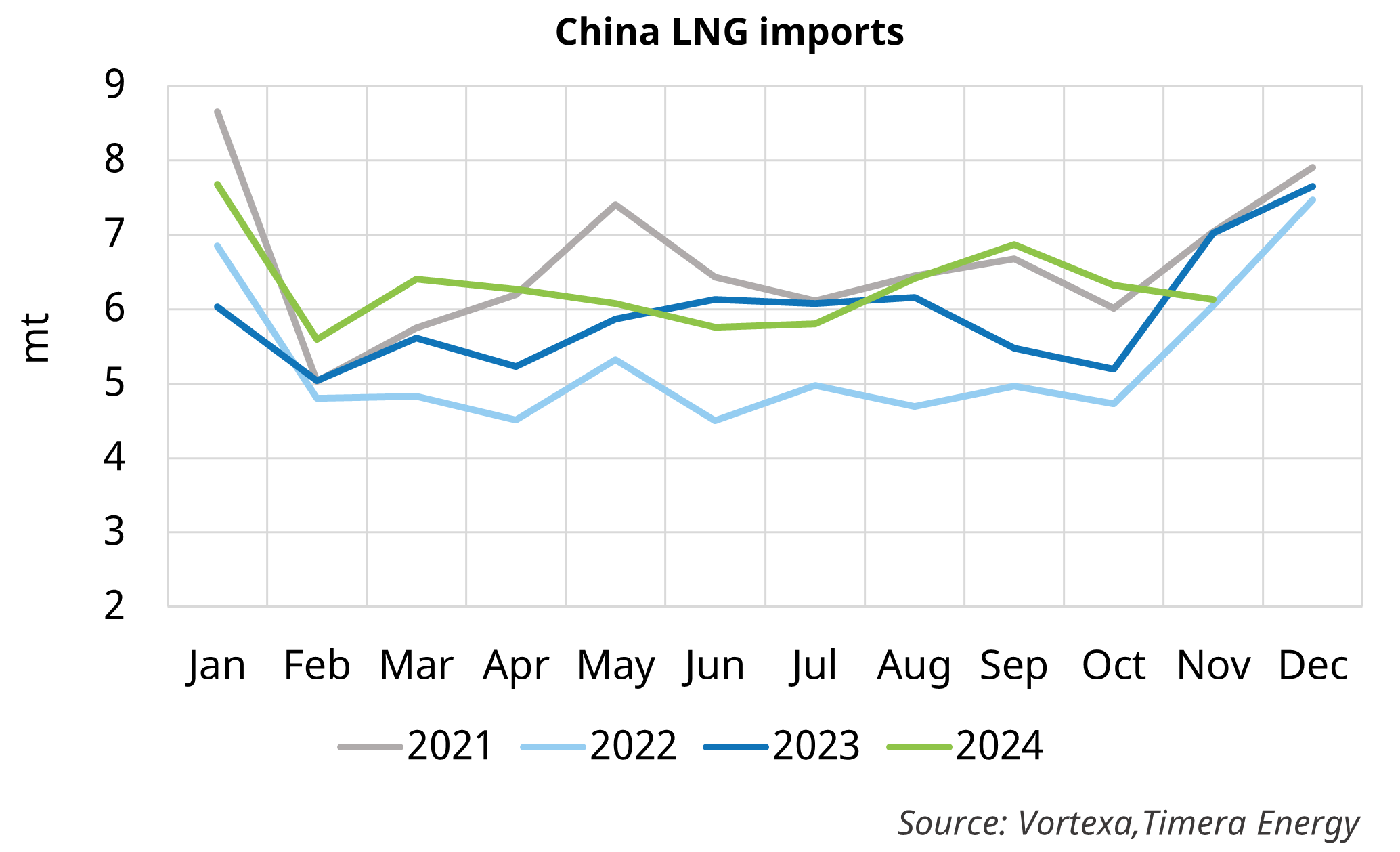

Chinese LNG imports fell across November to levels last seen during the 2022 gas crisis. Cumulative imports across 2024 are still up ~9% year-on-year (y-o-y), however in November, China imported ~6.13 mt of LNG, a 12% fall from the same period last year.

The drop in import volumes has been driven by globally interlinked fundamentals:

- Strong European gas demand from the power and residential sectors spurred rapid early winter storage drawdowns, driving strong TTF (& JKM) price rallies

- Monthly Asian demand more broadly declined y-o-y for the first time in 2024 in response to these higher prices, as JKM struggled to maintain a sufficient premium over TTF to outcompete Europe for destination-flexible LNG cargoes.

- Chinese gas consumption growth has showed signs of slowing in part due to higher global prices as price-sensitive industrial end-users switch to other fuels or reduce capacity.

- Onshore supply has placed further weight on China’s winter LNG import requirements, with the ramp-up of the Power-of-Siberia pipeline to full operational capacity and continued expansion of Chinese underground & LNG storage capacity.

Looking forward, Chinese demand price flexibility & seasonality (as they build out their storage capacity) will be key in how the market balances into the coming years.

For more details, please get in touch for a sample copy of our upcoming Q4 Global Gas Report, which goes into detail on these drivers & our outlook

If you are interested in a sample copy of our Global Gas Quarterly Report & Databook, or further information on the bespoke services we offer, feel free to contact David Duncan (Director of LNG & Gas) david.duncan@timera-energy.com