“Market volatility is driving the current commercial focus of LNG players”

2025 has been a volatile year in the LNG market. Forward prices surged in Jan over fears of storage inventory tightness in Europe.

Then from mid Feb to late Apr, prompt prices declined more than 40% due to

Market uncertainty & volatility is having a number of knock on commercial implications.

Today we summarise key current focus areas for LNG portfolio value as well as looking at a portfolio valuation case study.

Current value & risk focus for LNG portfolios

In Table 1 we set out a summary of key current focus areas across our client base with regards to physical LNG portfolios.

Let’s now use a practical case study to illustrate some of these value dynamics in focus.

Case study: valuing supply + regas flexibility

We use LNG Bridge, Timera’s portfolio valuation model, to analyse the interaction between US supply and European regas access.

Our case study compares two portfolios:

- No flexibility: A rigid flow from a US tolling position into a fixed European regas contract, with no ability to cancel or divert cargoes.

- With flexibility: The ability to (i) divert cargoes to Asia, (ii) backfill regas from spot, and (iii) cancel both toll and regas positions when they are out of the money on a variable cost basis.

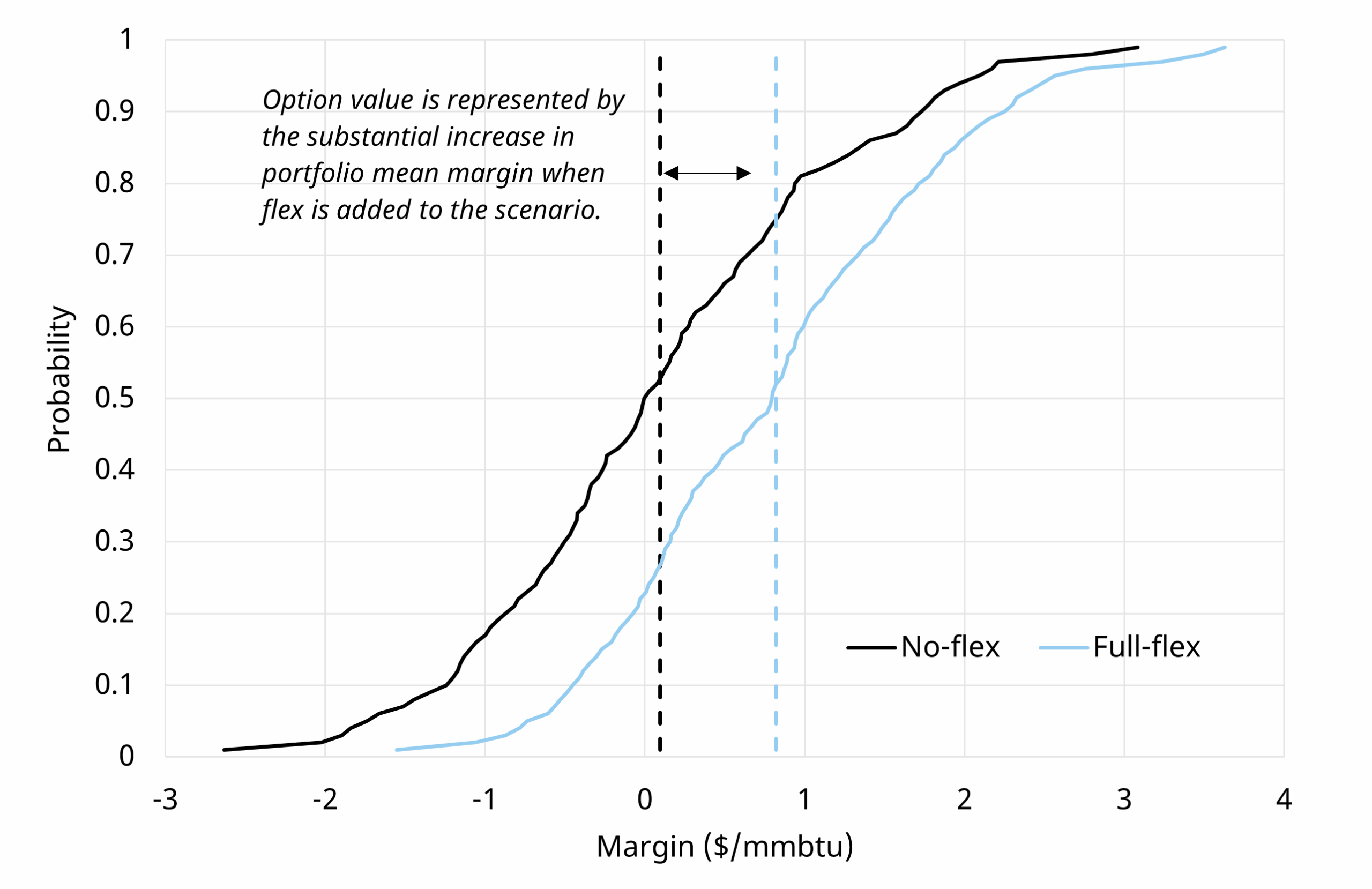

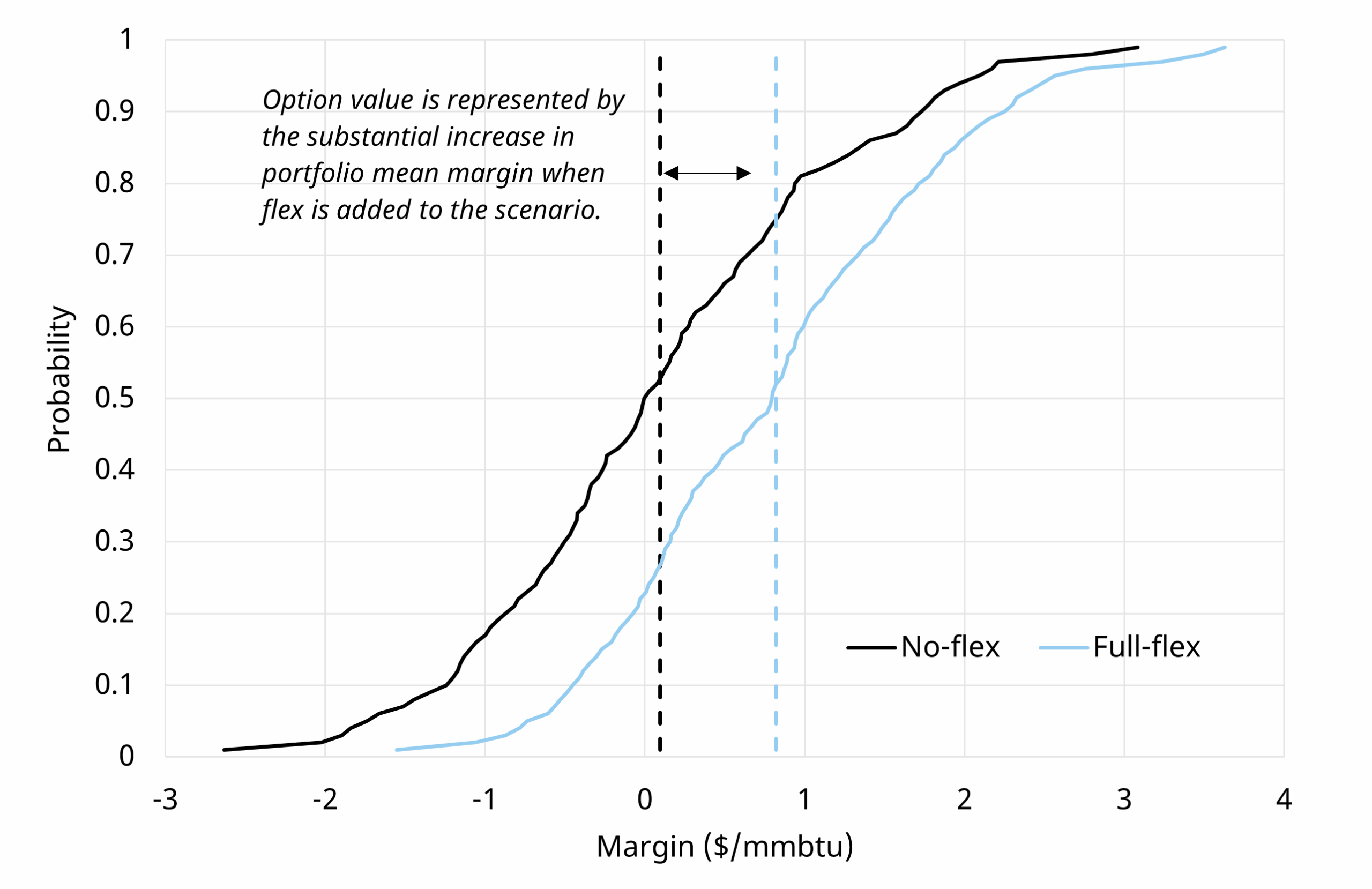

Chart 1 shows the probability distribution of portfolio margins under each structure.

Chart 1: Margin distribution of Flex vs No Flex portfolio

Source: Timera Energy LNG Bridge portfolio valuation model

The curve with flexibility shows a higher mean value and a significantly reduced downside risk, with the option to cancel or redirect flows absorbing adverse market conditions.

3 key case study takeaways?

Let’s finish with 3 conclusions from the case study analysis.

- Flexibility unlocks value: The rigid portfolio leaves substantial value on the table. It also carries higher downside risk, especially in low-margin market environments where cancellation options act as a crucial buffer.

- Valuation drives commercial strategy: Understanding the extrinsic value of optionality is central to origination and contract structuring. Whether negotiating toll terms or regas access, stochastic flex valuation supports better commercial decisions.

- Risk distribution is wide—and structural: Portfolios linking short US gas exposure to long global gas positions create a wide spread of outcomes. This highlights the importance of:

- A robust view on market fundamentals—particularly around the forward shape of global gas prices amid a new LNG supply wave.

- Proactive commercial risk mitigation—using indexation strategy, contract structuring, and access flexibility to manage downside exposures.

Feel free to reach out to our LNG & Gas Director David Duncan (david.duncan@timera-energy.com) if you would like more details on LNG Bridge, our services, or to discuss current areas of interest.