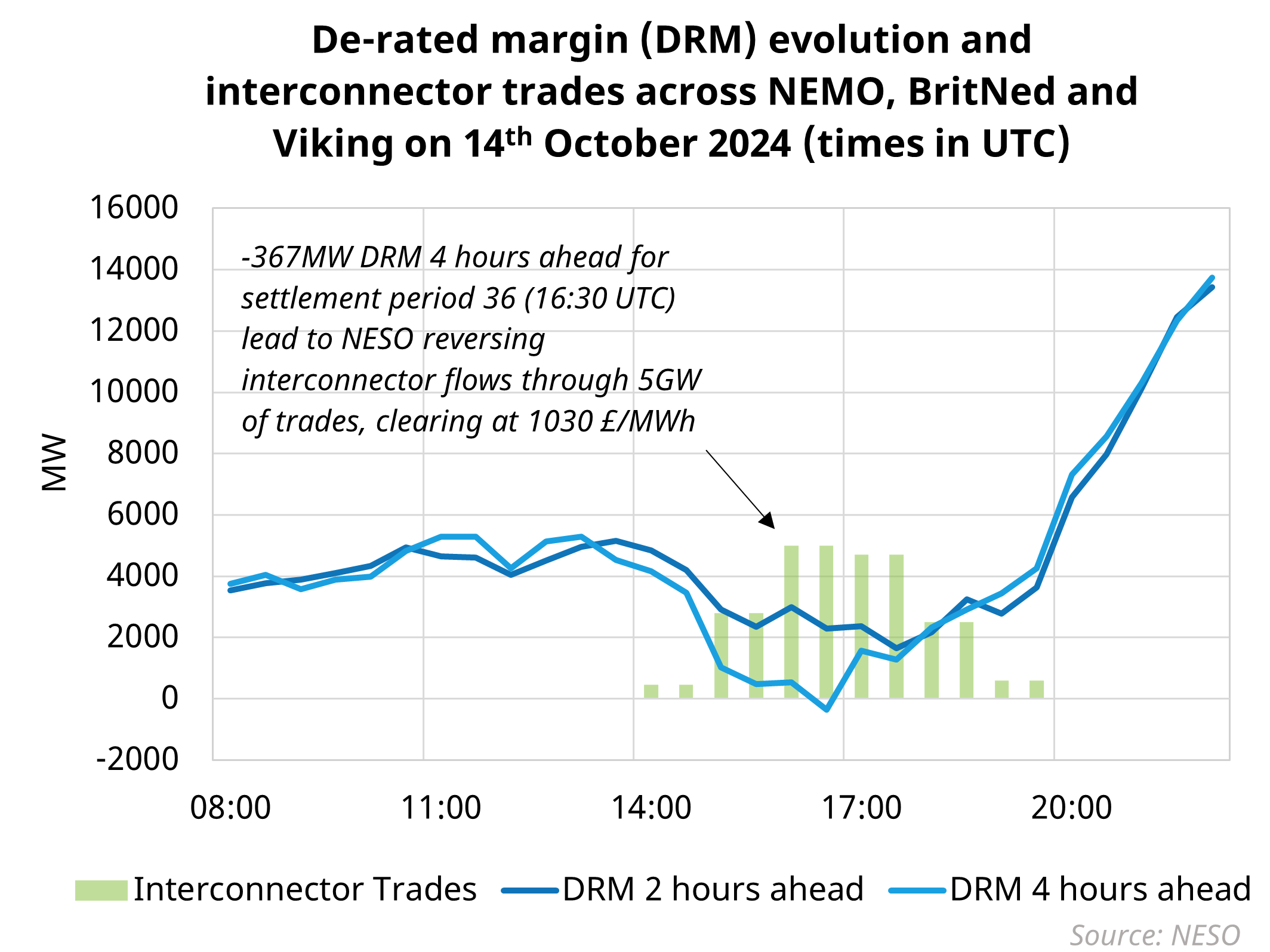

On Monday 14th October, the newly formed NESO issued the first Capacity Market Notice (CMN) of winter 2024/25, almost 2 years after the last CMN in November 2022. CMNs are a signal to the market at least 4 hours ahead of time, that system margins are below the 500MW threshold set by the UK government. There are a few reasons why de-rated margins were low, including:

- 4GW of interconnector outages, including 3GW to France (IFA1, IFA2 and Eleclink) and 1.4GW to Norway (NSL)

- Peak demand of ~37GW, the highest since last winter

- Outages of other units such as Sizewell B (1.2GW Nuclear), Damhead Creek (812WM CCGT)

- Recent closure of Ratcliffe (2GW Coal)

The CMN was eventually withdrawn as margins recovered due to trades taken by NESO to reverse interconnector flows from Belgium, Netherlands and Denmark. The price of these trades reached highs of 1030 £/MWh across 16:00-17:00 UTC. The impact of scarcity was also seen in wholesale markets where intraday weighted average prices peaked at ~677 £/MWh, and with intraday spreads reaching ~608 £/MWh. Retirement of firm nuclear capacity and CCGTs throughout the 2020s will make conditions like those seen on Monday become more frequent, heightening the chances of CMNs and driving increased price volatility in wholesale markets.