Europe’s drive towards decarbonisation is transforming the energy landscape. Renewable capacity is set to soar at the same time conventional firm capacity sources retire due to a combination of legislation and end of life retirements. Western Europe is set to see 350GW of wind and solar capacity by 2030, alongside a fall of at least 80GW of dispatchable coal, lignite and nuclear capacity.

“By 2030 average intraday swings in wind and solar will top 175GW, almost triple Germany’s average power demand.”

Over the past two articles in this series we have explored the effects of this transition. Firstly, we showed how a de-rated capacity crunch was looming, outlining the case for significant new flexible development.

Secondly, we examined the seasonal intermittency of renewables and the requirement for new gas generation to add incremental energy during periods of low renewables.

In today’s article, we see how even on a typical day, there will be a substantial increase in requirement for flexibility.

The intraday swing

Solar generation ramps from nothing overnight to peaking in the middle of the day, whilst wind can quickly change at any time of day. Managing this intraday swing in renewable generation is a key challenge for power systems.

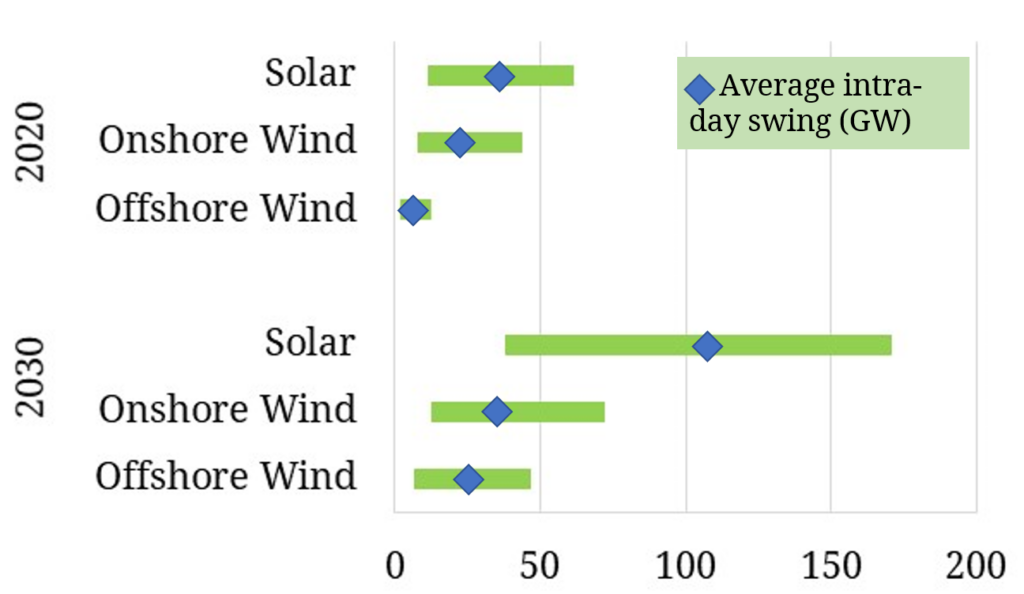

In the chart below, we show the estimated range of intraday generation swings for solar and wind generation in 2020 and in 2030 across our E-7 markets, i.e. the difference between the maximum and minimum generation across a given day. The blue diamonds show the average swing in generation, whilst the green bars show the minimum and maximum intraday generation volatility.

In 2020, the average intra-day swing in combined wind and solar is 66GW, equivalent to roughly the average size of German power demand (65GW). Through a combination of existing flexible capacity (dominated by coal and gas assets) the power system is capable to coping with this intermittency.

By 2030, however, things look different. Average swings in wind and solar will top 175GW, almost triple Germany’s average power demand and over 70% of forecast average E-7 demand.

Averages are useful when talking about intermittent generation but power systems have to be built to cope with the extremes. Take for instance, a particularly sunny summer’s day. Renewable generation in the middle of the day could be up to 215GW higher than overnight, hitting 90% of average power demand. Moreover, as power demand is typically lower in the summer, we could see solar generation eclipse total power demand, leading to widespread curtailment as available storage capacity quickly fills.

As the swings in renewable generation get bigger so to do the swings in flex requirement. New flex capacity is crucial to meet the evolving flex gap.

The evolving flex gap

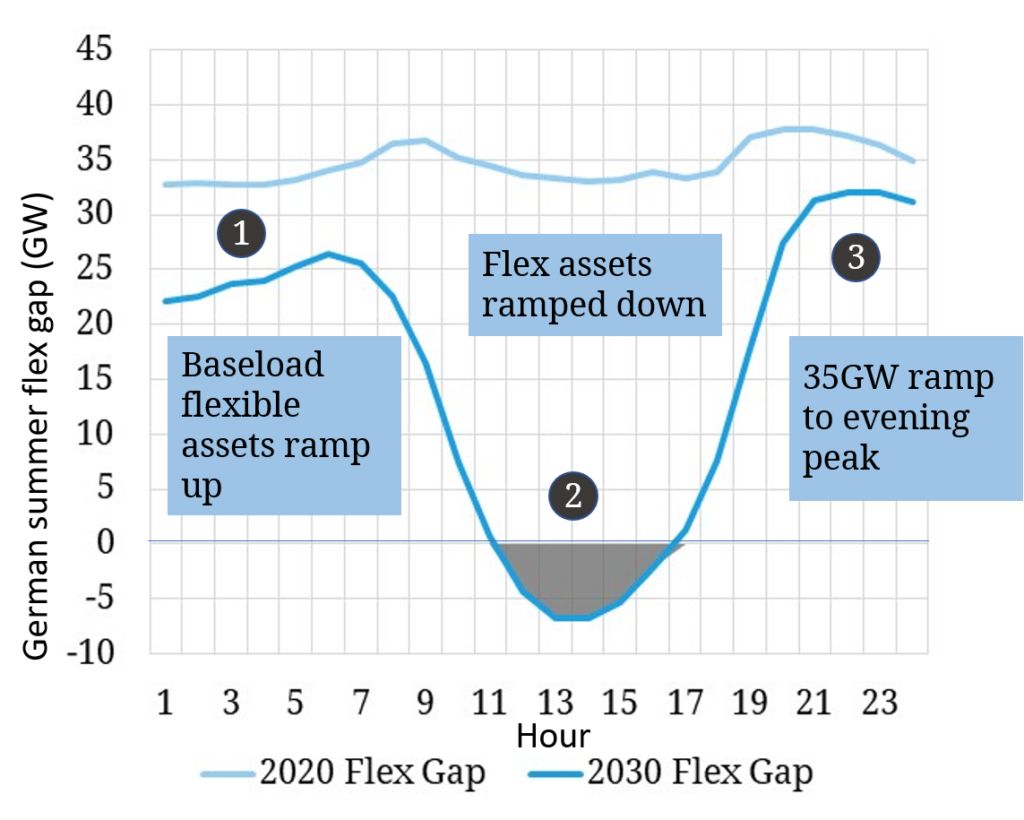

To see the impact of renewables on the power system in chart 2, we take a typical summers day in Germany in both 2020 and 2030 and see how the increase in renewables changes the flex gap (demand – renewables).

In 2020, we see a steady need for flex across the day, with a small pick up of around 5GW across the morning and evening peak. There is ample flex from large scale CCGTs and coal plants to meet this demand, with further back up from peaking assets.

By 2030, things are very different.

Overnight, up to 25GW of flexible generation is needed to replace the missing solar. As the sun starts to rise, flexible assets rapidly switch off as solar pushes the thermal gap negative. This requires batteries to charge, interconnectors to export and renewables to be curtailed. After the solar peak however, solar rapidly falls off, requiring over 30GW of flexible capacity to switch on and ramp up to meet evening peak demand.

Solar is broadly correlated with daily demand shape, however wind has very little daily shape. This means that whilst wind and solar offset on a seasonal level, on a daily level they can peak and trough together. This massively enhances the need for flex as when wind and solar peak together the impact on the flex gap is compounded.

With the closure of coal, flexibility provided by CCGTs will be inadequate to deliver the ramping requirements needed to meet the sharp hourly change in solar & wind generation. Instead a range of flexible options will be needed.

The forms of flex to meet the challenge

Storage: storage will be key in balancing the grid by levelling out intraday excess generation, stabilising system frequency and softening the ramping requirements of other flexible generation. As a net consumer of energy however, storage cannot cover extended periods of low renewables.

Interconnectors: interconnectors will arbitrage locational price spreads, moving excess generation from one system to cover shorts in another. But correlated renewable output across European markets constrains the flex role of interconnectors.

DSR: Price responsive energy demand will help smooth demand peaks reducing ramping requirements. But DSR shifts rather than creates energy, meaning it is key for balancing but does not cover extended periods of low renewables.

Gas engines & peakers: Fast responding and flexible, gas engines and peakers will be key in meeting both peak demand periods but also in managing the system ramping requirements as solar falls away. Low start-up costs, fast ramp rates and short minimum run times make peaking assets crucial in balancing renewables, but lower efficiencies and higher carbon emissions make them unsuitable for extended running.

CCGTs: Whilst not able to match the flexible credentials of peakers, CCGTs will continue to provide energy required to balance the system across lower renewables periods of the day. High start costs, however, make CCGTs favour longer running periods rather than short peaking runs.

Implications for flex capacity investment

There is a growing opportunity set for flexible asset investment across Europe. But currently the investment case for flex remains challenging in many European markets. Low power prices and often insufficient policy support has hampered growth. Looking forward, however, we see things shifting towards a more supportive environment for flex.

Policy makers are starting to realise the scale of the flex challenge ahead. Capacity markets are delivering stronger price signals in the UK, Italy and Poland and new schemes are set to start in Belgium. A range of other policy support mechanisms are in the process of being implemented to support flex investment e.g. sharper balancing, reserve and network charging incentives.

On a market basis, there is also a structural shift underway. Rising renewable generation is set to drive increased price shape & volatility, favouring flexible power assets which can quickly react to capture price fluctuating prices. If policy makers don’t provide adequate support for flex then market price signals will sharpen.

The requirement for new flex investment is clear, with at least €25bn investment required across Europe by 2025 (see ‘Flex to decarbonise’ briefing link below). As policy and market tailwinds grow, there are significant investment opportunities over the next 5 years. Investors able to locate the sweet spots where policy and market conditions combine will be in the best position to ride the wave of decarbonisation.

Briefing pack: The flexibility to decarbonise

Click on link to download our briefing pack with detailed analysis on flex capacity investment requirement, building an investment case and asset opportunities. |