Battery (BESS) investment is rapidly gaining traction across Europe. Many new solar PV projects are considering colocation options. Yet only a small portion of BESS capacity has so far been developed on a colocated basis with solar or wind assets.

At face value BESS colocation seems a promising solution. But a range of practical challenges have hindered the commitment of developers & investors to date.

In today’s article we look at hurdles for BESS colocation and how these may evolve to unlock future growth.

Why colocate BESS with RES?

It is still a common misconception that the biggest value drivers for collocating BESS are (i) balancing or firming colocated RES assets and (ii) consuming ‘clipped’ power from the RES asset which would otherwise be lost.

We have previously set out why this is not the case and why cost savings are the primary driver of BESS colocation value. In summary those cost savings fall into the following categories:

- Grid connection: Capex & opex cost reductions from a BESS & RES asset sharing a single connection

- Overheads: By sharing a site, co-location can reduce rent, insurance and security costs

- Losses: Charging directly from on-site generation reduces losses

- Network charges: Network charges are often calculated differently for co-located batteries and can result in project savings depending on location & network charging regime.

In addition BESS can also provide RES portfolios with a risk diversification benefit given the inverse correlation of asset return profiles.

The shared grid connection challenge

Despite sharing a grid connection, colocated assets should be optimised independently against wholesale markets (rather than in combination with RES asset output).

Why? Because a viable BESS investment case relies on maximum optimisation of battery flexibility to capture value from wholesale market price shape & volatility.

The RES asset (e.g. solar farm) however typically has priority access to the shared connection over the battery (for economic reasons i.e. to avoid lost revenue).

As a result the most complex aspects of analysing collocated BESS project value are:

- Value erosion: Calculating the BESS revenue impact of constrained access to the connection (during periods when the RES asset is exporting)

- BESS sizing: Optimising BESS asset sizing relative to the connection to minimise the value impact of this shared connection constraint.

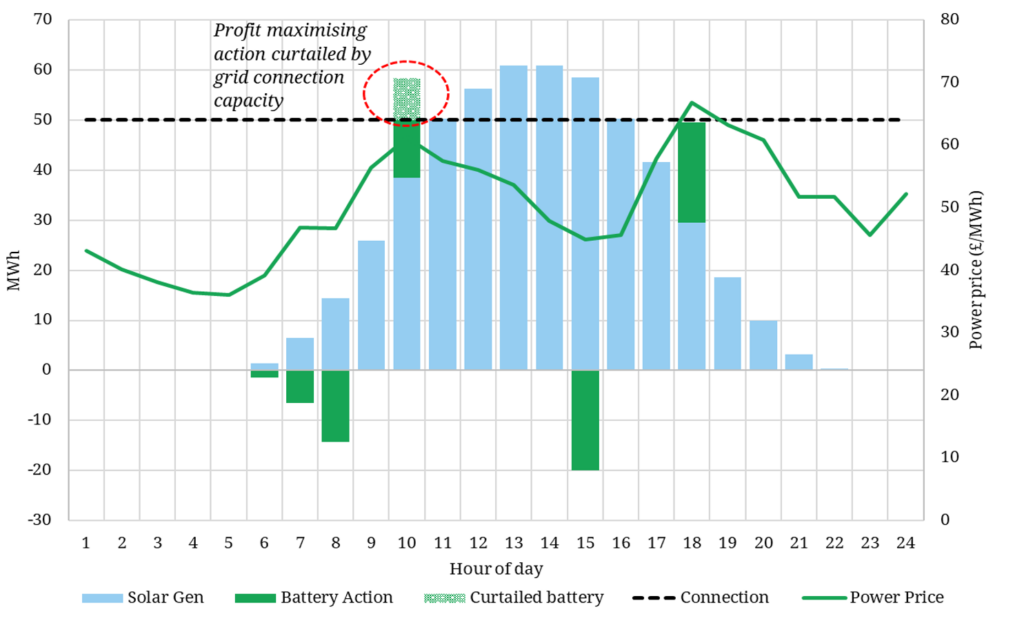

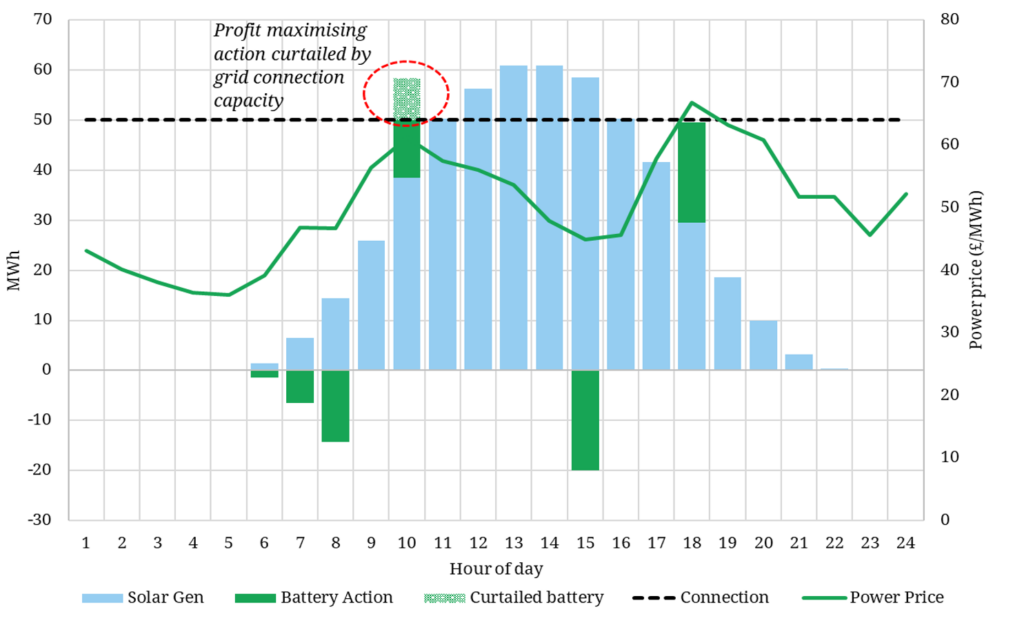

To show the impact of solar generation on battery dispatch we show a case study using Timera’s colocated battery optimisation modelling framework in Chart 1 (with an explanation below).

Chart 1: BESS optimisation against Day-Ahead power prices & solar output

Source: Timera Energy collocated BESS optimisation modelling framework

Chart 1 shows a typical solar profile (blue bars) against the Day-Ahead (D-A) power price (green line). Note: some solar production across the middle of the day is curtailed given it exceeds the grid connection size (blue bars exceed the black dashed line).

The battery dispatch pattern is shown via the green bars, charging in periods of lower price & discharging in periods of higher price. The battery’s discharge across the morning peak has been curtailed as the grid connection is not big enough to allow both the solar and the battery to fully discharge. Solar has priority over the battery in use of the connection, given curtailment of solar leads to lost energy (vs a battery’s ability to discharge in an alternative period).

The solar peak is marked by lower D-A power prices and so batteries are not typically discharged across this period against D-A prices. This helps to reduce the negative value impact of colocating batteries & PV.

Other practical challenges with colocation

The connection constraint challenge in the case of many colocated BESS projects actually has a viable solution i.e. BESS assets can be sized so that cost gains exceed revenue losses from the shared connection.

This is where other more practical challenges have constrained BESS colocation. For example:

- Offtake: BESS & RES offtake service providers are often different with parallel offtake contracts messy to structure & combined offtake so far less common (e.g. given different optimisers / capabilities / fee structures)

- Ownership: the structure of asset ownership across BESS (typically new asset) and RES + connection (often existing assets) can also be messy

- Site access: Standalone BESS assets have the advantage of being able to ‘cherry pick’ the best site locations (vs RES site constraints when colocating)

- Connection: Adding BESS to an existing RES project can impact connection application & queue positioning causing delays.

The good news is that many of these practical constraints are being resolved over time. But the other major tailwind that could kickstart BESS colocation is policy support.

Where is the colocation policy support?

Several countries have introduced explicit differentiation between standalone & colocated BESS assets at a policy level e.g. across charging structure, support schemes and grants. Table 1 sets out a comparison across 3 larger markets (GB, Germany & Spain).

Table 1: Differences in treatment of colocated BESS across GB, DE & ES

The key drawback for both the German & Spanish schemes is the inability to charge BESS from the grid under the colocation support schemes. This has a substantial adverse impact on BESS ability to capture energy arbitrage returns (by charging from the grid during low price periods).

The direct policy support for colocated BESS has looked most promising in Iberia so far although BESS investors face some other policy evolution challenges in these markets.

The volume and growth of solar PV in both Iberia and Italy also points to significant medium term growth potential in colocated BESS assets.

The other markets where BESS colocation is likely to evolve over time, for projects with the right cost gain vs revenue erosion characteristics, are GB and Germany given the sheer scale of BESS deployment in those markets.

Colocation may have been slow to gain traction in Europe, but don’t write it off yet. As some of the hurdles we list above dissipate over time and policy support tailwinds build, Europe will likely see GWs of collocated BESS projects developed, particularly in Southern Europe.