Explore practical examples of recent client work we have delivered.

Client case studies

EXPERTISE

We are industry experts in the valuation of flexible power, gas & hydrogen assets.

This includes batteries, storage assets, electrolysers, thermal power plants, midstream gas infrastructure and LNG supply chain assets.

Our team has extensive senior industry expertise in power & gas asset investment. So we provide clients with advice from the perspective of practical first hand experience.

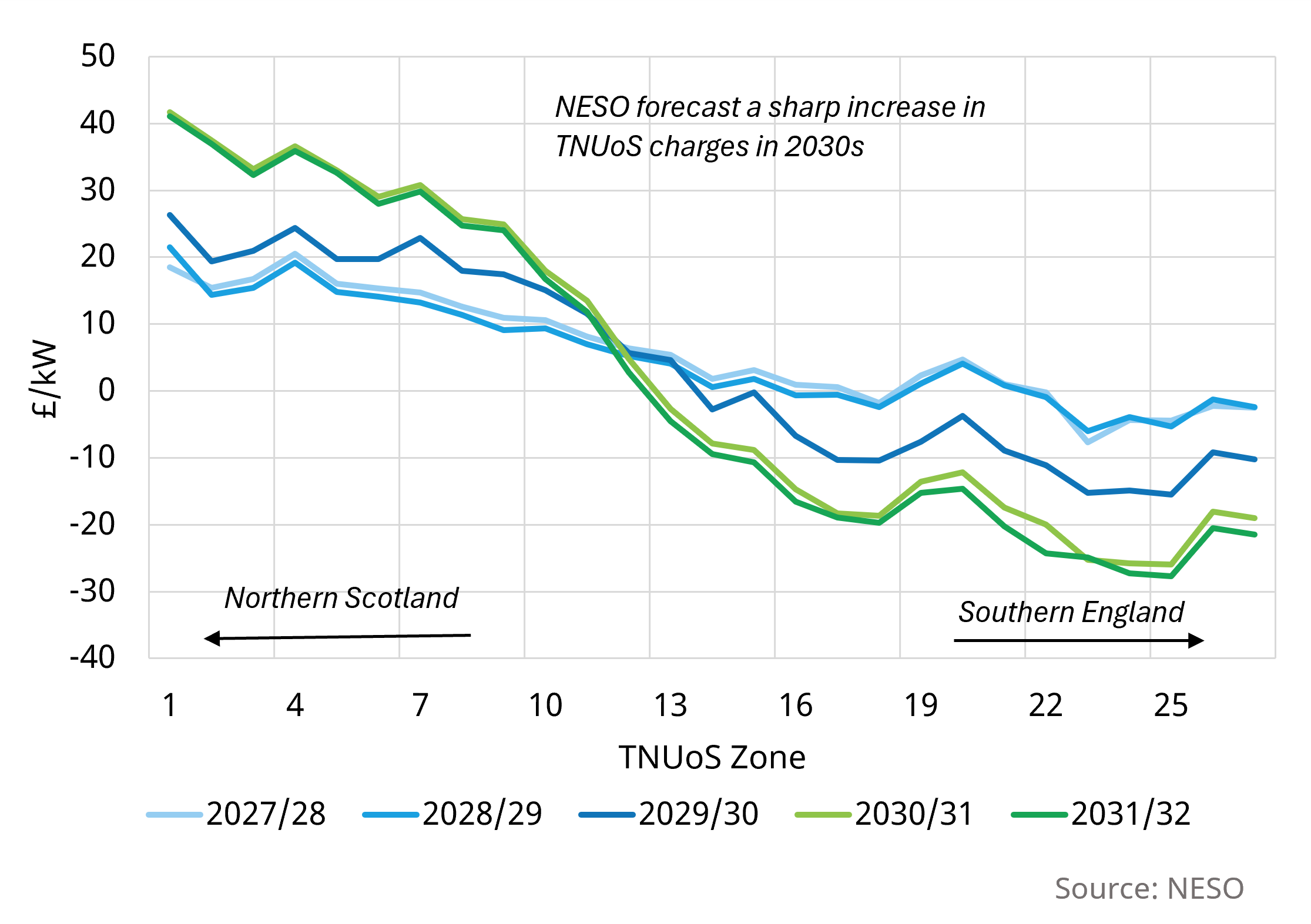

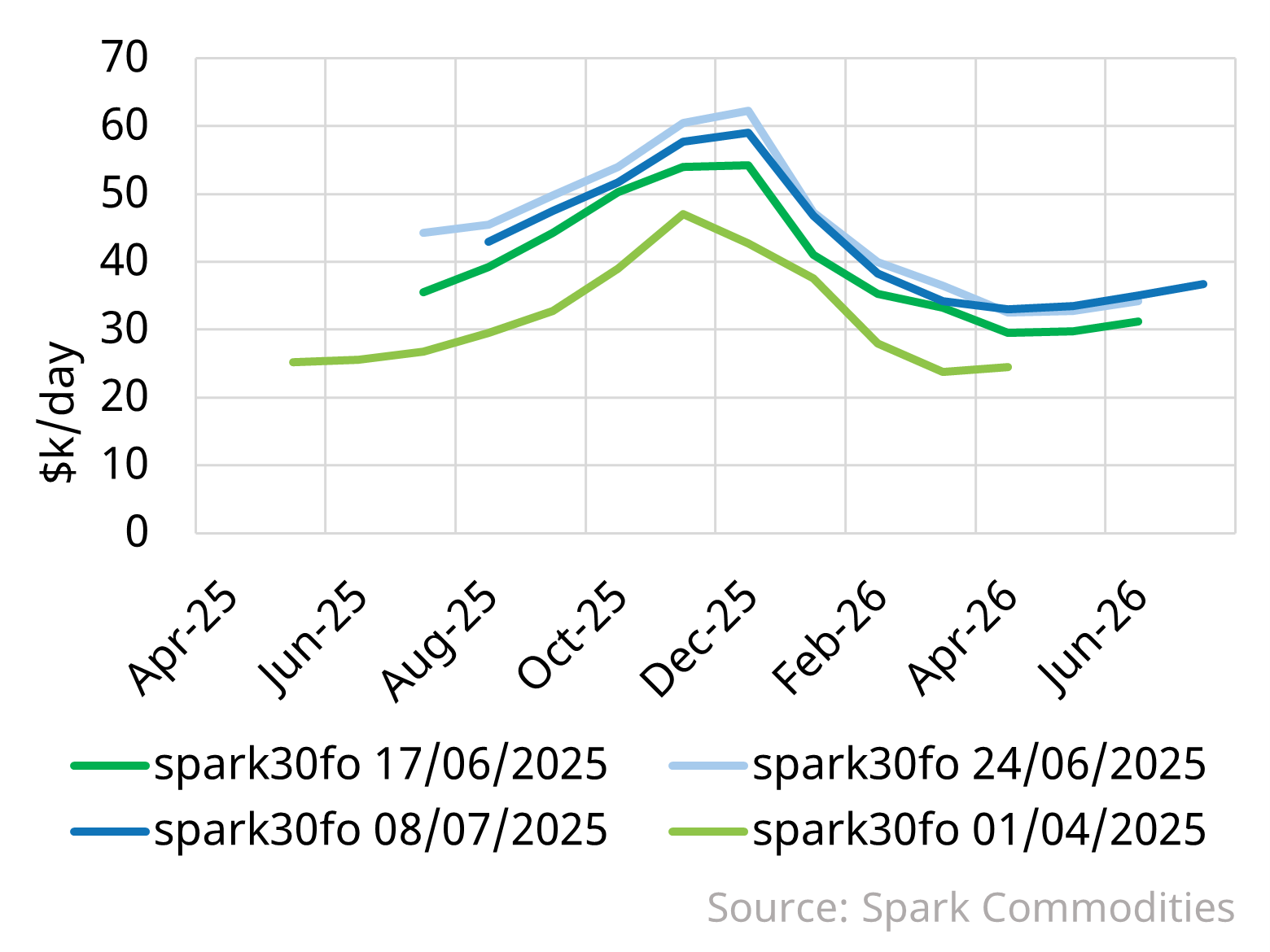

Our investment support services are underpinned by our leading edge asset valuation and market modelling capability. We apply sophisticated but transparent probabilistic techniques to analyse asset margin distributions and risk/return dynamics.