1.Policy momentum strong, with flex coming into focus

The EU’s new 55% emissions reduction target by 2030 was written into law in Q2 2021. In the same week, the US re-established its climate leadership credentials by announcing its own target of at least 50% reduction by 2030. Just two years ago, commitments of this scale belonged in the realm of fantasy.

“The most tangible step towards decarbonisation in 2021 has been driven by the market”

The EU is now starting to focus on tangible actions required to hit these 2030 targets. The ‘Fit for 55’ legislative package announced last week includes broader emissions reduction measures across aviation, shipping, road transport & buildings as well as a 40% by 2030 renewables target (up from 32%). It also sets out the framework for a carbon border tax. There is a tough road ahead over the next two years to get member state buy in and turn this into legislation.

The most tangible step towards European decarbonisation in 2021 has been driven by the market, not policy makers. A rise in carbon prices above 50 €/t looks set to rapidly accelerate closure of coal and lignite fired power plants across Europe. But carbon prices in a 50-100 €/t range are not enough to kick start deep decarbonisation of industry, heat and heavy transport. This where tangible policy support mechanisms, at an EU and national level, will need to follow the Fit for 55 announcements.

Policy makers have an effective existing tool kit to support deployment of wind & solar capacity, although this needs to be accelerated. The key bottleneck threatening to constrain decarbonisation of the power sector is a lack of clarity on the policy framework that will support flexibility.

The good news is that the policy makers appear to be waking up to the flexibility challenge in 2021. Momentum is building behind a range of flexible capacity investment mechanisms (e.g. capacity market evolution in Southern Europe) and targeted ancillary & balancing services payments. Just as importantly, network code and charging reforms are creating tailwinds for flexible assets.

2.Higher carbon & power prices

The move higher in carbon prices this year represents a key trend in itself. Prior to 2021, the EU ETS was predominantly a compliance driven market, and only tangentially related to the marginal cost of carbon abatement, supposedly its raison d’etre. Industry players bought EUAs to cover portfolio emissions footprints. But the ETS has been transformed in 2021 into an investor driven market.

Large investment fund buying has been the primary force behind the doubling of carbon prices from Q4 2020 to Q2 2021. The premise behind these investment flows is pretty simple:

- The EU has clearly flagged that the ETS will be the primary policy tool to achieve its 55% target by 2030

- Much higher carbon prices are required to drive required volumes of decarbonisation.

The rapid rise in carbon prices this year has caused some pretty seismic shifts in energy market pricing and asset value dynamics.

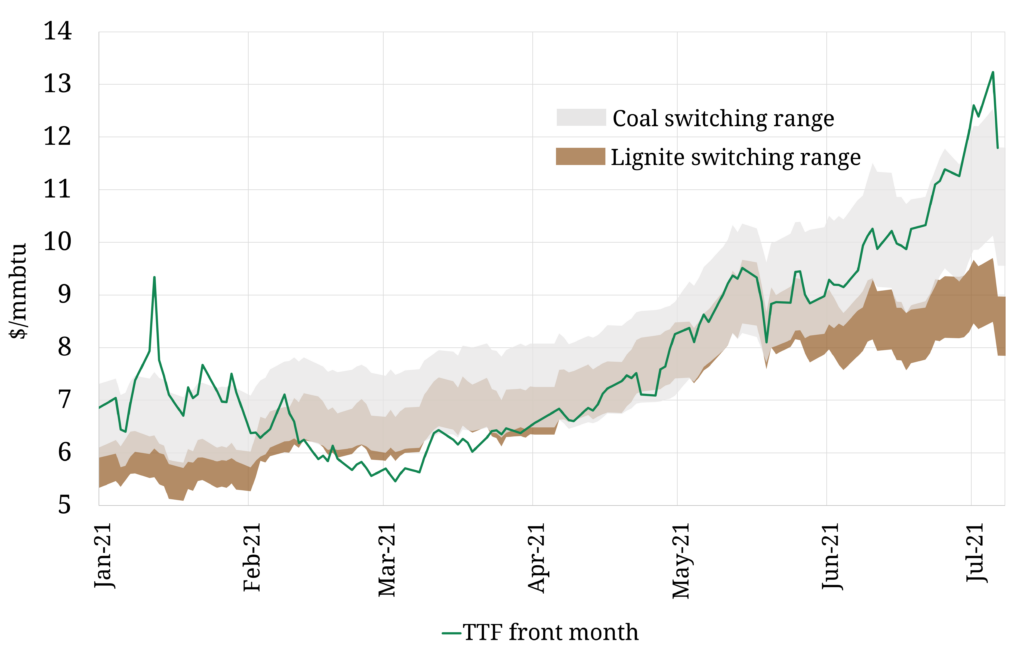

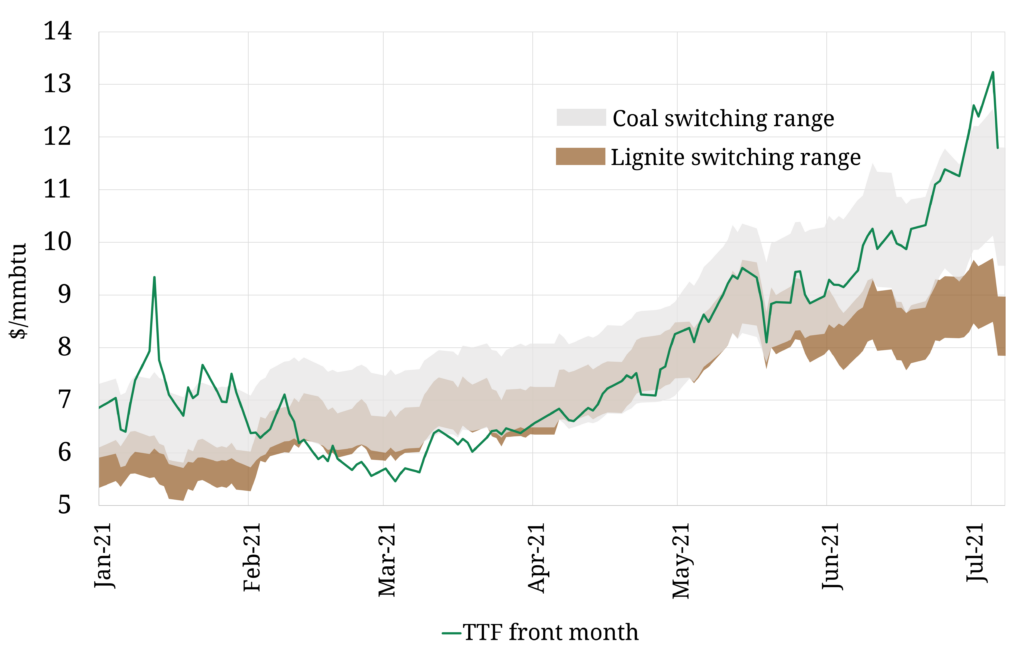

Chart 1 illustrates how rising carbon prices have driven up coal & lignite plant switching levels in 2021 (grey and brown ranges). This has in turn lifted European gas hub prices (green line is TTF). And the combination of rising gas and carbon prices has seen a surge in wholesale power prices across Europe.

Source: Timera Energy, CME, ICE

European industry has historically been shielded from the competitive impacts of decarbonisation via free carbon allocations and renewable levy exemptions. But if carbon prices continue to rise, industry faces a new competitive challenge from higher wholesale power & gas prices.

There is no simple answer to protect European industry from rising energy prices. The implementation of a European carbon border tax represents an enormous geo-political challenge, but rising carbon prices are bringing it into focus.

3.Batteries in Southern Europe

Solar will be one of the main pillars of decarbonisation in Southern Europe. Huge volumes of solar (& wind) are set to transform power markets e.g. solar output pushing peak prices below offpeak levels and rapidly rising price volatility. In power markets such as Italy and Spain, electricity storage will need to play a key balancing role as well as supporting system stability (e.g. frequency & inertia).

Up until a year ago, the investment case for batteries in Southern Europe was virtually non-existent. That is changing fast with implementation of new capacity markets to support flexible capacity in both Spain and Italy, albeit with policy clarity on auctions still required.

The next Italian capacity auction has been a victim of bureaucratic delays, but is anticipated before the end of 2021. The new Spanish capacity market will take a couple of years to fully implement, but transitional auctions are anticipated to be announced later this year.

Spain is embarking on a particularly interesting path of precluding investment in new gas fired generation. This underpins a pivotal role for batteries in the Spanish market and a good proportion of battery investment is likely to be collocated with solar farms.

The UK has led the battery investment charge across the last 3 years, supported by a relatively mature policy framework and a healthy revenue stack. Italy and Spain are set to play catch up across the next 3 years.

4.Tighter LNG & gas markets

This time last year, weak gas prices in Europe & Asia saw huge volumes of US LNG cargo cancellations with 70% of export capacity shut in. The TTF & JKM gas curves have exploded higher across the last 12 months, with forward prices for 2021 broadly tripling.

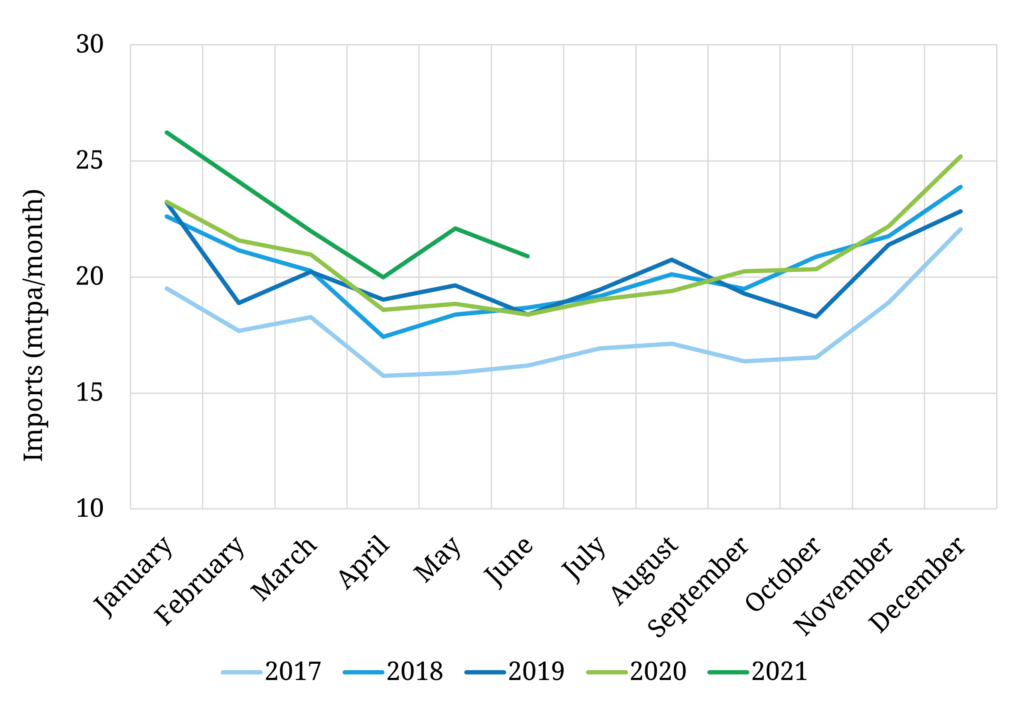

Chart 2 illustrates an important driver of this sharp tightening: strong Asian LNG demand. Despite some evidence of demand destruction as JKM prices surge (e.g. in India), there has been a step change in Asian demand growth this year, with China leading the way.

Strong Asian LNG demand is drawing flexible cargoes from Europe, but there are other factors in play behind surging European gas hub prices. We show the impact on TTF of rising coal and carbon prices and switching levels in Chart 1. Europe also has an unusually tight storage balance in 2021 and Gazprom has shown little inclination to increase supply volumes ahead of the commissioning of Nordstream 2.

Higher gas prices are driving the big move up in wholesale power prices across Europe in 2021, working in combination with rising carbon prices.

5.Hydrogen momentum

ESG themed investment has seen a wall of capital hunting for a hydrogen home in 2021. A good deal of this capital is not coming from traditional energy investors, let alone investors with expertise in flexible energy assets.

There is also to date a relatively limited range of opportunities to put capital to work, on either the debt or equity side. Most green & blue hydrogen projects are currently at a small scale or pilot phase and are being funded by the balance sheets of utilities or large industrial companies.

The announcement of aggressive European policy targets across the last 12 months is fueling interest in hydrogen infrastructure investment. But there are a couple of key practical challenges that need to be resolved for hydrogen to start to scale:

- Hydrogen is an expensive fuel relative to power & gas (& getting more expensive as commodity prices rise in 2021) – effective business models & high value use cases need to be developed that are robust to these high costs

- Tangible policy support measures (e.g. CfDs, FiTs, network charge / tax advantages) need to be introduced in order to support initial scaling and the development of associated infrastructure.

The best hydrogen projects we are involved with are those that have high value local offtake opportunities that are driving decarbonisation of processes that are very hard or expensive to electrify. There is big potential for hydrogen, but scaling is not going to happen until policy makers define a clear set of rules.

Summer time

This is the last feature article before our usual summer break. We’ll be back in mid August with more, but in the meantime we’ll still be publishing regular snapshot articles.

2021 has been an exciting year of expansion for Timera. You can read here about the projects and client work that is keeping us busy. Our team is also growing and we are actively recruiting both Analysts and Senior Analysts. See job spec & contact details here If you are interested in finding out more.

Blog readership and subscribers are also continuing to grow in 2021. Thanks for your support and wish you all the best for a relaxing summer.